Talking Points:

- While the S&P 500 continued to lead risk assets higher, it did so without a bullish gap on the open and a more tepid follow through

- The Dollar managed a needed rebound but it seemed mainly a move for EUR/USD; but keep tabs on AUD/USD, GBP/USD and USD/JPY

- Emerging market currencies deserve a second look through the ease of feedback risk and cryptocurrency is taking a breather

What makes for a 'great' trader? Strategy is important but there are many ways we can analyze to good trades. The most important limitations and advances are found in our own psychology. Download the DailyFX Building Confidence in Trading and Traits of Successful Traders guides to learn how to set your course from the beginning.

Capital markets were still pushing generally higher to start the second trading week of 2018, but there was clearly a moderation of the enthusiasm that had offered so much inspiration to bulls this past week. For the S&P 500, that would translate into the fifth consecutive positive close - essentially every trading day of 2018 so far - but it did so under more restrained circumstance. It is interesting that the record high the benchmark US equity index is not the only aspect of the day's performance we monitor as it has become commonplace against the exceptional complacency of the period, but the advance for the day was notably measured and the open was actually a gap down. We have seen a remarkable run of positive gaps (16 of the past 19 trading sessions) recently. Looking more broadly, we had a similar mix for global equities, emerging markets, junk assets and carry trade among other 'risk' assets. In the back of our mind, we should be weighing whether the new year has opened to a fresh sense of speculative appetite or simply a need to reinvest from year-end hedging. The latter is hard to fathom given the maturity of this move and the latter destined to stall out given the prevalence of complacency and lack of speculative withdrawal to afford for this past holiday's illiquidity.

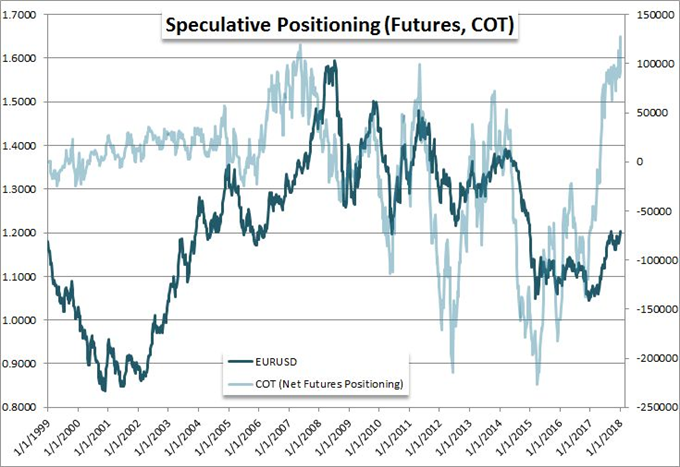

A vigilant eye should be kept on general sentiment throughout the system as a shift in that view will no doubt usher in a change in intensity - in other words, a directional change will likely revive volatility and volume. Yet, as we await the shift in deeper currents, we are seeking out paths of least resistance. For some like the S&P 500, that may be a slow but comfortable push to subsequent record highs. Yet, for others, it equates to the traditional retreat into range. The Dollar made a tentative effort to pull back towards the epicenter of its recent range via the DXY Index. That said, looking at an equally weighted index of the USD-based majors, we don't see the same effort. That is likely to suggest that much of the Greenback's move was concentrated on EUR/USD which took the easier path of a break from recent congestion. A move lower simply opens up the larger range of the past four months. A push higher alternatively would get into the sticky situation of forging a major break higher beyond a collection of multi-year and multi-decade resistance with very underwhelming fundamental credentials to achieve it. We will see what the Dollar's commitment to the cause is as other pairs like AUD/USD, USD/JPY and GBP/USD face short-term technical barriers of their own.

In other majors, the Euro was clearly the instigator for EUR/USD and collectively the currency has taken a dive that translated into a synthetic index's break of a long-standing bullish trend channel. There is still technical support below if we want to take the index at face value; and with that we can also consider that the European event risk this past session (German government coalition talks and Euro-area sentiment surveys) were actually quite robust. Meanwhile, the Pound showed little response to the news of a questionable cabinet reshuffle for UK Prime Minister Theresa May - even with the suggestion of a 'No Brexit' minister. Emerging market currencies meanwhile should be kept under watch with intervention and global risk feedback measured through the likes of the South Korean Won (USD/KRW) and Hong Kong Dollar (USD/HKD). As for the national traditional 'currencies', precious metals gold and silver seem to be consolidating after their long runs while cryptocurrencies like Bitcoin and Ripple are taking a clear breather. We discuss all of this and more in today's Trading Video.

To receive John’s analysis directly via email, please SIGN UP HERE.