Silver Price Forecast Overview:

- Silver prices are proving sluggish as January comes to a close, with the uptrend from the coronavirus pandemic low coming into focus as critical support soon.

- It remains the case that long-term technical studies still suggest that a bottoming process is underway, and even a near-term pullback in silver prices has not and may still not disrupt the narrative.

- Recent changes in sentiment suggest that silver prices retain a mixed outlook in the near-term.

Silver Prices Not Gaining Traction

Silver prices have had some tough sledding at the start of 2021. A stronger US Dollar, relatively higher US Treasury yields, and near-term economic weakness due to near-record daily coronavirus infections in developed economies provoking lockdowns have all contributed to a weaker environment for silver prices. Silver prices are down over -3.6% thus far in January, but perhaps notably, they were down over -9% at their trough on January 18. Focus on the next tranche of US fiscal stimulus may be helping silver prices’ recovery.

Keeping an Eye on Long-term Fundamentals

Although price action hasn’t been encouraging in recent weeks, the longer-term backdrop remains bullish for silver prices. On the fiscal side, rising government deficits and debts, coupled with prolonged low interest rates, on the monetary side, are curating an environment akin to the 2009 to 2011 period.

As the global economy is looking ahead to a period of significant growth post-pandemic, silver prices have a recent historical precedent to suggest that they will benefit over the coming months, if not longer. Accordingly, long-term technical studies still suggest that a bottoming process is underway.

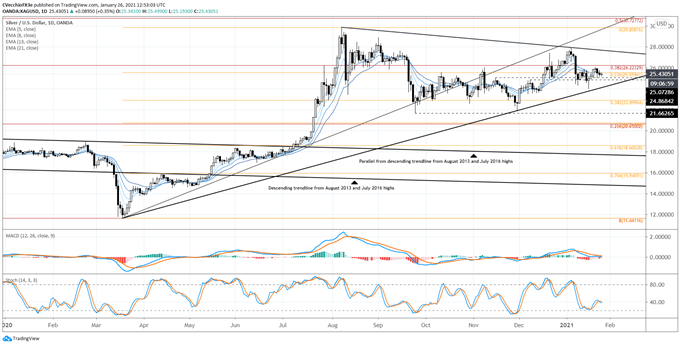

SILVER PRICE TECHNICAL ANALYSIS: DAILY CHART (January 2020 TO January 2021) (CHART 1)

Silver prices continue to linger around the 23.62% Fibonacci retracements of the 2020 low/high range at 25.5594, where previous rallies have met resistance and turned lower (notably, in October and November 2020). Silver prices are just below their daily 5-EMA, but the EMA envelope is in neither bearish nor bullish sequential order. Daily MACD is trending lower ever so slightly but remains above its signal line, while daily Slow Stochastics have just turned lower below their median line.

Directionless indicators in context of silver prices continuing to consolidate in their symmetrical triangle (support drawn from March and November 2020 lows, resistance drawn from August 2020 and January 2021 highs) suggests more consolidation is ahead, for now.

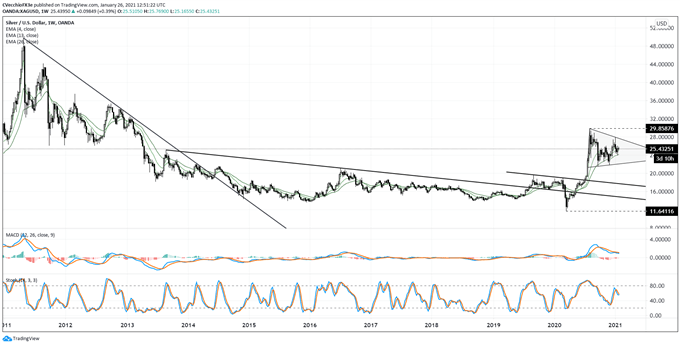

SILVER PRICE TECHNICAL ANALYSIS: WEEKLY CHART (January 2011 TO January 2021) (CHART 2)

The long-term view on silver prices remains bullish. “The recent triangle consolidation is occurring in context of the breakout from the downtrend dating back to the August 2013 and July 2016 highs, suggesting that a long-term bottoming effort is still under way. If the silver price triangle were to breakout to the topside, there would be good reason to suspect that the move had meaningful technical tailwinds pushing prices higher.” The near-term bullish breakout in silver prices may be in question, but the longer-term technical structure remains clear from this strategist’s perspective.

Silver Prices and Volatility Lose Touch

Both gold and silver are precious metals that typically enjoy a safe haven appeal during times of uncertainty in financial markets. While other asset classes don’t like increased volatility (signaling greater uncertainty around cash flows, dividends, coupon payments, etc.), precious metals tend to benefit from periods of higher volatility as uncertainty increases silver’s safe haven appeal.

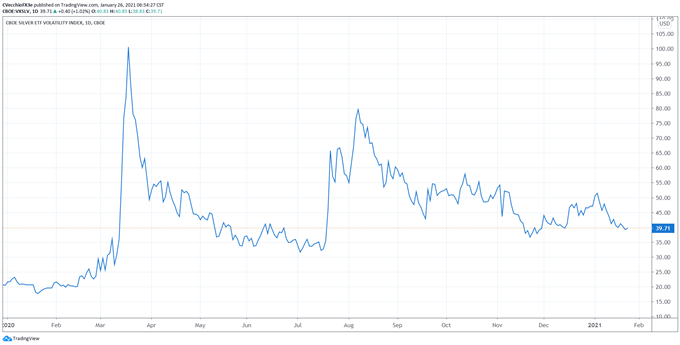

VXSLV (SILVER VOLATILITY) TECHNICAL ANALYSIS: DAILY PRICE CHART (January 2020 TO January 2021) (CHART 3)

Silver volatility (as measured by the Cboe’s gold volatility ETF, VXSLV, which tracks the 1-month implied volatility of silver as derived from the SLV option chain) was trading at 39.71 at the time this report was written. The 5-day correlation between VXSLV and silver prices is +0.64 and the 20-day correlation is +0.75. One week ago, on January 19, the 5-day correlation was +0.77 and the 20-day correlation was +0.78.

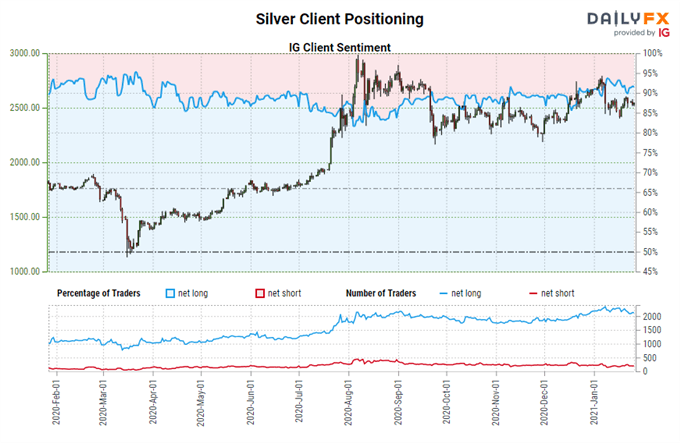

IG Client Sentiment Index: Silver Price Forecast (January 26, 2021) (Chart 4)

Silver: Retail trader data shows 91.30% of traders are net-long with the ratio of traders long to short at 10.50 to 1. The number of traders net-long is 0.33% higher than yesterday and 5.85% lower from last week, while the number of traders net-short is unchanged than yesterday and 3.55% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Silver trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist