The U.S. Dollar Index (DXY) dropped back below breakout levels but once it did it posted a sharp reversal back higher to keep its generally bullish posturing intact. EURUSD continues to have technical headwinds it will need to overcome to change its trend which keeps the shorts alive. NZDUSD and USDCHF also have strong technical backdrops for continued moves along their paths of least resistance, lower for the former and higher for the latter.

Technical Highlights:

- EURUSD has factors keeping it aimed lower

- USDCHF looking to make good on reversal from support

- NZDUSD bearish as long as channel stays intact

Fresh Q2 Forecasts are out for major markets and currencies. Check them out on the DailyFX Trading Guides page.

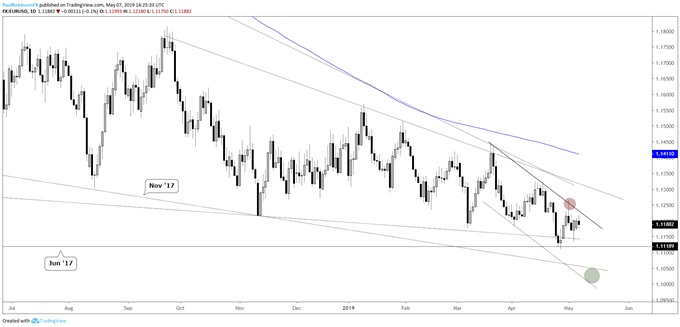

EURUSD has factors keeping it aimed lower

The Euro continues to stay within the confines of a downtrend and beneath the trend-line off the March swing-high. The trend-line and rejection-day from May 1, for as long as they hold in place, will keep pressure on the Euro. With a little more bobbing around we could see a wedge form, which may act as a continuation pattern. Looking lower given the lack of sustainable trends in FX, a fresh low into the 11000s may be best played by looking to book profits on any short positions as bounces have been quick to develop.

EURUSD Daily Chart (trend and resistance favor lower prices)

Find out where our analysts see USD heading in the coming weeks based on both fundamental and technical factors – Q2 USD Forecast

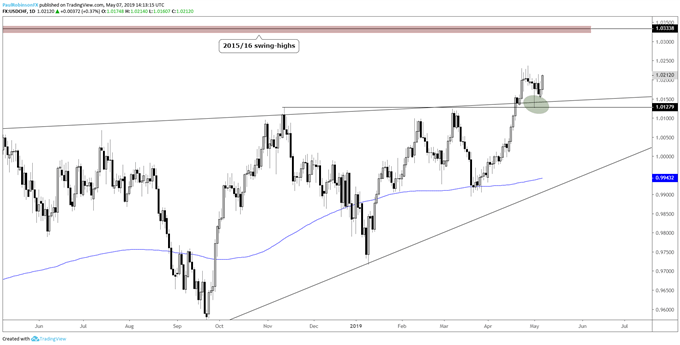

USDCHF looking to make good on reversal from support

USDCHF recently reversed off confluence of support by way of a trend-line tied into a long-term wedge as well as the high from November. This has the pair sitting strong and not giving up any ground, consolidating for what should be another leg higher. Looking to highs in the 10300s from 2015 and 2016 as the target.

USDCHF Daily Chart (looks headed into the 10300s)

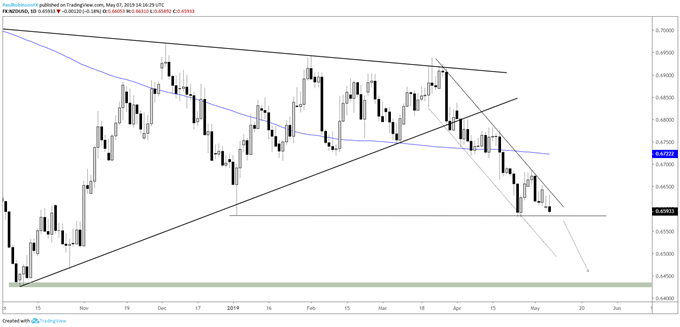

NZDUSD bearish as long as channel stays intact

Kiwi has a strong technical structure in place with a bearish channel keeping the upside contained. A drop below the recent low and flash-crash reversal-day low (January 3) should have price continuing into the 6400s. A strong break above the upper parallel of the channel will be needed to turn the picture neutral to bullish.

NZDUSD Daily Chart (channel keeps it pointed lower)

Resources for Forex & CFD Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX