Talking Points:

- U.S. Dollar Fails to Benefit From Mixed Non-Farm Payrolls (NFP) Report.

- Shift in EUR/USD Behavior Persists; ECB Forecasts at Risk.

- USD/CAD Slips to Fresh 2017-Lows as Canada Employment Jumps 45.3K in June.

- USD/JPY Eyes May-High Ahead of Fed Chair Janet Yellen Testimony.

- Gold, Silver and Oil Prices Weaken; Opening Monthly Range in Focus.

- Join the DailyFX Trading Webinars for an opportunity to discuss potential trade setups.

Join DailyFX Strategists Michael Boutros,David Song and Christopher Vecchio to cover post-NFP trade setups as market attention turns to the Humphrey-Hawkins Testimony.

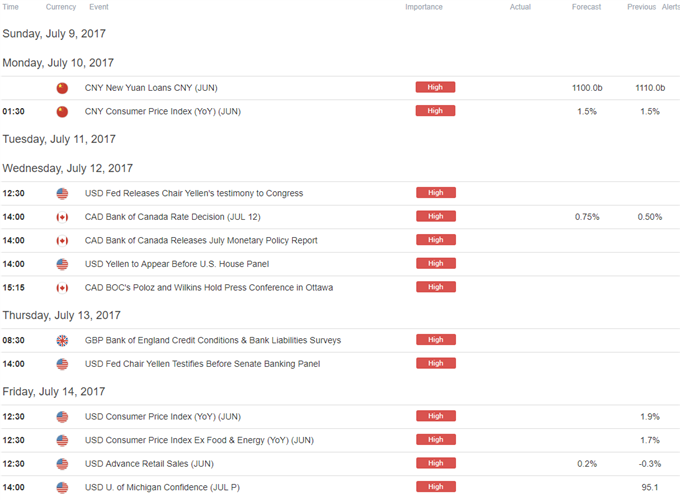

The initial market reaction to the U.S. Non-Farm Payrolls (NFP) was short-lived, with the greenback regaining its footing ahead of the semi-annual Humphrey Hawkins Testimony as the Federal Open Market Committee (FOMC) appears to be on course to deliver three rate-hikes in 2017. With Fed Fund Futures back to pricing a 60% probability for a December rate-hike, fresh comments from Chair Janet Yellen may sway market expectations amid the growing discussion at the central bank to start unloading the balance sheet. However, the central bank head may refrain from saying anything new in front of U.S. lawmakers amid the mixed data prints coming out of the U.S. economy.

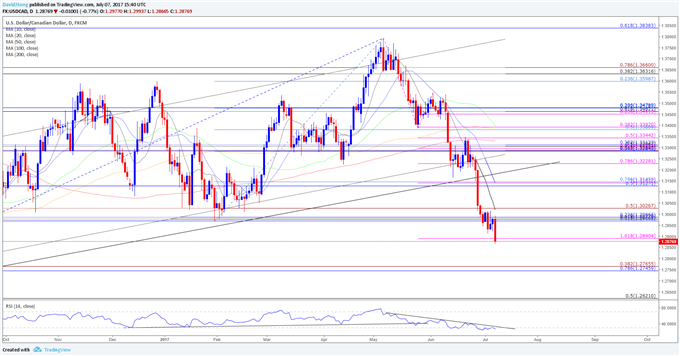

USD/CAD Daily Chart

In contrast, the pickup in Canada Employment appears to be fueling a further shift in market behavior as USD/CAD pushes to fresh 2017-lows. Recent developments in the exchange rate suggests dollar-loonie stands at risk for a further decline especially as the Bank of Canada (BoC) alters the outlook for monetary policy.

Highlighted setups include EUR/USD, USD/CAD, USD/JPY, DXY, AUD/USD, Gold, Silver, Oil, USD/ZAR, USD/MXN. Check out the Quarterly DailyFX Forecasts for additional trading ideas.

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.