Talking Points:

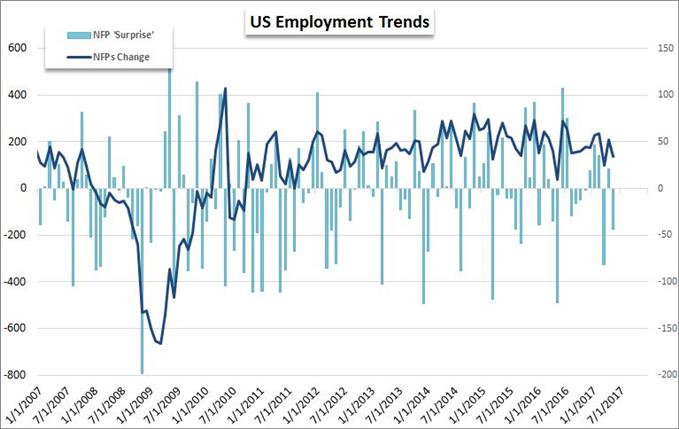

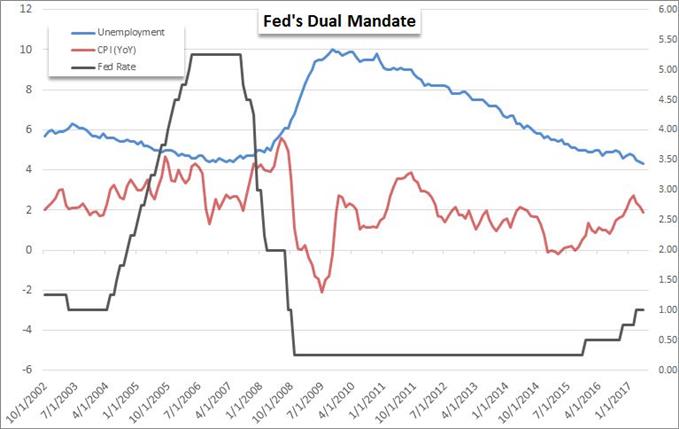

- June NFPs and labor data is due Friday with a forecast of around 180k jobs added, 4.3% jobless rate and 2.6% wage growth

- To determine how much impact this event has; first we must determine whether policy, growth or risk trends matters most

- The Dollar is near the mid-point of its multi-decade range while the S&P 500 stands on a technical cliff

Join analysts on the DailyFX US desk as they cover the NFPs outcome and its impact on the markets live. Sign up for the webinar on the DailyFX Webinar Calendar.

The monthly labor report - headlined by the net payrolls (NFPs) change - is a well-known market mover for the Dollar, equities and broader financial system. There is little doubt that the upcoming June figure has the potential to generate volatility for all the above, but the intensity and persistence of the move depends on what theme this event taps into. For broader market conditions, the trading potential seems to be filling out. Liquidity is slowly recovering from the extreme dearth of activity centered on the seasonal trough of the US Independence Holiday. That said, the pick up in activity is slow to take; and the resistance to trends and the depth of skepticism throughout the investor rank is profound. This will shape the market's possible response to this important and somewhat complext event risk.

To gain serious traction on this event risk, there are three particular themes that this otherwise complex report can channel. The most popular through the past fear years is monetary policy. Looking to Fed Fund futures, there is a 55 percent probability that the central bank will meet its forecasts and hike rates again before the year's end. This indicator is unlikely to push that probability to below 20 percent or above 80 percent short of an extreme change. The pace of improvement for labor conditions is so gradual and consistent, that it is hard to alter the deeply set course it has carved out. What matters now is the change from extremes rather than the absolute, deflated yields to be made. For the Fed, we know the hawkish course is well set. The wild card is whether this data can materially change the probability of an earlier start to the QE wind down. That would be difficult to achieve.

A more traditional venue that this data can influence the market is the traditional growth assessment. The future of low returns and speculative reach depends significantly on a stable economic backdrop. Employment and wages are foundational to growth in the world's largest economy, so the connection is present. That said, the persistent trend of payroll growth and decline in joblessness cannot be completely waylaid or definitely reinvigorated by a single update. The most direct potential for this event is straight throught to 'risk trends.' While the jobs data usually has to connect through monetary policy or economic performance before escalating to the systemic tide, skepticism is so universal that it may amplify the influence that this data typically has. Where the most imminent potential lies in the short-term risk response. Volatility is the lowest boundary for the NFPs and tipping the scales may be most capable course to a true trend that carries through the weekend drain. We discuss the strategy for trading the US employment report in today's Strategy Video.

To receive John’s analysis directly via email, please SIGN UP HERE.