Talking Points:

- Volatility remains extremely low and the abundance of event risk thins out in the week ahead

- It is possible that we are looking at an extended Summer lull akin to 2014 or 2015, but remember how both ended

- The pairs most appealing given their motivations are USD/CAD, EUR/JPY, GBP/JPY and NZD/USD

See how retail traders are changing their positions on the Dollar-based majors following the Greenback's charge higher this week following two weeks of indecision on the DailyFX Sentiment page.

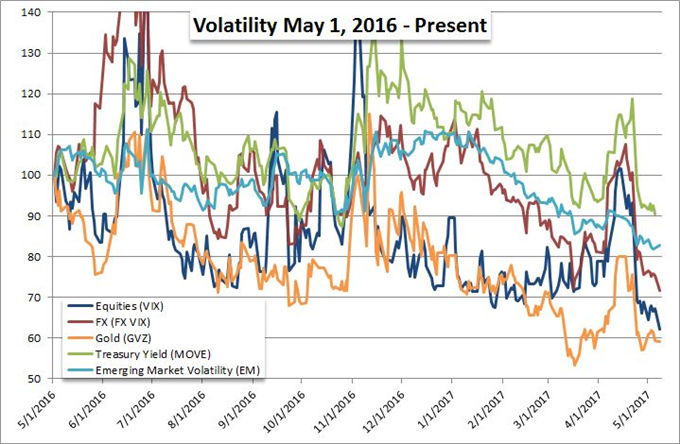

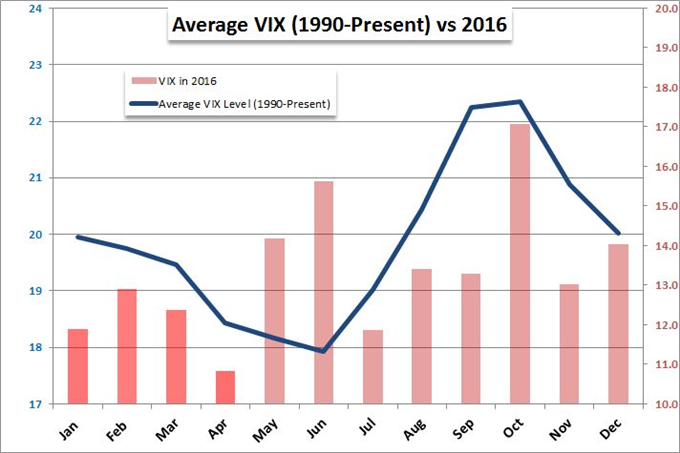

The Dollar has seen a pick up in activity with larger daily swings, but those moves still are not translating into meaningful direction. For global equity indices and other risk-leaning assets, there is a similar lack of conviction but none of the short-term volatility. Volatility measures this past week - from the VIX, alternative asset activity measures and the 10-day S&P 500 realized volatility - ticked up from their extreme lows dredged the previous week. Yet, even with the pick up, we stand at extremely low levels of market turnover. On one hand, this likely reflects the seasonal 'Summer Lull'. That said, the extent of the deflated activity readings puts us in conditions more akin to the extremes witnessed in the Summers of 2014 and 2015. Complacency ran rampant through seasons that lasted longer than many had expected. And, they both ended in spectacular volatility.

The motto, 'hope for the best, prepare for the worst' is appropriate for our current conditions. We are experiencing a dichotomous situation of remarkable quiet with the persistent threat of sudden collapse. To reasonably position for this low-return-high-risk state, trading reduced risk and time frame is the most flexible approach we can take. If the measured pace remains, a reasonable target, lower risk and proximate stop is exactly appropriate for what prevails. If the markets start to gain traction on substantial and persistent moves, we can jump into the trend multiple times until we develop conviction that start-and-stop volatility is being replaced by lasting moves. The pairs that I will be paying closest attention to on the open of the coming week will be set to this pace. USD/CAD has one of the densest technical backdrops in the market among the majors and a distinct relationship to another congestion bound asset - crude oil. With a greater amplitude risk response, EUR/JPY and GBP/JPY have shaped appealing technical patterns with tentative turns on hand. For NZD/USD, a fundamentally-conflicted backdrop can turn the focus on larger technical levels.

Looking at fundamental landscape for the coming week, there is a notable drop in high profile event risk. The rate decisions, NFPs, elections of previous weeks are absent. The traditional economic measures don't carry much promise for focused volatility. Euro-area GDP readings (including Greece's 1Q), UK inflation and Chinese data are all headline worthy; but do little to tap investors' broader concerns. A history of more discreet volatility reactions to event risk like the Australia employment statistics though may present flashes of activity. For themes, we have the concerted effort by the Fed to acclimate the market to a future that puts the central bank on the path of QE reduction. This is likely to be a pivotal development for risk trends - but only when the markets are ready to acknowledge its impact. On the other end of the spectrum, we have remarkably familiar circumstances in current conditions to the Chinese-led collapses of 2015 (August) and 2016 (January). We discuss trading conditions as much as event risk for opportunities in the week ahead in this weekend Trading Video.

To receive John’s analysis directly via email, please SIGN UP HERE