GBP/USD - Prices, Charts, and Analysis

- UK house prices rise further, according to one lender.

- The US Jobs Report is now key for overall market direction.

- GBP/USD sitting on a prior level of resistance.

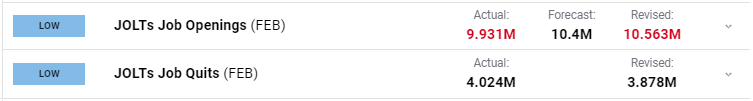

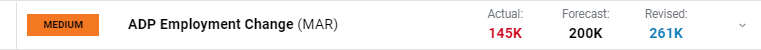

The British Pound is trading in a very range against most other major currencies today as the markets slow down ahead of an extended bank holiday weekend. While a range of countries will be off on both Friday and Monday next week, there is still a major data release tomorrow that traders need to be aware of, the latest US Jobs Report, or nonfarm payrolls. Friday’s release will be watched more closely than usual after two US employment reports released this week showed the jobs market unexpectedly weakening.

April 4, 2023

April 5, 2023

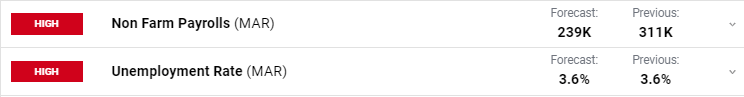

Friday’s NFP report is expected to show 239k new jobs created, down from 311k in February, with the unemployment rate steady at 3.6%. The report is released at 12:30 GMT.

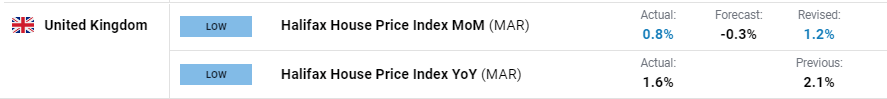

The UK housing market ‘continues to show resilience following the sharp downturn at the end of 2022’ Kim Kinnaird, director at Halifax Mortgages said today. The lender’s report highlights the easing of mortgage rates as the principal driver behind the move higher as borrowing costs continue to ease from the highs seen at the end of last year.

Halifax House Price Report (March)

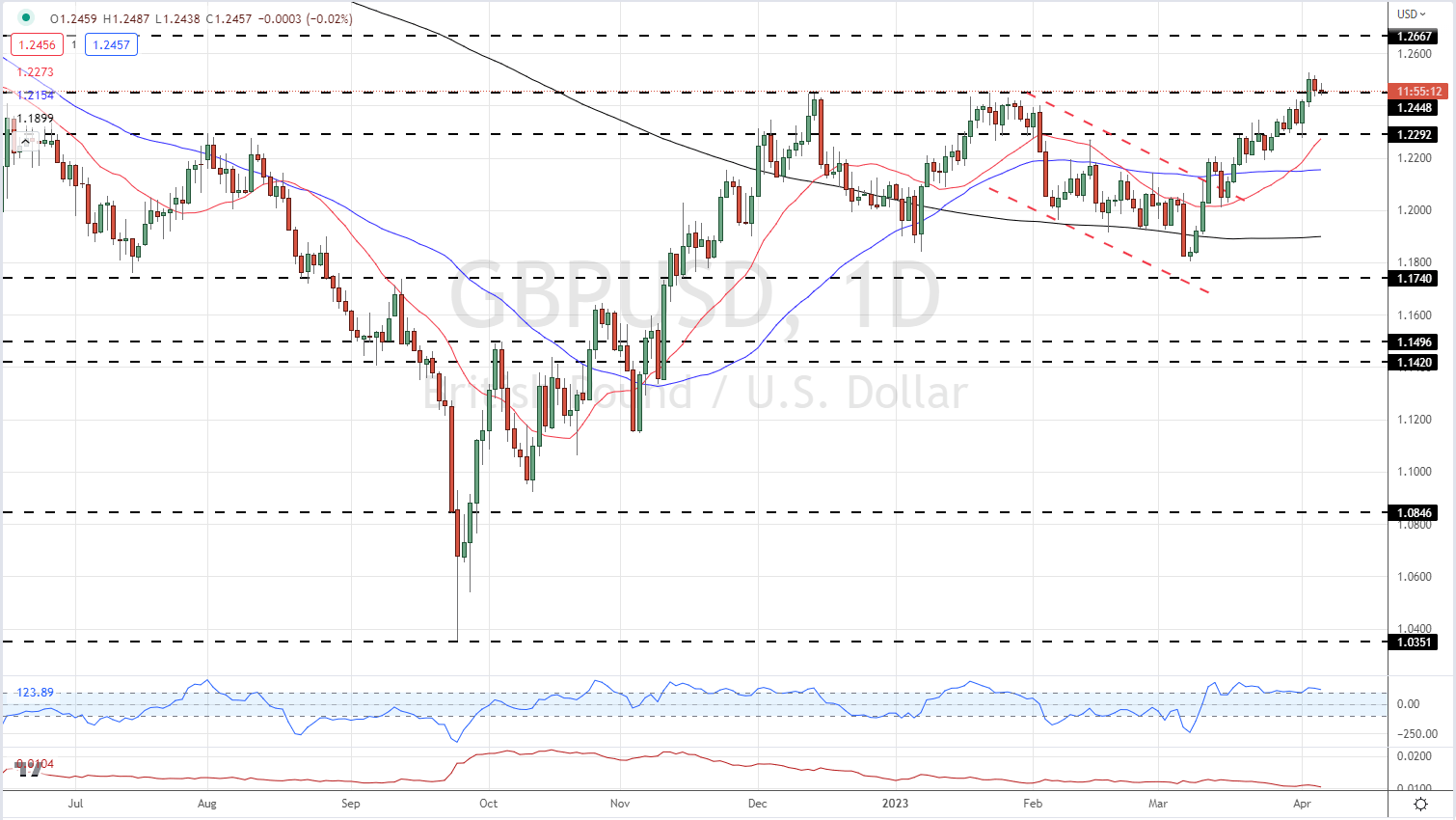

GBP/USD remains below 1.2500 but just above a prior line of resistance at 1.2448. This is now trying to act as support but Friday’s NFP could break this if the Jobs Report is stronger-than-expected. The overall chart set-up however is positive with all three simple moving averages in place and the 20-dma moving higher. The 14-day Average True Range indicator at the bottom of the chart shows cable volatility at a multi-week low, and while the CCI indicator shows GBP/USD in overbought territory, it has been that way for a few weeks now. If GBP/USD uses the 1.2450 area as support, the next level of technical resistance is situated at 1.2667.

GBP/USD Daily Price Chart – April 6, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 2% | 4% | 3% |

| Weekly | 24% | -6% | 10% |

Retail Trader Sentiment is Mixed

Retail trader data show 39.09% of traders are net-long with the ratio of traders short to long at 1.56 to 1.The number of traders net-long is 12.84% higher than yesterday and 3.24% lower from last week, while the number of traders net-short is 9.66% lower than yesterday and 3.51% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

What is your view on the GBP/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.