Crude Oil, WTI, Brent, Fed, Powell, Jackson Hole, US PMI, EIA – Talking Points

- The crude oil price is treading water as markets await Fed views

- Weak US PMI data appeared to overwhelm EIA inventory figures

- Markets are poised for clues from the Fed. Will WTI break support?

The crude oil price slipped overnight after US data disappointed and that led to speculation in the market that the Federal Reserve might step back from a more aggressively hawkish posture, potentially as soon as later today.

The Kansas City Fed-hosted Jackson Hole economic symposium will get underway in the next few hours and commentary from a number of Fed board members will be crossing the wires.

The main event though will be Fed Chair Jerome Powell’s comments and he won’t be taking to the microphone until Friday.

The symposium has been used in the past by previous Fed leaders to get a clear message across, especially if there is a perception that the market has misinterpreted the Fed’s outlook.

Overnight saw the S&P Global Composite PMI come in at 50.4 for August against 52 anticipated and previously.

Stripping out the components, most of the market’s disappointment was in the Manufacturing PMI that printed at 47, notably below the 49.3 forecast and 49 in the prior month.

Being a diffusion index, a read below 50 is seen as economically contractionary while a number over 50 is seen as expansionary.

The equity market appeared to take the stance that bad news is good news and Wall Street stacked on the gains with the Nasdaq leading the way, adding 1.59% in its cash session.

However, crude seemed to slump on the prospect of lesser demand despite US stockpiles dipping again.

The US Energy Information Agency (EIA) weekly petroleum status report revealed a massive drop of -6.135 million barrels for the week ended August 18th, lower than the -2.85 million anticipated and following the disappearance of -5.96 million barrels in the prior week.

Going into Thursday’s session, oil appears vulnerable with the WTI futures contract trading under US$ 78.50 bbl while the Brent contract is eyeing off US$ 82.50 bbl.

For more information on how to trade oil, click on the banner below.

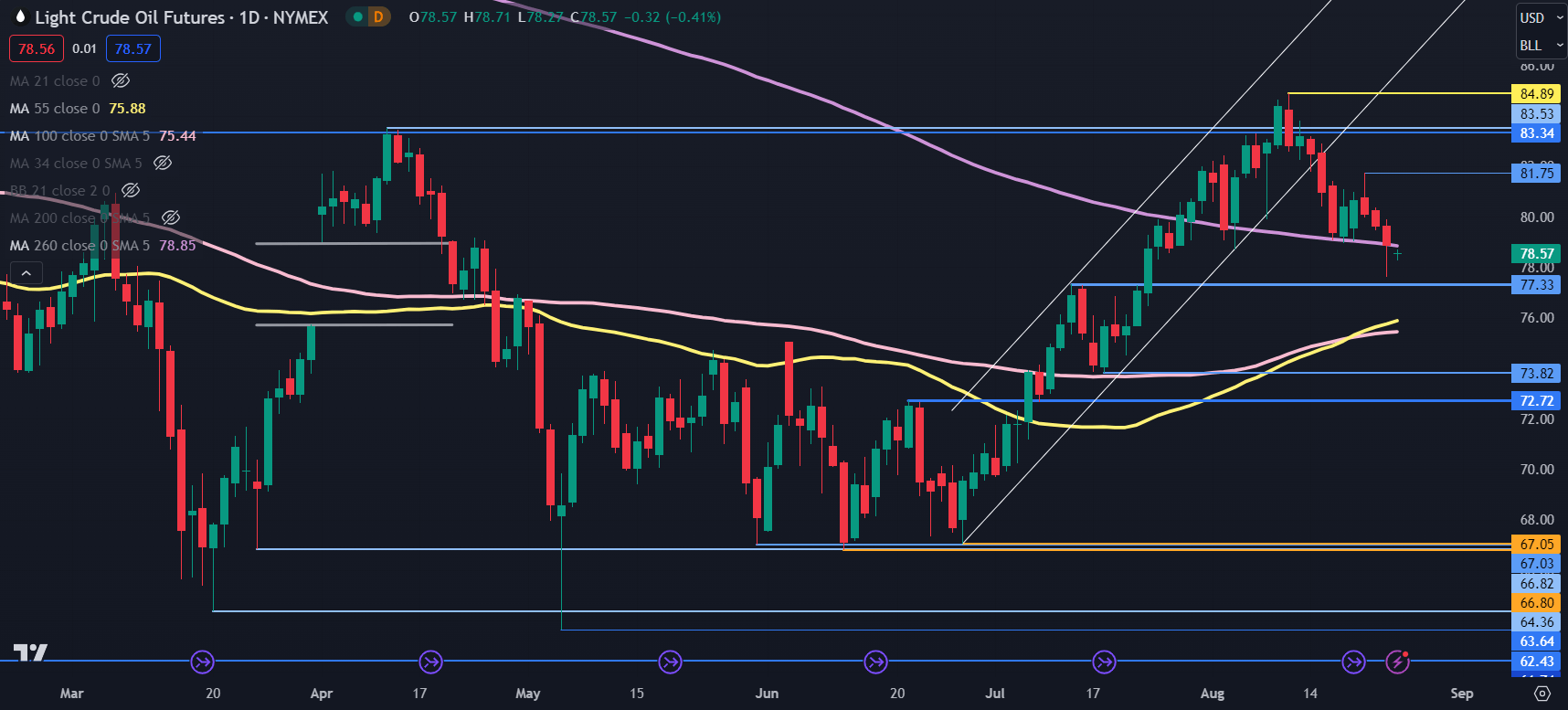

WTI CRUDE OIL TECHNICAL ANALYSIS SNAPSHOT

After breaking below the ascending trend line a fortnight ago, the WTI futures contract has continued lower and overnight moved under the 100-day simple moving average (SMA).

This may indicate that bearish momentum is evolving. The price action yesterday pulled up short of potential breakpoint support at 77.33 ahead of the prior low at 73.82.

Between those levels, the 55- and 100-day SMAs may provide support in the 75.50 – 75.80 area.

On the topside, resistance might be at the recent peak of 81.75 ahead of the breakpoints near 83.40 ahead of the prior high at 84.89.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter