Talking Points:

- There are many points for leaders to discuss at the G20 summit Friday and Saturday, but US-China trade relations are key

- Further steady decline in trade is expected given recent history - a threat of risk aversion - but don't write off a breakthrough

- A vow not to add further tariffs by the US is entry-level compromise, but what happens if risk trends falter despite improvement?

Want to watch analysis of events as they happen, develop your trading strategy or ask analysts trading questions? See what live events are scheduled for the coming week on the DailyFX sentiment page.

The Importance of the G20...The Importance of Trump-Xi's Discussions

If we were to take stock of the many global uncertainties facing speculators, there would be more than a few concentrated themes that could single-handedly set the global markets in a specific course heading. US monetary policy moving from unprecedented tightening to a convergence with the rest of the largest central banks' listless strategy, a growing risk of a painful 'no-deal' Brexit outcome and Italy's gearing for a fight with the EU that could spur yet another financial crisis are just a few of the open-ended issues floating in the market. And yet, complexity around an issue can be just as acute a killer of market movement as a disappointing outcome for a high-profile event risk. There is little that is truly 'simple' when it comes to the trade war. While the primary front is between the US and China, there are a host of other countries burdened by US tariffs or the threat of them. In the upcoming G20 meeting, there is almost certain to be a range of critical topics on hand, but the attention will hold to the sideline conversations between US President Trump and his Chinese counterpart Xi. A steady course between these two countries would drag the financial system closer to the cliff edge while global growth will suffer the fallout of the world's two largest economies raising taxes against each other.

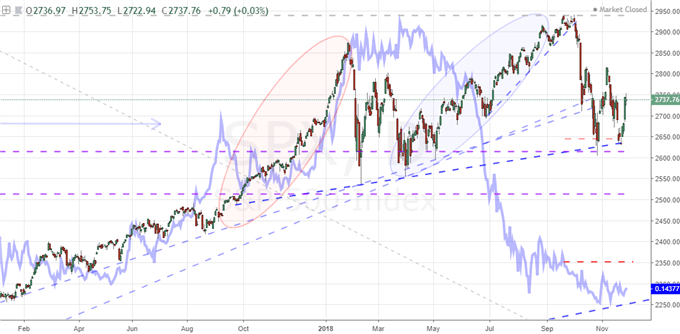

Chart of S&P 500 and Overlay of the Chinese Yuan – US Dollar Exchange Rate (Daily)

A Clear Baseline and its Dour Impact

What does the market expect from the forthcoming G20 meeting specifically as it pertains to the US and Chinese leaderships' sideline conversations? The running consensus forecast is for the stubborn sides to keep up their end of the standoff. There is good reason to expect this. We have seen numerous opportunities for each to call off the escalating efforts and retain (perhaps even earn) political face squandered. With President Trump comfortable raising the tab on the tariffs by leaps and bounds, it seems reasonable to assume that the same will happen at this meeting. There are added troubles to finding a compromise between the two powerhouses. Maintaining the damaging path can render political value as each states their efforts are to subvert the dominance of the other. In terms of what happens should this gathering end with a 'status quo' outcome, it would naturally call up Donald Trump's threats over the past few weeks. The President made clear that he would not delay the increase in the tariff rate from 10 percent to 25 percent by year's end as previously warned. What's more, he said the failure to render a more palatable capitulation by Chinese authorities would prompt the next tranche of tariffs ($267 billion) to fully encompass all of China's exports to the United States. Such an outcome would tease risk trends lower, but the liquidity drain over the weekend could create an explosive backdraft within the market which is not properly triggered until Monday trade kicks back in. It is further worth mentioning that President Trump has made a point to mention his concerns over the state of GM's cost cutting which has led to a planned culling of its North America work force. Seemingly, he believes imposing auto tariffs may resolve that risk; but, in reality, embroiling the Eurozone and Japan in this protectionism drive would only hasten a recession and financial instability.

Don't Write Off a Breakthrough and Don't Assume Clear Skies

As consistent and dire as some of the best scenarios may be, we should not write off the chance of a compromise between US and Chinese interests. There is a natural assumption that this is impossible given the White House's inability (or sheer disinterest) to seriously study the proposals offered up. That said, there is growing evidence to speak to possible capitulation. There are reports that the President is growing anxious about the long-term impact of the trade war on the economy and financial system. The GM layoffs in particular have made the President wary. So, if there is an agreement in the works - as Trump suggested may be in play this past session - what would it feasibly contain? A clear plan to withdrawal is unlikely given the strategy the US has employed is similar to the shock-and-awe of recent military engagements. Therefore, the decision not to add more tariffs on each other - or upgrade existing ones - could be the 'positive' scenario the market is looking for further the Powell reaction. That said, such an inspiration doesn't compensate for an overwhelming force against the markets. Mere agreement to hold off further fire is a tepid turn of events, but maybe enough in this speculative environment to provide some lift. An outright compromise between the two on the other hand would certainly register as more bullish. Yet, through it all, what happens if the market faltered despite a breakthrough? What would you think of risk trends if you witnessed that? We discuss all of this in today's Quick Take Video.