Australian Dollar, AUD/USD, US Dollar, Unemployment, RBA, China – Talking Points

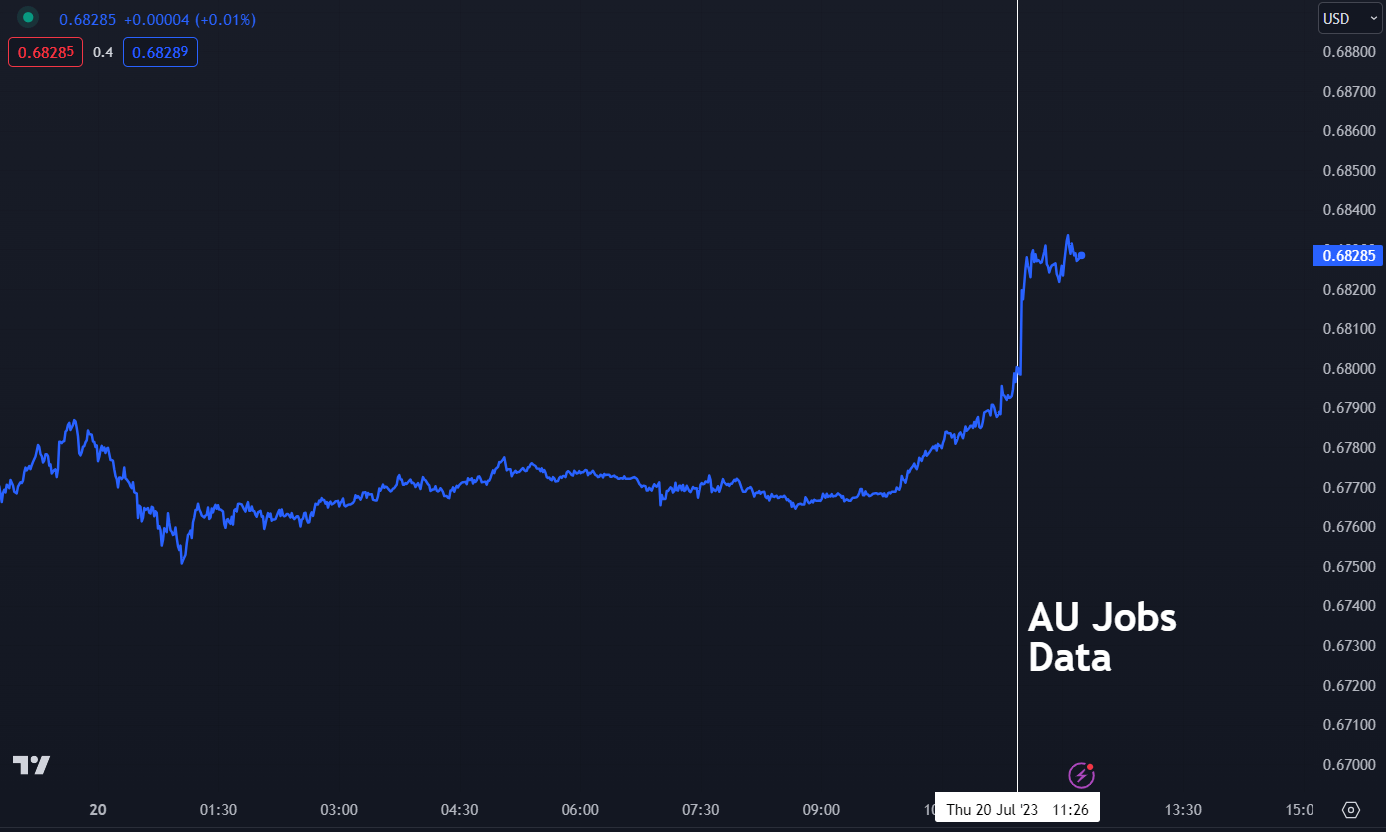

- The Australian Dollar raced above 68 cents on strong jobs numbers

- The RBA meeting has taken on a new light with signs the economy remains ablaze

- The market is eyeing next week’s CPI. Will it drive AUD/USD direction?

The Australian Dollar ran to higher ground immediately after sizzling local jobs data that shows that the economy remains robust. This is despite 400 basis points of tightening by the Reserve Bank of Australia (RBA) since May last year.

The unemployment rate came in at 3.5% in June against the 3.6% anticipated and prior. 32.6k Australian jobs were added in the month, which was notably above the 15k expected to be added and 75.9k previously.

Of note was the full-time boost of 39.3k while the participation rate dipped slightly to 66.8% from 66.9%.

The RBA left rates unchanged earlier this month at 4.10%. Before today’s numbers, the interest rate futures market ascribed a low probability of a hike in the cash rate by the RBA at its August monetary policy meeting.

The odds increased only slightly after the data but a 25 basis point lift is priced in by the end of the year.

Elsewhere in the region, the Peoples Bank of China (PBOC) refrained from cutting the rate on the 1- and 5-year loan prime rate today, keeping them at 3.55% and 4.20% respectively.

There is speculation that Beijing will look to do more stimulus measures as they try to reignite their economy.

Looking ahead, next Wednesday will see Australian headline CPI to the end of the second quarter. A Bloomberg survey of economist is anticipating 6.2% against 7.0% previously.

The same survey is forecasting the RBA’s preferred measure of trimmed mean inflation for the same period to be 6.2%. It was 6.6% in the prior quarter.

A wide variation from expectations could trigger a bout of volatility for AUD/USD. The RBA’s fight on inflation is set to continue with many award wages rising by 5 to 8% in recent weeks.

AUD/USD PRICE REACTION TO JOBS DATA

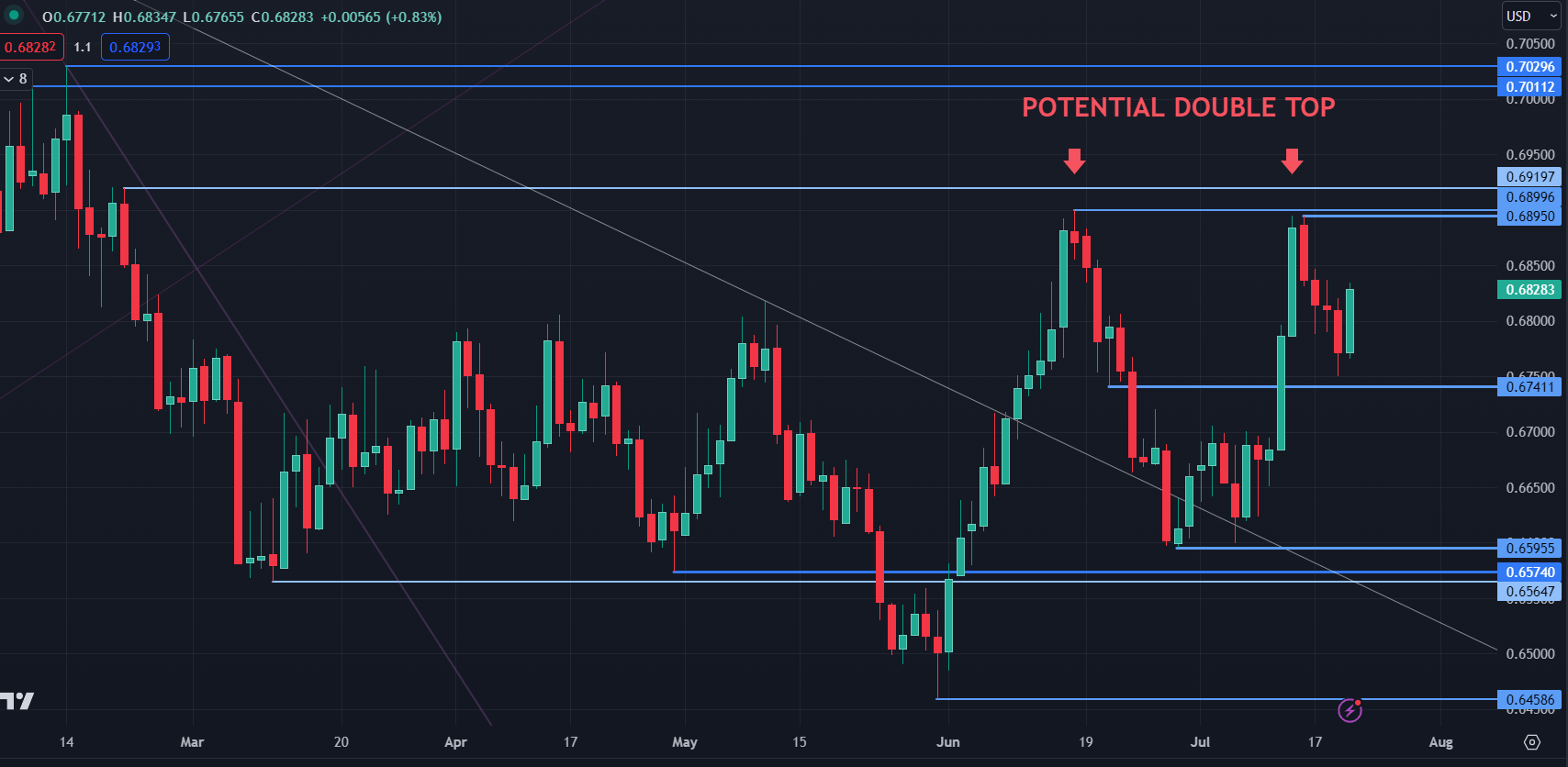

AUD/USD TECHNICAL ANALYSIS

AUD/USD has been in a five-month trading range of 0.6459 – 0.6900 and it failed to break the upper bound last week and has potentially set up a Double Top.

A break above 0.6920 would negate the pattern, but as long as it stays below that level, potential bearishness may unfold.

Resistance could be in the 0.6900 and 0.6920 zone ahead of possible resistance in the 0.7010 – 0.7030 area where several previous peaks lie.

On the downside, support might be at the breakpoint of 0.6741 ahead of the prior low of 0.6595. Further down, the previous low of 0.6565 or the breakpoint of 0.6547 may provide support.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter