Silver Price Outlook:

- Despite the sharp uptick in global bond yields over the past week, silver prices have proven resilient.

- The drop below the February low and quick return above henceforth suggests that demand for silver remains ample around key technical support.

- Recent changes in sentiment suggest that silver prices have a bearish bias in the near-term.

Silver Prices Weather Rising Yields

Like other precious metals, silver prices have been challenged in recent days by the rise in global bond yields, particularly US Treasury yields. Even as silver prices have dropped below the February low, the market is still proving rather resilient. The quick return back above the February low as well as key Fibonacci retracements suggests that underlying demand remains robust, even through the yield storm.

Long-term Fundamentals Matter, But…

It’s important to view recent price action across asset classes through the lens of asset allocation and risk-adjusted returns. Silver, like other precious metals, does not have a dividend, yield, or coupon, thus a jump in both US nominal and real yields presents a problem. Moreover, rising US Treasury yields, narrowing the gap with key metrics like US S&P 500 dividend yield (and above that, the earnings yield), are provoking reallocation not just in commodities, but equities and FX as well.

Bond markets are the ‘tail that wags the dog,’ and while longer-term fundamentals matter, a rapid advance in yields can provoke short-term havoc that runs counter to longer-term expectations (in this case, which is a steady erosion in real yields due to the combination of loose monetary policy and expansionary fiscal policy).

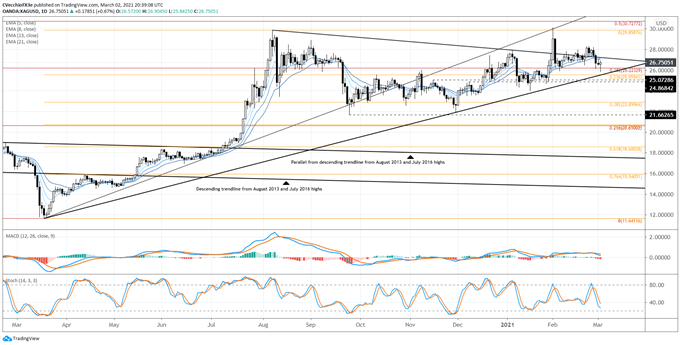

SILVER PRICE TECHNICAL ANALYSIS: DAILY CHART (March 2020 TO March 2021) (CHART 1)

In the last silver price forecast update, it was noted that “silver prices are still carving out ‘higher highs and higher lows’; December, January, and February have set higher highs and higher lows than each of the preceding months.” Technically speaking, this trend has now ended, with today’s price action producing a ‘lower low’ relative to February. In context of the early-February spike that produced a brief break of the 2020 high, traders shouldn’t dismiss a potential double top coming together.

For now, silver prices remain in the uptrend from the March and November 2020 low, but the slow grind higher through symmetrical triangle resistance from the August 2020 and January 2021 highs has lost some momentum. Despite the daily hammer candle, silver prices are below their daily 5-, 8-, 13-, and 21-EMA envelope, which is in neither bearish nor bullish sequential order. Daily MACD is trending lower but remains above its signal line, while daily Slow Stochastics have already dropped below their median line.

It still holds that, “silver prices are weathering the rise in US yields and remain technically well-positioned for further gains.”

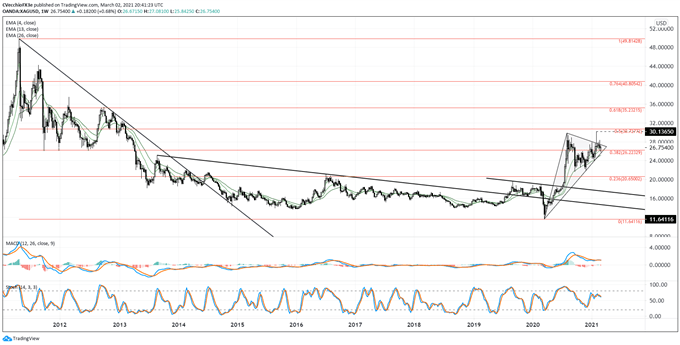

SILVER PRICE TECHNICAL ANALYSIS: WEEKLY CHART (March 2011 TO March 2021) (CHART 2)

The long-term view on silver prices remains bullish. “The recent triangle consolidation is occurring in context of the breakout from the downtrend dating back to the August 2013 and July 2016 highs, suggesting that a long-term bottoming effort is still under way. If the silver price triangle were to breakout to the topside, there would be good reason to suspect that the move had meaningful technical tailwinds pushing prices higher. The near-term bullish breakout in silver prices may be the start of the next leg higher in this multi-year bottoming effort.”

Silver Prices Not Falling as Fast as Silver Volatility

Both gold and silver are precious metals that typically enjoy a safe haven appeal during times of uncertainty in financial markets. While other asset classes don’t like increased volatility (signaling greater uncertainty around cash flows, dividends, coupon payments, etc.), precious metals tend to benefit from periods of higher volatility as uncertainty increases silver’s safe haven appeal.

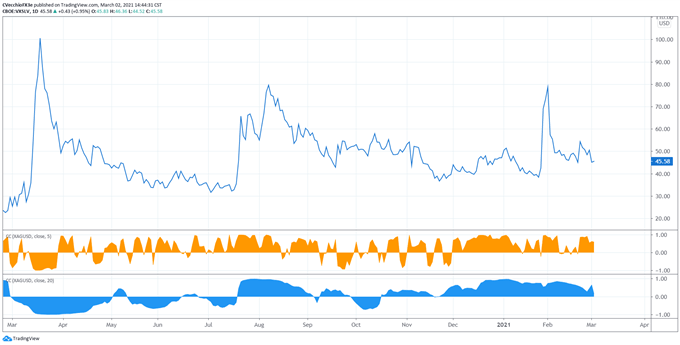

VXSLV (SILVER VOLATILITY) TECHNICAL ANALYSIS: DAILY PRICE CHART (March 2020 TO March 2021) (CHART 3)

Silver volatility (as measured by the Cboe’s gold volatility ETF, VXSLV, which tracks the 1-month implied volatility of silver as derived from the SLV option chain) was trading at 45.58 at the time this report was written (notably down from the monthly high of 137.95, which is now the new all-time intraday high). The 5-day correlation between VXSLV and silver prices is +0.61 and the 20-day correlation is +0.16. One week ago, on February 23, the 5-day correlation was +0.88 and the 20-day correlation was +0.49.

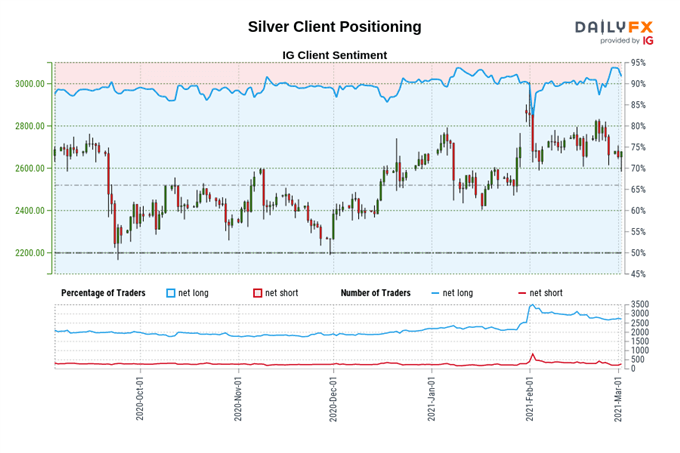

IG Client Sentiment Index: Silver Price Forecast (March 2, 2021) (Chart 4)

Silver: Retail trader data shows 92.65% of traders are net-long with the ratio of traders long to short at 12.61 to 1. The number of traders net-long is 0.74% higher than yesterday and 2.25% higher from last week, while the number of traders net-short is 15.29% lower than yesterday and 28.00% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Silver-bearish contrarian trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist