This week's top fundamental theme is likely to remain the most proactive fundamental theme of the past months and years: monetary policy. While there is plenty to expect from the relative policy perspective for FX markets, the collective outlook's influence on risk trends may soon hit critical mass.

Talking Points:

- Monetary policy remains one of the most active relative FX drivers, but it also carries significant collective influence in markets

- Amid various central banks speeches and inflation reports, the Panel attended by Yellen, Draghi, Carney and Kuroda is top event risk

- There is a bubble in speculative exposure fostered by accommodative monetary policy which poses a clear risk to the change in tide

Have questions about the themes and markets we discussed in this weekly fundamental webinar? Bring them to the Trading Q&A that I conduct on a weekly basis or to the other question events hosted by other analysts listed on the DailyFX Webinar Calendar.

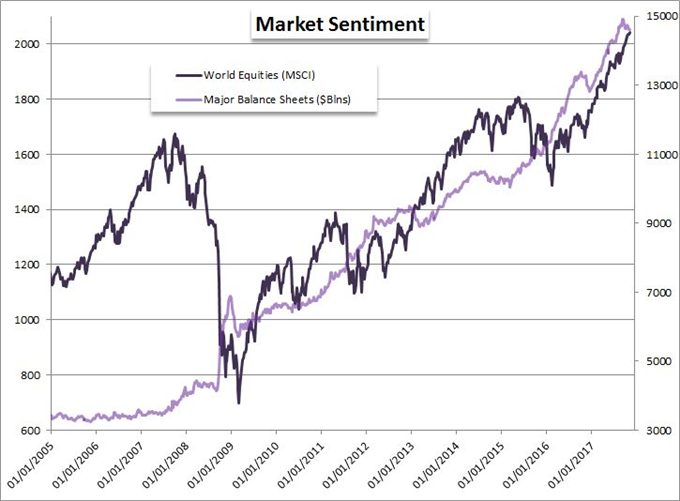

We are in the midst of a possible transition in speculative conviction. On the one hand, global benchmarks for speculative value - such as the Dow Jones Industrial Average and other major equity indexes - are pushing record highs. In contrast, the build of exposure behind those markets showing conviction continues to flag while the fundamental disparity with measures of value show ever widening gaps to pricey spot levels. For many reasons, monetary policy is likely to play a sizable role in the inevitable turn in capital markets. The question is whether it will be a passive contribution or a strong proactive one. There is plenty of event risk this week that can actively shape this realization of fading support from the market's most reliably deep-pocketed buyers. Whether or not it provides impetus remains to be seen.

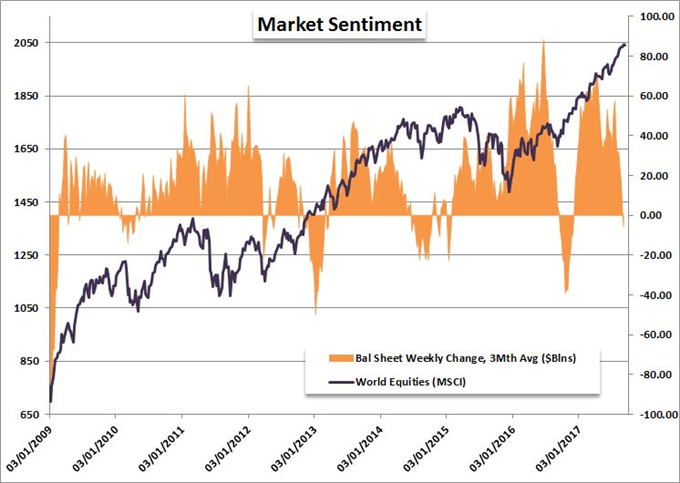

Before evaluating each listing for its market moving capacity, it is first important to appreciate what has the ability to move markets. We wouldn't apply a range strategy to a trending market and expect it to be a successful career. In similar fashion, we need to be honest and observant as to what is leading the market on a fundamental basis. 'Risk trends' is an all-consuming motivation when active, but it has been so rarely driven over the past months and years. That said, one of the most effective sparks could very well be the most active major theme over the past years: monetary policy. Since the Great Financial Crisis, the world's largest central banks have pumped the markets full of easy money and excessive confidence through rate cuts and stimulus. In some ways this went beyond encouragement and into a degree of forcing exposure. Yet, we have seen many signs recently that we are coming to the end of the escalation phase and that the retreat is nigh.

There is a serious opportunity for the major central bank heads - for the Fed, ECB, BoE and BoJ - to say collectively that they are turning the tide on support. However, that would be a very low probability for a group that is in such varied stages but is universally dedicated to reducing volatility. Nevertheless, they may not be able to de-escalate the market's hyper sensitivity and the influence of that actual change they are initiating. There will be other event risk to shape policy from individuals and the collective from individual policy speakers events to key inflation statistics. It is important to first evaluate what matters in fundamentals before you can assess the impact of event risk; but it is pretty clear that monetary policy and risk trends are the most influential overall.

To receive John’s analysis directly via email, please SIGN UP HERE.