Gold & Silver Price Technical Outlook

- Gold is caught between a pair of trend-lines from varying angles

- Silver is rolling over, in position to sell off with more authority

Gold Price Poised to Move Soon, Silver in Position to Trade Lower

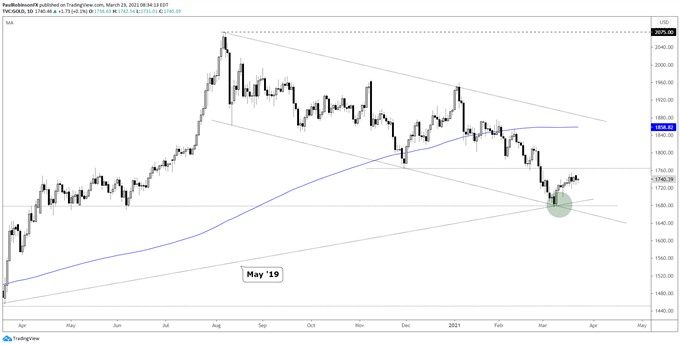

Gold is currently stuck at a cross-road consisting of a downtrend line from early January and a near-term uptrend line from earlier in the month. The price action since the monthly low has been a choppy grind higher, which hints at the notion that it is a corrective play within the context of a downtrend.

If this is the case, then a move lower should begin soon. To validate this outlook a break below the lower trend-line needs to take shape, with a drop below the recent low (4-hr chart) under 1718 as ideal to confirm.

Should this develop, weakness will quickly bring back into play a larger crossroad of support via the May 2019 trend-line, 2020 horizontal line, and the underside trend-line from August.

Should we see the upward grind pick up momentum and clear the top-side trend-line it is currently poking above, then a larger recovery or better may be under way. Will need to keep an eye on how price action unfolds around the 1764 area for signs of whether it will turn from a prior source of support to resistance.

Gold 4-hr Chart (crossroad)

Gold Daily Chart (big support below to watch)

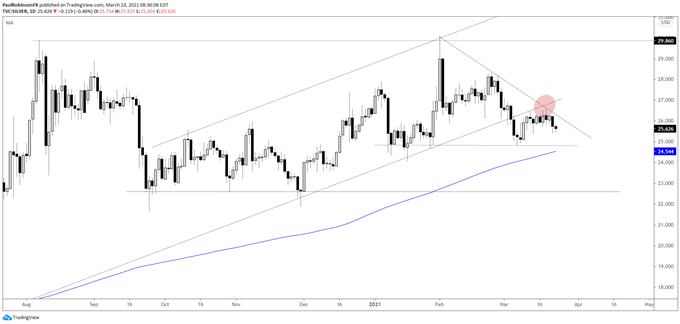

Silver is rolling over from a corrective pattern, and may be suggesting gold is about to do the same. It broke the underside trend-line and carved out a lower-low that has the monthly low at 24.95 in focus. The 200-day MA is running up around 24.54, which is in rough alignment with the yearly low at 24.06. A big spot from 24.95 down to 24.06. Should price fall into that zone we will want to keep an eye on how things play out; momentum build or fade back to the upside.

On the top-side to turn the increasingly bearish outlook positive, a break above the downtrend line and last week’s high at 26.31 is needed.

Silver 4-hr Chart (positioned for lower prices)

Silver Daily Chart (watch support below on weakness)

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX