Talking Points:

- The May labor report from the US is forecasting a 190,000 payroll addition, 3.9% jobless rate and 2.6% wage growth

- Though important economically, the US jobs data has leveraged most of its influence recently through monetary policy

- Fed pacing has struggled to motivate the Greenback in previous months and the hurdle is even higher now amid trade wars

Are you trading a Dollar-based pair or risk assets sensitive to US economic health? Keeping tabs on the monthly US labor report is crucial. Join DailyFX analysts as they cover the event and its market impact live. Sign up on the DailyFX Webinar Calendar page.

US NFPs and Why It Is Still Impressive

There are few regular fundamental events that can claim the consistency for moving the markets that the US nonfarm payrolls (NFPs) can. However, the mere presence of this monthly report does not guarantee volatility much less a full-blown trend. For the May labor update, there is a much more active US Dollar that naturally tunes it to the frequency of meaningful fundamental charge. The problem with dragging the world's most liquid currency - or general risk trends - is the moderation in rate speculation as a pace setter and the rise of conflicting themes such as the revived winds of trade wars. Heading into the data run, the topline payrolls figure is expected to report a 190,000 job increase in the US headcount. The jobless rate is seen holding to last month's surprise 3.9 percent reading (the lowest since 2000) while wage growth is also expected to keep pace at 2.6 percent growth. Generally speaking, this reflects a robust labor market; but again, it does not ensure a favorable currency or capital market response.

Context: Why Jobs Data Matters for the Dollar

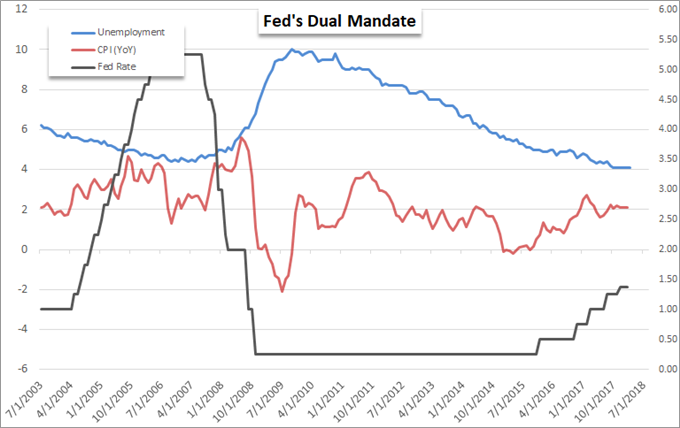

As is true of all fundamental events and themes, if we want to assess whether it it can actually move the markets or not, it is necessary to establish its importance for the speculative balance. For the Dollar, the labor report is most relevant for FX traders for its direct influence over monetary policy. The Federal Reserve maintains a dual mandate to foster steady inflation and low unemployment. With a 17-year low unemployment rate, the jobs objective is already well in hand. It is the inflation component that is still lacking drive to motivate a faster pace of hikes. In the this run of data, we have one of the most appropriate price measures in the form of wage growth. Between these two factors, we have already seen the Fed promote a hawkish regime that is an extreme contrast to its major counterparts. And, that consistent advantage has offered an uneven market response over the past few years. It is hard to further impress an advantage to the already-unique policy standing from the Fed, but it is likely much easier to disappoint.

Context: How Jobs Data Can Impact Risk Trends

Risk trends is another area whereby this update may register a meaningful market response. Yet, here too, the potential is skewed. The steady improvement in health of the labor markets has certainly contributed to the buoyancy of benchmarks like US equities. It is just another piece of the complaceny puzzle that have kept buy-and-hold investors engaged. To materially upgrade the economic forecast in such a way to inspire a flush of new speculative funds despite the growing issues of normalizing monetary policy (more expensive funds), building trade wars and other systemic fears; we would need to see a highly improbable reading. That said, a material slip that undermines the set trend of optimism can unsettle complacency. This is just as likely from the data print itself as it would be from the systemic view of its underlying trend. A significant short fall from this data can add to an already percolating concern over trade and even generate enough traction to help carry a move over to the new trading week.

Setups for Miss or Beat

Given the assumptions behind the well establish trends and the shifting importance of related themes that the report could tap, it is important to estabish a baseline and candidates for trades. In general, I do not favor a long-Dollar scenario that would be based on this data. The Greenback may extend its recovery owing to its safe haven status or due to the collective retreat of major counterparts like the Euro, but the Fed's unique policy position is already well-established not to mention it would be hard to override renewed concerned in the other key fundamental outlets. Alternative, an outcome that undermines the Fed's deeply set forecasts can exacerbate the Dollar's emergent risks and foster a pullback from the past few months' gains. I like USD/CHF, AUD/USD and NZD/USD for a US bearish outlook. On the risk front, it is hard to impress in currency conditions. Concern would build on other headlines and potentially feed further retreat from the likes of the S&P 500 and Dow towards their 200-day moving averages. Establish your expectations and chose your outlets wisely. We focus on the upcoming NFPs in today's Quick Trade Video.