Weekly Technical Trade Levels on USD Majors / Commodities

- Technical trade setups we’re tracking across the USD Majors / Commodities this week

- Updated trade levels on DXY, EUR/USD, USD/CAD, USD/JPY, SPX, Gold and more!

- New to Gold Trading? Get started with this Free How to Trade Gold -Beginners Guide

Covid-19 Vaccine Headlines Drive SPX back into Resistance– Gold Breakout Under Review

Markets remain headline driven with the participants focused on the re-opening efforts across the globe and extremely sensitive news on developments in Covid-19 therapeutics / vaccines. Despite the recent volatility, markets largely remain rangebound with price action across the majors continuing to contract within the monthly opening-ranges. The gold breakout is in question as price tests fresh multi-year highs and we’re looking for guidance with today’s close. In this webinar, we review the updated technical trade setups on DXY, EUR/USD, USD/JPY, USD/CAD, Crude Oil (WTI), GBP/USD, Gold (XAU/USD), S&P 500 (SPX500), AUD/USD, NZD/USD, AUD/NZD and EUR/JPY.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

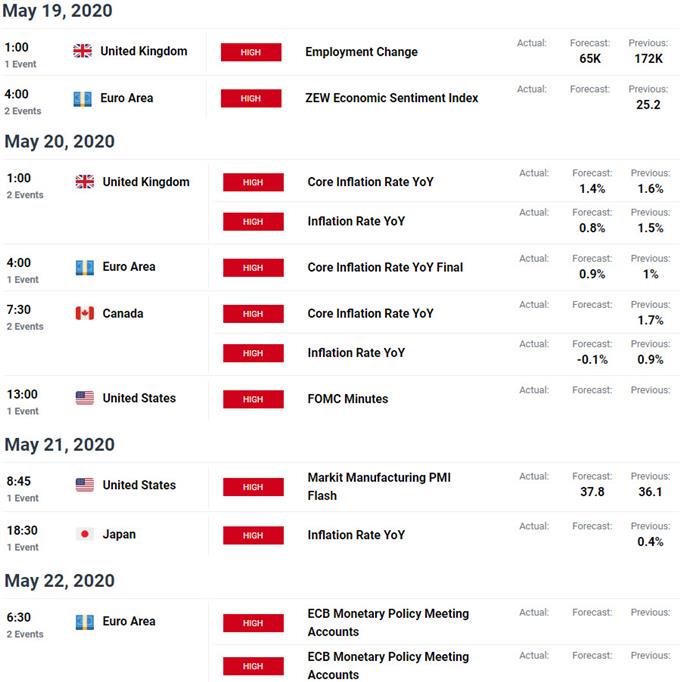

Key Event Risk This Week

Economic Calendar - latest economic development and upcoming event risk

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex