Talking Points:

- There are three general states for any market: ranging, breakout and trending

- Technicals are often considered the signal for a systemic transition in market type, but conviction lays in motivation

- With a large scale technical break for DXY and sharp moves for AUD/USD as well as USD/CAD, has the Dollar turned to trend?

See how retail traders are positioning in EUR/USD, AUD/USD and other Dollar-based majors using the DailyFX speculative positioning data on the sentiment page.

Has the Dollar transitioned from years of range to a full-blown trend this past week? How do we confirm phase transitions for major markets - from range to breakout to trend and back the opposite direction? Volatility and high profile event risk can stir speculative appetite which in turn clouds our rational evaluation of trade opportunities. This is especially true of periods when activity levels are extremely low and the field of genuine trades has been barren - exactly the conditions for the financial system over the past months and years. However, markets do ultimately transition. Skepticism is healthy to ensure we don't let our desires dictate our decision making rather than a sound strategy and objective analysis.

For most, the fall of a particularly distinct technical level is often taken as the best possible sign that we have transitioned from range to breakout or breakout on to trend. Chart-based analysis is truly helpful in spotting tentative changes in bearing and condition. That said, clearing a level or line or zone does not necessarily ensure conviction. The bulk of capital in markets like fixed income and currencies hardly takes charts into account when placing transactions. Therefore, market-wide conviction is best established when it is based upon something more elemental; and that typically runs on a deep fundamental theme or even a general circumstance of the market - such as participation or volume.

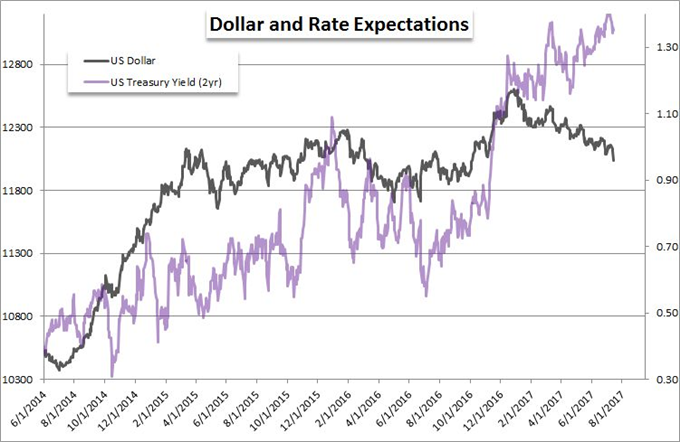

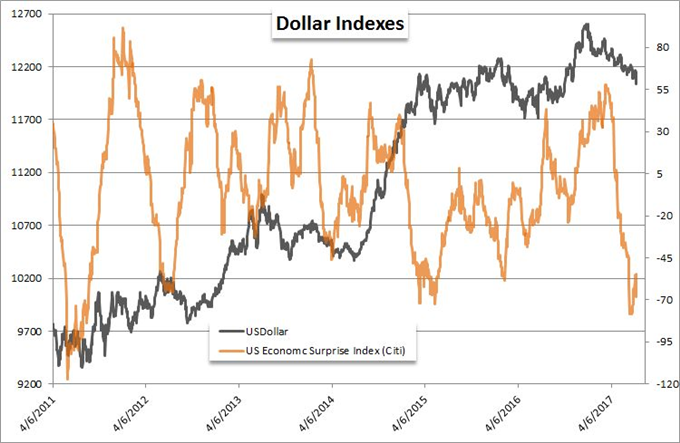

In short, phase change of this magnitude - which should lead to a change in trade criteria, trade frequency, time frame for exposure and more - should be established on a higher degree of conviction. Each person is different. Some are anxious about missing unfolding opportunities and will in turn act early on suspected course alterations. On the opposite end of that spectrum are those that virtually never act in the market as they await unrealistic depth of evidence. These factors can be considered against the Dollar's recent developments. This past week, the DXY Dollar Index dropped below the mid-point of a multi-decade range. It does so with headlines of dubious forecasts for the Federal Reserve and even disappointing data such as the consumer inflation report and UofM sentiment survey - both released on Friday. Yet, does that systemically change the bearings of the Dollar and in turn ensure a full-scale bear market ahead. We discuss the high bar that should be set in calling a change in market winds in this weekend Strategy Video.

To receive John’s analysis directly via email, please SIGN UP HERE