Gold/Silver Price Technical Outlook

- Gold trading at both price and moving average resistance

- Silver has multiple levels/lines of resistance to overcome

Gold Price & Silver Technical Outlook: Face-off with Resistance

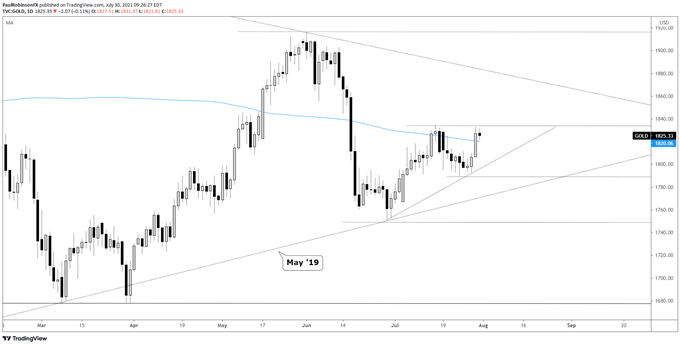

The price of gold is trading around the monthly high and the 200-day moving average. The monthly high is at 1834 while the 200-day is at 1820. From here we may see some backing-and-filling, and if it gold does behave in this manner it could form a consolidation pattern that leads to higher prices.

A breakout above 1834, whether it comes now or after a horizontal period of price action, is seen as a bullish development that would have the August 2020 trend-line in focus as the next level of resistance.

There is a trend-line off the late June low that is seen as helping keep the trajectory pointed upward. A break below 1789 would undermine bullish posturing and have the May 2019 trend-line in focus.

Tactically speaking, risk/reward from either side doesn’t look particularly appealing. However, with some time this should change, especially if we see a congestion pattern form that provides defined barriers on the top and bottom side to work with.

Gold Daily Chart

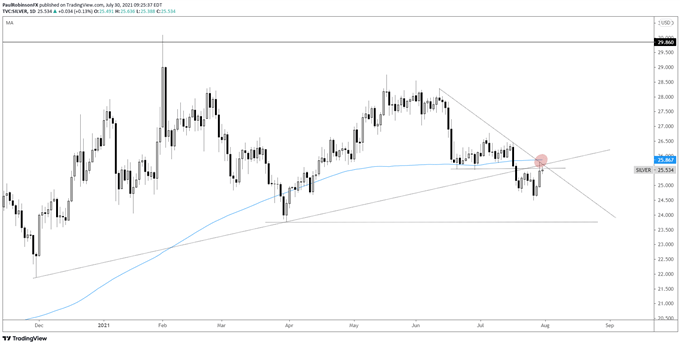

Silver shot up hard yesterday, but now has a set of resistance levels and lines to contend with. There are four angles of resistance in confluence; June trend-line, June lows, 200-day MA, and the underside of the November trend-line.

This resistance will need to be overcome if the current bounce is to morph into anything more than just a bounce. Tactically speaking, would-be shorts might find this an attractive spot from a risk/reward perspective to join the trend off the May highs.

Would-be longs may be best served waiting for resistance to get cleared before dialing up a bullish bias.

Silver Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX