Market Recap

Major US indices attempted to stabilise towards the end of last week (DJIA +0.22%; S&P 500 +0.14%; Nasdaq +0.09%), but gains remained feeble following recent de-risking in tech and concerns of a resurgence in inflationary pressures. Thus far, Wall Street’s performance has been in line with the weak seasonality pattern for September, but several support lines may still have to give way before there are greater conviction that the broader upward trend is reversing. For now, the VIX has struggled to move higher, seemingly placing its sight back at its year-to-date low.

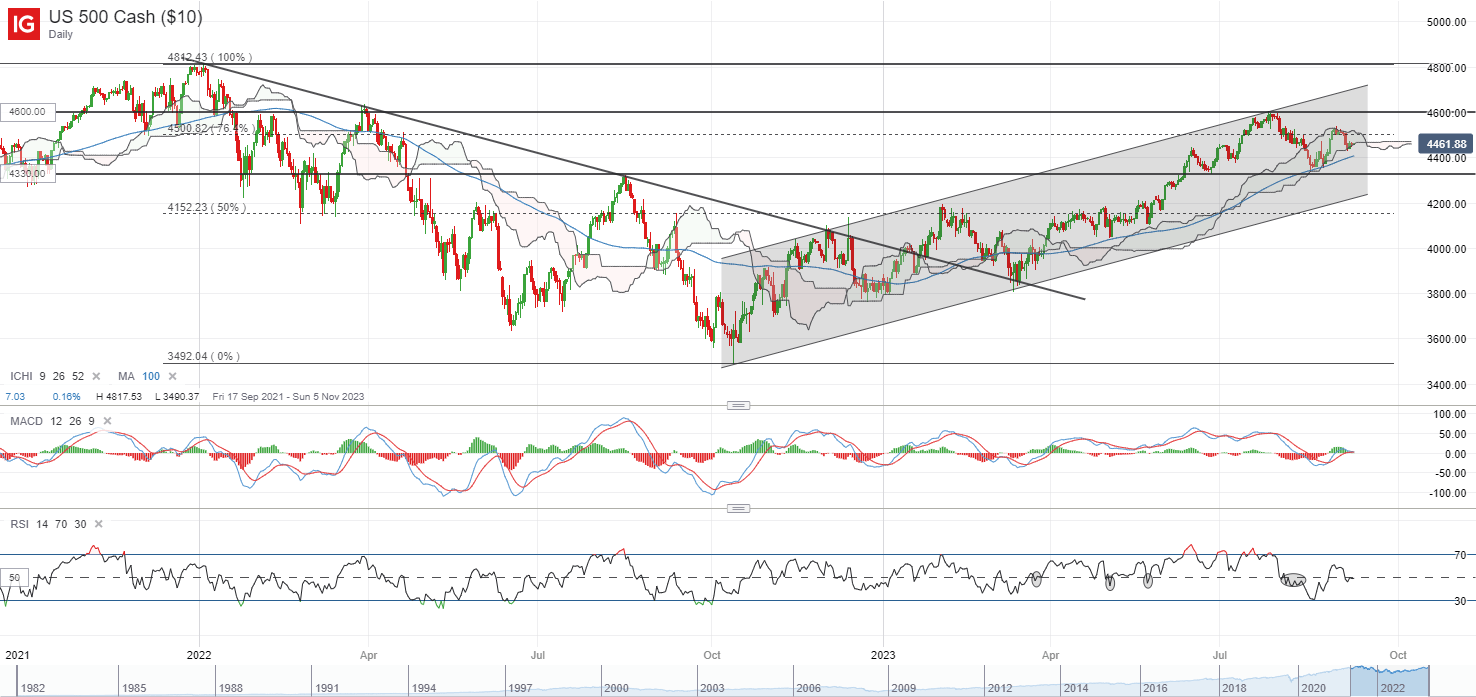

For the S&P 500, the index continues to trade within its Ichimoku cloud pattern on the daily chart, with buyers successfully defended it back in mid-August this year. Further downside may leave the 4,400 level on watch as support to hold, while sentiments could likely stay cautious to start the new week amid the Fed blackout period and lead-up to the US Consumer Price Index (CPI) – the last piece of key inflation data to anchor rate expectations before the next Federal Open Market Committee (FOMC) meeting.

Market expectations have been firmly priced for the Fed to keep rates on hold at the September meeting, but the central bank’s guidance for policymaking to be on a meeting-by-meeting basis still leaves the November meeting wavered. This may likely be in line with the Fed’s previous guidance of having one last rate hike by the end of this year before heading into a prolonged pause.

Source: IG charts

Asia Open

Asian stocks look set for a downbeat open, with Nikkei -0.37%, ASX -0.29% and KOSPI -0.12% at the time of writing. The key story for markets to digest may revolve around the weekend remarks from Bank of Japan (BoJ) Governor Kazuo Ueda, with him guiding that the central bank may have enough wages data by year-end to decide on its ultra-loose monetary policies. With the option for an end to negative interest rates on the table, it is perceived to lay the groundwork for further policy normalisation ahead, although the Governor is also quick to downplay some speculations by indicating patience.

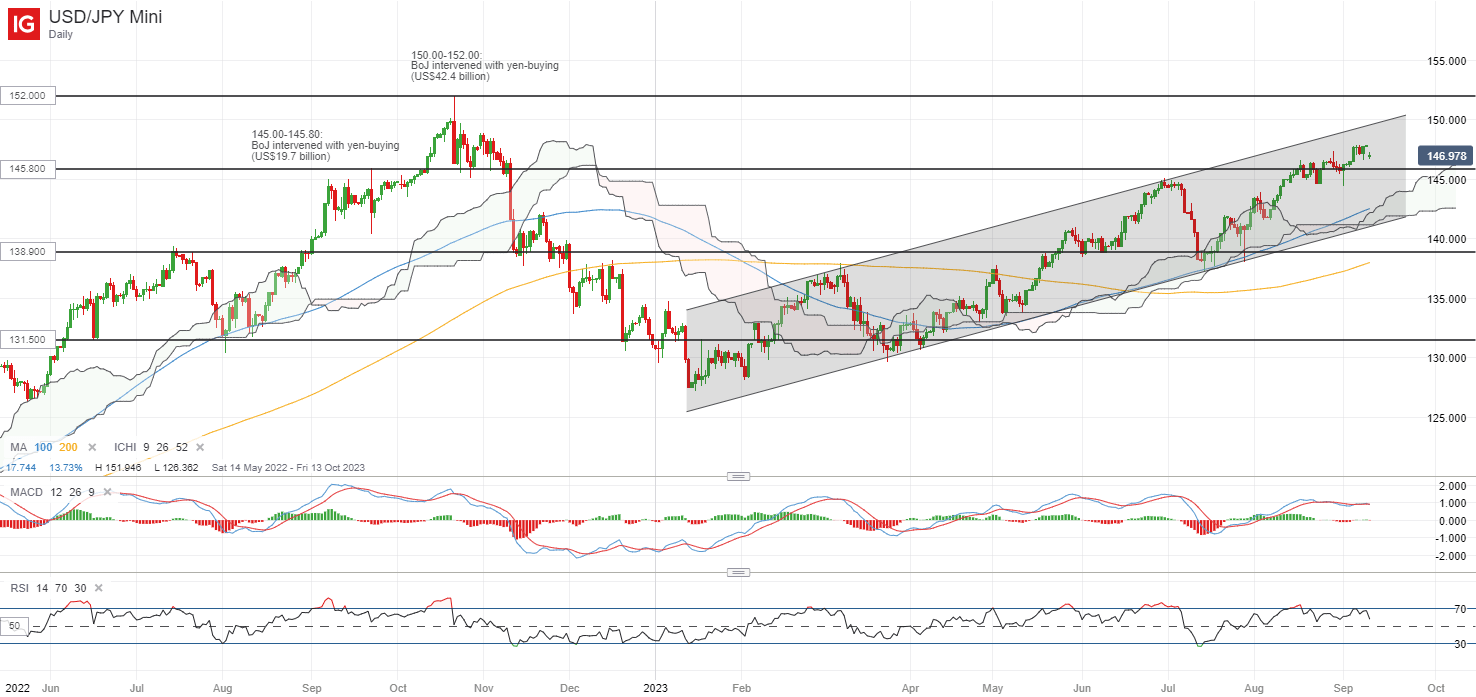

The slightly hawkish takeaway from his comments brought the Japan’s 10-year yields to another new high since 2014, narrowing the yield differential with the US which has been a key driving force for the USD/JPY. That said, with the next BoJ meeting scheduled to be less than two weeks away, there may still be room for disappointment for near-term hawkish bets, given that the Governor’s comments seem to place any rate decision only in 2024, along with the less likelihood of back-to-back policy tweaks given its broadly patient stance.

The 145.80 level may be a key support level on watch for the USD/JPY, which marked the upper bound of previous yen-buying intervention back in September 2022. Declining moving average convergence/divergence (MACD) and lower highs on relative strength index (RSI) may suggest ebbing upward momentum for now, but the broader upward trend may remain intact until several support lines are broken, with the 145.80 level serving as an immediate support to hold.

Source: IG charts

On the watchlist: US dollar on watch ahead of US CPI data this week

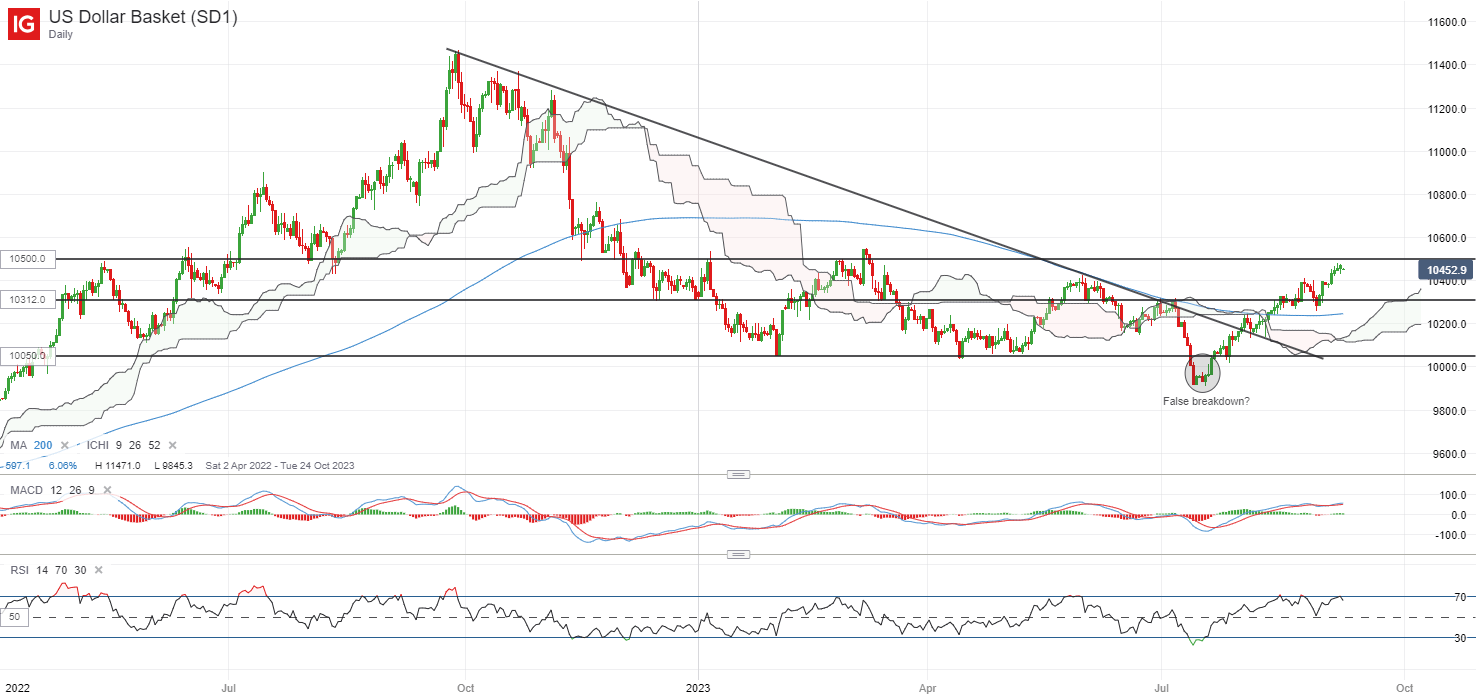

Thus far, US Treasury yields have stayed firm in the lead-up to the US CPI release this week, pricing for rates to be kept high for longer with ongoing expectations for a resurgence in US headline inflation (est 3.6% vs previous 3.2%). That have kept the US dollar near its six-month high, following a 5.6% rebound since mid-July this year.

While the US dollar continues to trade above its key 200-day moving average (MA), a potential bearish divergence in the making on the daily RSI may point to some near-term indecision with ebbing upward momentum. Ahead, the 105.00 level will be a crucial resistance to overcome, which marks the upper bound of a long-ranging pattern since the start of the year. Failing to cross the level may leave the 103.12 level on watch as immediate support.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Source: IG charts

Friday: DJIA +0.22%; S&P 500 +0.14%; Nasdaq +0.09%, DAX +0.14%, FTSE +0.49%