S&P 500, GameStop, Silver, EURUSD, AUDUSD Talking Points:

- The most volatile assets of 2021 thus far – the targeted run on the most heavily shorted stocks like GameStop – seem to be coming under increasing pressure

- With AMC’s numbers being delayed, the focus afterhours Tuesday was on Amazon and Google which blew expectations away, furthering the S&P 500 and Nasdaq enthusiasm

- In FX markets, EURUSD has notched a technical break of its head-and-shoulders pattern while the Australian Dollar took a hit from a dovish RBA

A Power Shift

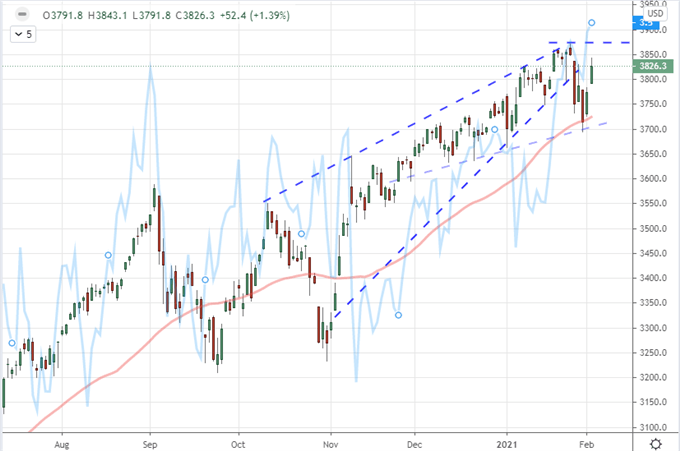

While volatility continues to favor the focus of the Reddit crews’ appetites – from heavily shorted stocks to lagging cryptocurrencies and silver – performance has clearly flagged in the past 48 hours of trade. Yet, that doesn’t mean that risk trends have summarily been undercut. It seems reality is quite the opposite of that notion with the benchmark US indices leading other risk-leaning assets to gains through Tuesday’s close even as the likes of GameStop and other highfliers seriously flag. While there were weighty fundamental updates to absorb this past session, it seemed that speculative strain was a bigger factor in the disparity than anything docket-related. Moving forward, it is likely that the volatility the social groups have suffered will undercut their efforts for revival; so the focus will now turn to whether the S&P 500 and other risk-leaders will return to record highs. I will note that one of my previous high watermarks for sentiment – the Nasdaq 100 to S&P 500 ratio – has pushed a record through Tuesday’s close.

Chart of the S&P 500 Overlaid with the Nasdaq-to-S&P 500 Ratio (Daily)

Chart Created on Tradingview Platform

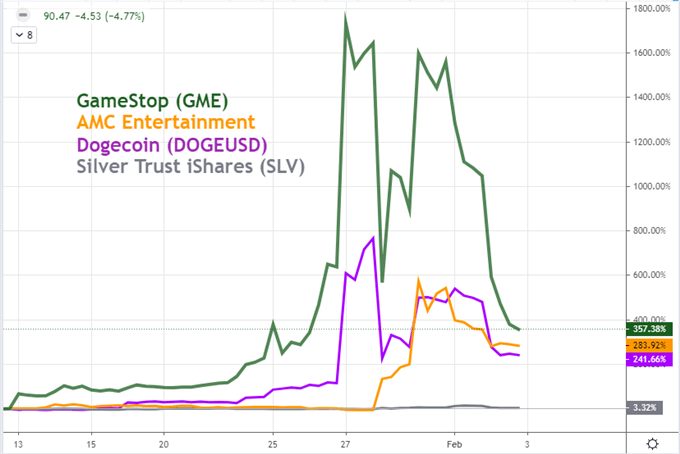

Meanwhile, the concentrated interest of the high seas Reddit boards have come under serious pressure in the days through Tuesday’s close. From last Wednesday’s intraday high, GameStop extended its drop to a staggering -82 percent retreat with a -60 percent slump just this past trading session. Similar upheaval was registered for the other stocks at the center of the short-selling era with AMC down -41 percent Tuesday, Blackberry off -21 percent and Bed Bath & Beyond losing -16 percent. Other targets for the active retail swarm faltered well before such dramatic heights were reached. Dogecoin (DOGEUSD) was -57 percent off the high notched on Friday while regulatory-focused Ripple lost -51 percent from Monday’s highs. This week’s most recent attempt, Silver suffered a -10 percent retreat Tuesday alone before the market could truly gain traction behind a similar level breakout enthusiasm.

Chart of Performance for GameStop, AMC, Dogecoin and Silver (2 Hour)

Chart Created on Tradingview Platform

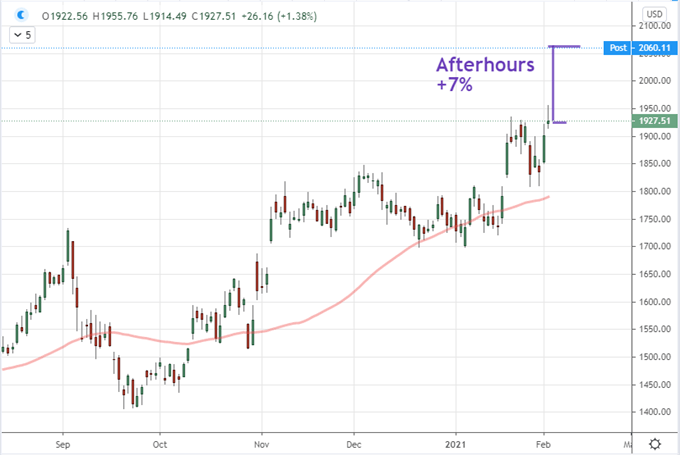

From Reddit boards to traditional headlines, it is worth noting that the afterhours release of AMC earnings for the past quarter was delayed to a period sometime at the end of this month or the beginning of March. It wasn’t that this company’s performance was particularly important for the bigger picture – in fact it was likely to reflect the struggle of the pandemic. Instead, I was watching the update to see how the crowd that has de-prioritized the traditional fundamental measures reacted to the headlines. In the absence of this company’s headlines, the attention shifts more squarely onto Google and Amazon. Both companies soundly beat their respective analyst forecasts with EPS (earnings per share) of $22.30 (vs $15.58 expected) and $14.09 (vs $7.34 expected) respectively. The Nasdaq Composite will be a particular focus of mine into Wednesday.

Chart of Google Including Afterhours (Daily)

Chart Created on Tradingview Platform

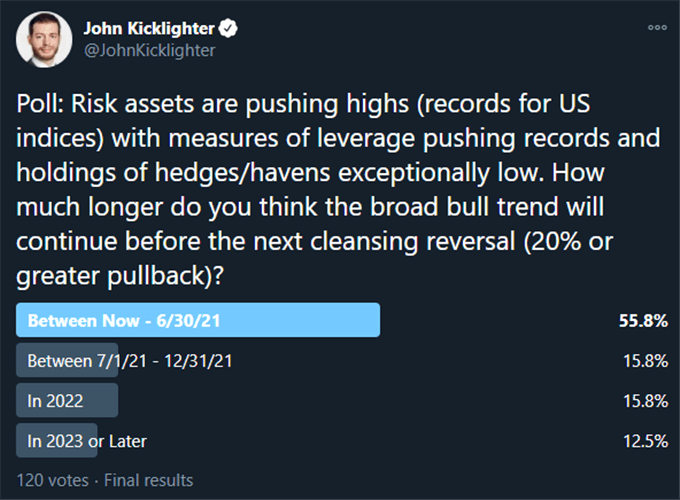

The Speculative Crest

Though this has been a frequent refrain from me over the past week, I feel it is important to reiterate at a regular interval: despite the speculative fervor as of late, traders remain skeptical of the immediate outlook. It remains the case that my Twitter poll from last week reflected the majority of participants (56 percent) believe the next bear wave would set in through the first half of this year. Of course, it may be the case that the 120 person sample size is too small and I simply draw the more cautious market participants as I myself am cautious. That said, there are other measures that earn scrutiny.

Twitter Poll: When Will Capital Markets Put in for the Next Bear Market

Poll from Twitter.com, @JohnKicklighter

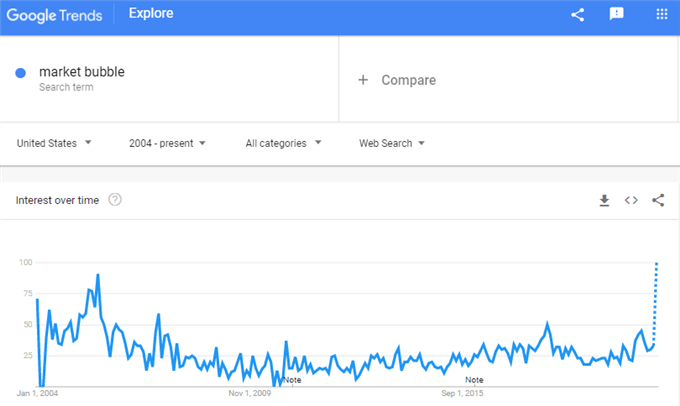

Less a consideration of my limited reach for sample size, the (US) search for ‘market bubble’ extended its rise to hit unprecedented levels going back to when Google began collecting data in 2004. The interest in ‘day trading’ is similarly holding up, but fear is historically the more unflappable emotion relative to greed.

Learn more about some of history’s greatest market bubbles.

Google Trend Search Interest for ‘Market Bubble’ in the US

Chart from trends.google.com/trends

Systemically Important Fundamentals Threatens Dollar Based Majors

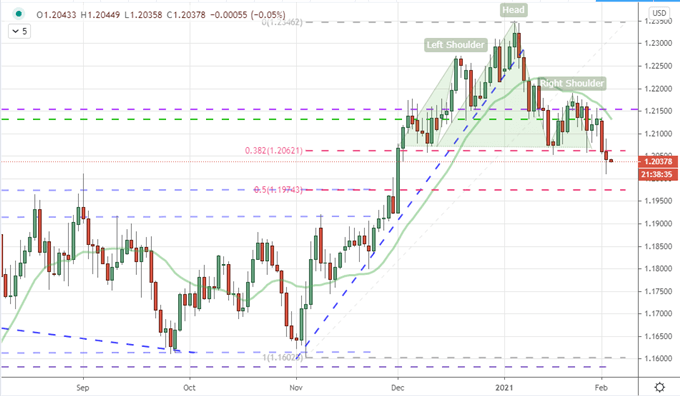

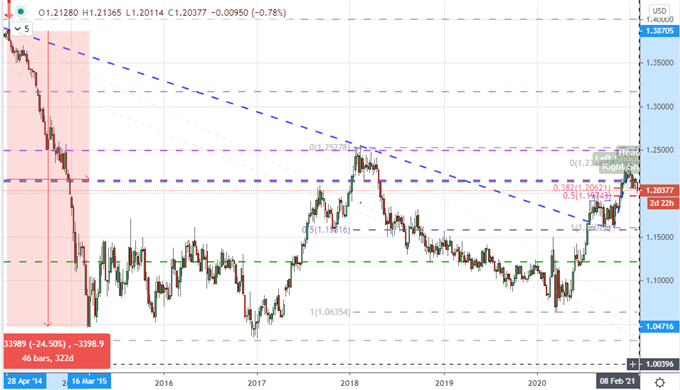

While there has been understandable interest paid to the certain stocks that have been at the center of Reddit efforts, it remains important to keep tabs on the systemic fundamental developments that will eventually reestablish control over the global financial system. In the FX market, the Dollar’s edge higher through Wednesday to rouse serious speculation as to whether the benchmark currency – and in many regards the most liquid asset in the world – has definitively broken resistance on the reversal of a many-month bear trend. In practical terms, the EURUSD has slipped the neckline of its past three-month head-and-shoulders pattern. I will point out that critical for such a reversal pattern is the buildup that is subsequently reversed. However, the technical spark and build up along are not enough to ensure a market slide.

Chart of EURUSD with 20-Day Moving Average and 10-Day ATR (Daily)

Chart Created on Tradingview Platform

Meanwhile, the very big picture of fundamentals have been stirred for this benchmark pair. This past session it was reported that former ECB President Mario Draghi is being eyed to stand in as Italy’s next Prime Minister as the country’s political coalition continues to falter. I will remind (or inform if you haven’t been trading that long) that Mr. Draghi as the head central banker manufactured the incredible Euro slide back in Spring/Summer of 2014 by connecting a level in EURUSD to policy actions. I don’t think he will follow similar tack in this situation, but it speaks to the person being considered and what he will do to achieve growth.

Chart of EURUSD with 20-Day Moving Average and 10-Day ATR (Daily)

Chart Created on Tradingview Platform

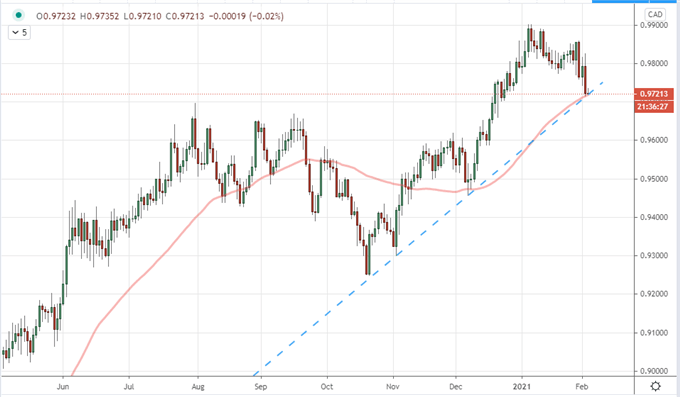

Looking ahead to Wednesday trade, the traditional economic docket is somewhat restrained. One very notable highlight will be the US ISM service sector survey. I will not suggest this is a certain market mover for the Greenback much less broader risk trends, but it is worth reiterating that the world’s largest economy is first and foremost a service driven economy. Further, underappreciated event risk can certainly move the needle. Consider the RBA this past session. The group’s extension of its stimulus effort to purchase A$100 billion undermined the currency’s position as a global carry currency which in turn cut pairs like AUDCAD to the point of being on their own technical cusp.

Chart of AUDCAD (AUDCAD)

.