Silver Price Outlook:

- Both US nominal and real yields are on the rise, proving to be a veritable headwind to silver’s otherwise bullish machinations.

- Improved economic prospects may be one of the reasons that metals like silver, copper, and platinum are faring better than gold prices.

- Recent changes in sentiment suggest that silver prices hold a mixed bias in the near-term.

Silver Prices Sail into Headwinds

Asset allocation decisions drive markets. The concept of achieving inflation-adjusted and risk-adjusted returns underlines many of these decisions. Which is why, for silver prices (and precious metals in general), as an asset without any dividend, yield, or coupon, the rise of both US nominal and real yields presents a problem. It’s worth drawing a key distinction, however: improved economic prospects may be one of the reasons that metals like silver, copper, and platinum are faring better than gold prices.

Long-term Fundamentals Matter, But…

There’s no denying that rising US yields present a problem across markets, not just silver and precious metals. Rising US Treasury yields, narrowing the gap with key metrics like US S&P 500 dividend yield (and above that, the earnings yield), are provoking reallocation not just in commodities, but equities and FX as well. Bond markets are the ‘tail that wags the dog,’ and while longer-term fundamentals matter, a rapid advance in yields can provoke short-term havoc that runs counter to longer-term expectations.

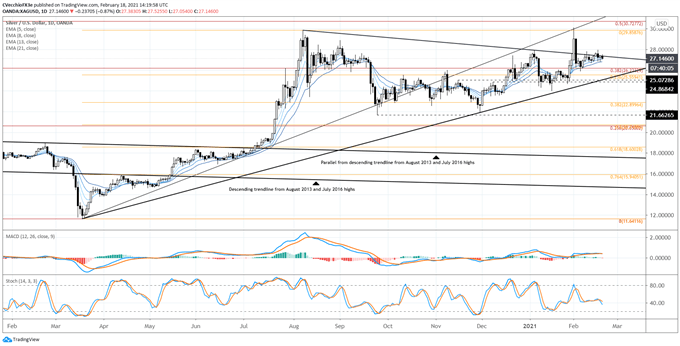

SILVER PRICE TECHNICAL ANALYSIS: DAILY CHART (February 2020 TO February 2021) (CHART 1)

For all the talk about rising US yields, silver prices have been…stable. There has been some modest weakness this week, but price action has proved paltry compared to its golden counterpart. It’s worth noting that silver prices are still carving out ‘higher highs and higher lows’; December, January, and February have set higher highs and higher lows than each of the preceding months.

Silver prices are enmeshed in their daily 5-, 8-, 13-, and 21-EMA envelope, which remains in bullish sequential order. Daily MACD is trending lower but remains above its signal line, while daily Slow Stochastics have already dropped below their median line. The resiliency in silver prices relative to the pace in momentum indicators is a promising sign, as far as this strategist is concerned. All-in-all, silver prices are weathering the rise in US yields and remain technically well-positioned for further gains.

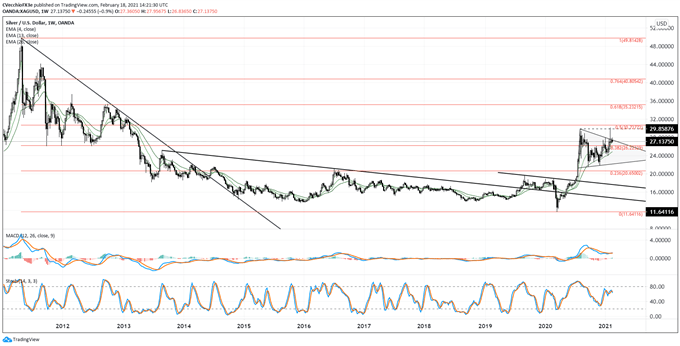

SILVER PRICE TECHNICAL ANALYSIS: WEEKLY CHART (February 2011 TO February 2021) (CHART 2)

The long-term view on silver prices remains bullish. “The recent triangle consolidation is occurring in context of the breakout from the downtrend dating back to the August 2013 and July 2016 highs, suggesting that a long-term bottoming effort is still under way. If the silver price triangle were to breakout to the topside, there would be good reason to suspect that the move had meaningful technical tailwinds pushing prices higher. The near-term bullish breakout in silver prices may be the start of the next leg higher in this multi-year bottoming effort.”

Silver Prices, Silver Volatility Shuffle

Both gold and silver are precious metals that typically enjoy a safe haven appeal during times of uncertainty in financial markets. While other asset classes don’t like increased volatility (signaling greater uncertainty around cash flows, dividends, coupon payments, etc.), precious metals tend to benefit from periods of higher volatility as uncertainty increases silver’s safe haven appeal.

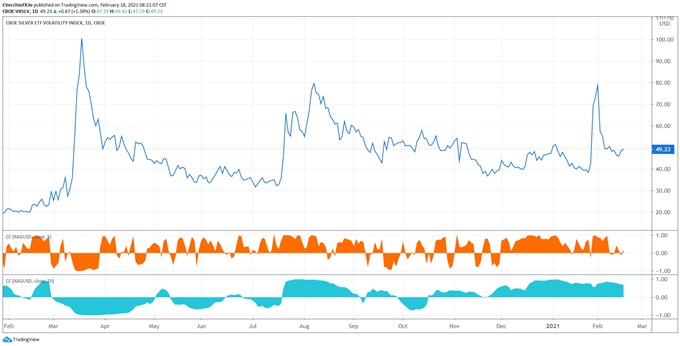

VXSLV (SILVER VOLATILITY) TECHNICAL ANALYSIS: DAILY PRICE CHART (February 2020 TO February2021) (CHART 3)

Silver volatility (as measured by the Cboe’s gold volatility ETF, VXSLV, which tracks the 1-month implied volatility of silver as derived from the SLV option chain) was trading at 49.23 at the time this report was written (notably down from the monthly high of 137.95, which is now the new all-time intraday high). The 5-day correlation between VXSLV and silver prices is +0.17 and the 20-day correlation is +0.65. One week ago, on February 11, the 5-day correlation was +0.40 and the 20-day correlation was +0.76.

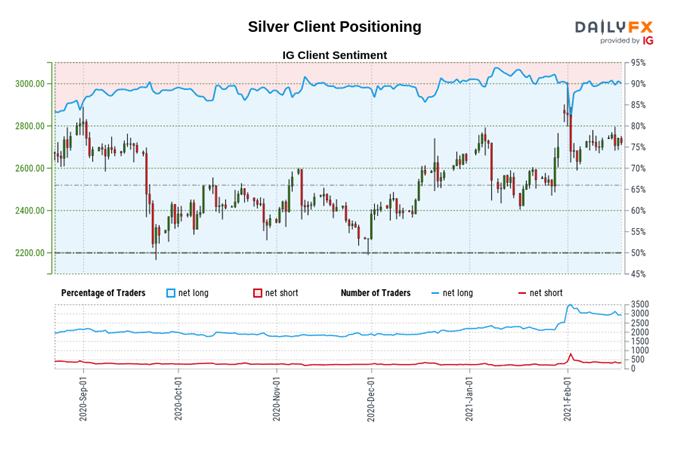

IG Client Sentiment Index: Silver Price Forecast (February 18, 2021) (Chart 4)

Silver: Retail trader data shows 90.35% of traders are net-long with the ratio of traders long to short at 9.36 to 1. The number of traders net-long is 0.54% lower than yesterday and 0.20% higher from last week, while the number of traders net-short is 3.37% lower than yesterday and 11.76% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Silver-bearish contrarian trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist