Talking Points:

- Sterling trades at post-election lows and below 100-DMA as Carney goes Dovish

- Commodity currencies AUD & CAD take a step back as commodity weakness resumes

- DXY is higher for the second day as Evans carried Dudley’s torch on another hike in 2017

- Sentiment Highlight: IGCS continues to show retail buying EUR/USD, may signal ST downside

Carney provided plenty of disappointment to those who believe the three dissenters from the recent MPC vote from the BoE could mean a rate hike is on the horizon. BoE Governor Mark Carney showed traders that buying the weakest relative currency can be full of peril. At a delayed Mansion House speech, Carney shared the sentiment, “From my perspective, given the mixed signals on consumer spending and business investment, and given the still subdued domestic inflationary pressures, in particular, anemic wage growth, now is not yet the time to begin that adjustment.” By describing wage growth as “anemic” and inflation as “subdued,” we do appear to be distant from any pressures that would help sterling longs, and instead seem to have abundant reasons to think that GBP could be sold. Carney called these reasons the ‘reality of Brexit negotiations.’

Oil continues to spill, and on Tuesday, the front-month futures contract traded at 2017 lows. In addition to Oil weakness, there was also pain to be felt in base metals that all points to a weakening inflation outlook, which was confirmed with US 10Yr Breakevens (the fixed income product that helps show inflation predictions over 10-years) was at 8-month lows. The breakdown in Crude Oil bled through to commodity currencies like the Canadian Dollar and Australian Dollar that traded lower against the USD by ~0.3%.

Would you like to know what our top minds are watching over the long-term in markets?

Supporting the USD on Tuesday, Federal Reserve Bank of Chicago President Charles Evans provided hesitant optimism that gives traders reason to believe will continue to see another Fed Funds Rate (FFR) hike before 2017 is in the books. Evans spoke in an interview and said, “Up to this point, I think that we can still expect that inflation will go up to 2 percent, although I will say that the most recent inflation data make me a little nervous about that, so I think it’s much more challenging from here on out.” His optimism, albeit caution optimism mirrored NY Fed President Dudley on Monday and seems to show that the Fed is looking through the recent softness in data in hopes of pulling the FFR as high as the market will reasonably allow while reducing the Balance Sheet from the $4.5T level we currently have.

JoinTylerin his Daily Closing Bell webinars at 3 pm ET to discusstradeable market developments.

Where are the trades to be found among the low-volatility environment? Find out here !

Closing Bell’s Top Chart: June 20, 2017, Cable breaks below 100-DMA on Carney comments on rates

Chart Created by Tyler Yell, CMT

Tomorrow's Main Event: CB Speaker’s abound on Tuesday: NZD Reserve Bank of New Zealand Rate Decision (22 Jun)

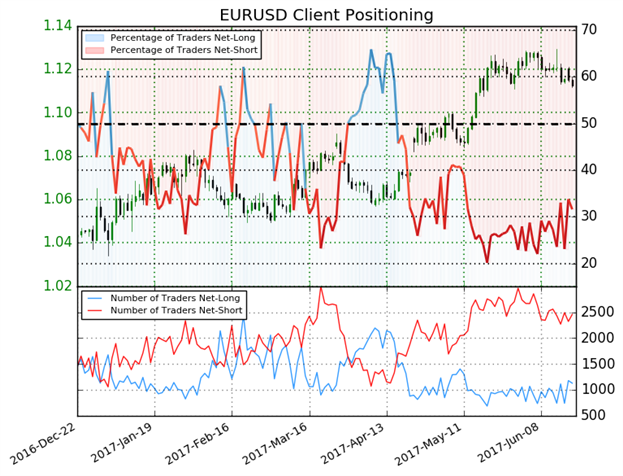

IG Client Sentiment Highlight: Retail buying of EUR/USD may signal ST downside to 1.1076

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

E

URUSD: Retail trader data shows 33.3% of traders are net-long with the ratio of traders short to long at 2.01 to 1. In fact, traders have remained net-short since Apr 18 when EURUSD traded near 1.05782; the price has moved 5.2% higher since then. The number of traders net-long is 16.0% higher than yesterday and 4.9% higher from last week, while the number of traders net-short is 11.4% lower than yesterday and 9.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse lower despite the fact traders remain net-short.(Emphasis mine)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell