Silver Price Forecast Overview:

- While gold prices recently broke to their lowest levels since July, silver prices never cleared their September low

- Ongoing weakness in the US Dollar, even as US Treasury yields creep higher, portends to silver prices withstanding significant downside through the end of the year.

- Recent changes in sentiment suggest that silver prices have a mixed outlook in the short-term.

Silver Prices Continue to Consolidate

Silver prices have seen less attention than gold prices in recent weeks (at least in financial media), in part because volatility hasn’t been as extreme: while gold prices recently broke to their lowest levels since July, silver prices never cleared their September low. In part, as is explained below, this divergence may be due to the perceived differences in economic utility for gold versus silver (or gold versus platinum, for that matter).

Ongoing weakness in the US Dollar, even as US Treasury yields creep higher, portends to silver prices withstanding significant downside through the end of the year. The triangle that’s formed in recent weeks may not produce a breakout in either direction, but it’s important for traders to keep their on the longer-term technical perspective in the face of other monotonous trading.

Silver Price Fundamentals are Evolving, But are Strengthening in One Meaningful Way

The ebb and flow of US fiscal talks against the backdrop of weakening US economic data on one hand and coronavirus vaccine development progress on the other hand has provoked an evolution in the fundamentals underlying precious metals, silver prices included.

Unlike gold, silver is not just seen as a safe haven, but benefits more than its golden counterpart from renewed economic optimism; silver has greater utility in the real economy.Furthermore, with government deficits rising and interest rates staying low – much like the 2009 to 2011 window – now that the global economy is looking ahead to a period of significant growth post-pandemic, silver prices have a recent historical precedent to suggest that they are likely to lead gold prices for the foreseeable future.

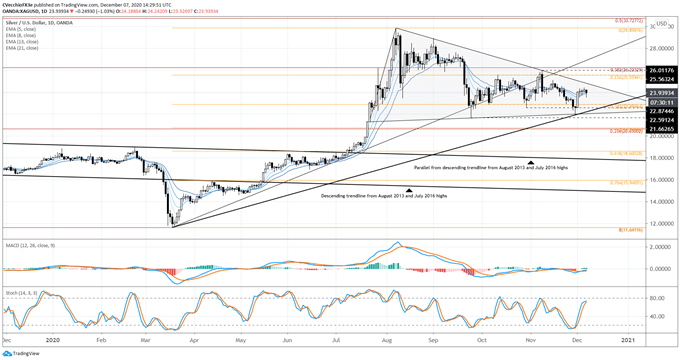

SILVER PRICE TECHNICAL ANALYSIS: DAILY CHART (DECEMBER 2019 TO DECMBER 2020) (CHART 1)

Our last update to the silver price forecast was several weeks ago, but as the range has remained in place, the point of view has not changed. “Silver prices remain within their bull flag/triangle, which has been in place since the end of July. A sideways range has been carved out in recent weeks, dating back to September, between the 23.6% and 38.2% Fibonacci retracements of the 2020 low/high range (22.8996/25.5594).

“It may be the case that the break through the coronavirus pandemic trendline is insignificant if the triangle is the predominant focus. Unfortunately, momentum is flat. Silver prices are still intertwined among their daily 5-, 8-, 13-, and 21-EMA envelope.” The only difference is that Slow Stochastics are nearing overbought condition, and daily MACD is trending lower on approach to its signal line. Marginally speaking, silver’s posture has improved within its range.

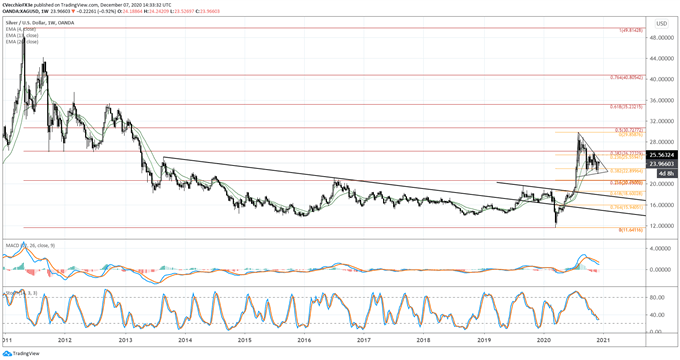

SILVER PRICE TECHNICAL ANALYSIS: WEEKLY CHART (DECEMBER 2010 TO DECEMBER 2020) (CHART 2)

Bullish momentum is still subsiding on the weekly timeframe, though it is from this perspective that silver prices’ full potential comes into view. The recent triangle consolidation is occurring in context of the breakout from the downtrend dating back to the August 2013 and July 2016 highs, suggesting that a long-term bottoming effort is still under way. If the silver price triangle were to breakout to the topside, there would be good reason to suspect that the move had meaningful technical tailwinds pushing prices higher.

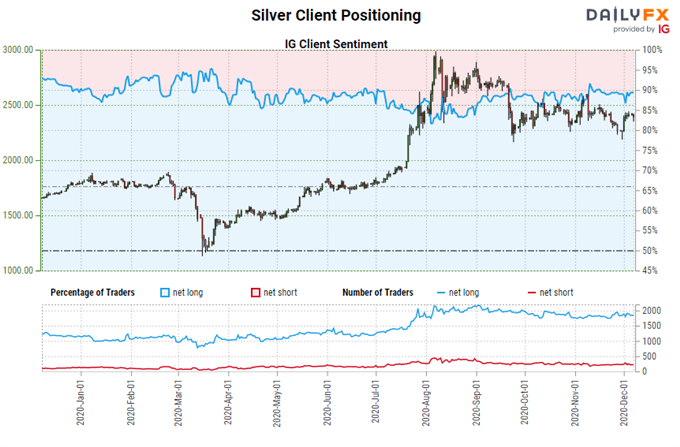

IG Client Sentiment Index: Silver Price Forecast (December 7, 2020, 2020) (Chart 3)

Silver: Retail trader data shows 88.78% of traders are net-long with the ratio of traders long to short at 7.91 to 1. The number of traders net-long is unchanged than yesterday and 0.16% higher from last week, while the number of traders net-short is 5.91% higher than yesterday and 13.38% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Silver trading bias.

Silver Prices and Silver Volatility Back in Sync

Both gold and silver are precious metals that typically enjoy a safe haven appeal during times of uncertainty in financial markets. While other asset classes don’t like increased volatility (signaling greater uncertainty around cash flows, dividends, coupon payments, etc.), precious metals tend to benefit from periods of higher volatility as uncertainty increases silver’s safe haven appeal.

VXSLV (SILVER VOLATILITY) TECHNICAL ANALYSIS: DAILY PRICE CHART (MARCH 2011 TO DECEMBER 2020) (CHART 4)

Silver volatility (as measured by the Cboe’s gold volatility ETF, VXSLV, which tracks the 1-month implied volatility of silver as derived from the SLV option chain) was trading at 40.99 at the time this report was written. The 5-day correlation between VXSLV and silver prices is +0.62 and the 20-day correlation is +0.55. One week ago, on November 30, the 5-day correlation was -0.59 and the 20-day correlation was +0.54.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist