US Dollar Talking Points:

- It’s been relatively quiet in FX-land, but the USD did push below a big zone of support earlier today.

- This may be setting a trap, however, and below I look at the matter from a couple of different angles.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

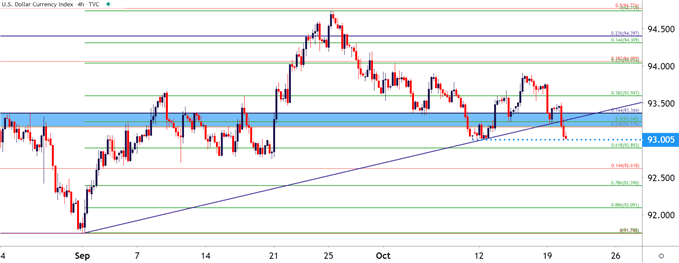

What at first may appear eventful, the US Dollar has broken below a key zone of support this morning as rumors and hopes for a stimulus deal continue to permeate the backdrop. But – that bearish push has had little motivation beyond the same 93.00 level that held the lows last week. This may start to feel a little like a trap scenario and with both stimulus and the election looming large for US economic trends, this may be an area where cross-pairs away from the USD can be seen as attractive. That said, there may be some open opportunity on either side of the matter, with USD-weakness potential pointing towards AUD/USD reversal scenarios and USD-strength potential pointing to the possibility of a bear flag break in GBP/USD.

US Dollar Four-Hour Price Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

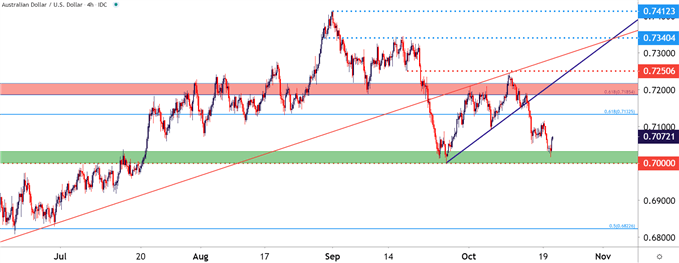

AUD/USD Bounce from Support Zone

AUD/USD put in yet another bearish push over the past week but, similar to what happened in September, price action ran into a brick wall of support that’s so far arrested the move. This can keep the door open for bullish reversal potential, particularly for those looking at short-USD scenarios.

AUD/USD Four-Hour Price Chart

Chart prepared by James Stanley; AUD/USD on Tradingview

GBP/USD Bear Flag Remains

On the long-side of USD, GBP/USD bearish potential remains of interest. The pair continues in a bear flag formation but, at this point, sellers haven’t yet taken-control. The price of 1.2896 appears to be big, and below that, another big level of support exists around 1.2712.

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley; GBP/USD on Tradingview

EUR/USD Testing Resistance at Prior TL Support

Another possible long-USD option is the short-side of EUR/USD. The pair has broken out this morning, testing above the prior October swing-high around 1.1831. Also of interest, a prior bullish trend-line is seeing an underside re-test, and this can create some interesting potential.

Near-term, there could be short-side reversal scenarios to entertain. Bigger-picture, however, draws the attention to the 1.1794-1.1800 area on the chart; a support hold of which can re-open the door for bullish continuation scenarios in the recent move.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley; EUR/USD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX