Silver Price Forecast Overview:

- After an explosive start to the summer, the silver price rally has come to a screeching halt as the seasons have changed to the fall. In part, this has to due with the last US jobs report – which is why the forthcoming release on Friday is so critical.

- A rise silver volatility in context of broader market conditions (strength in equity markets, weakness in the US Dollar) could prove to be beneficial for silver prices and reverse a recent deterioration in the relationship between silver prices and silver volatility.

- Recent changes in sentiment suggests that silver prices have a bearish outlook in the short-term.

Silver Prices Find Support at Pandemic Trendline

Silver prices have struggled throughout September, with the rally from the March lows brought to a screeching halt thanks to a turn in US real yields. Following the August US jobs report, the precious metals complex topped alongside the US Dollar bottoming; both silver and gold prices continue to trade in contrast to the DXY Index. It stands to reason that, with the upcoming September US jobs report being the last major labor market release prior to the US presidential election, silver prices are approaching a major milestone that could set – or reset – the narrative for the coming weeks.

Real Yield Argument Turns Against Silver Prices

As noted elsewhere, another strong US labor market report and expectations for near-term fiscal stimulus could drop further, providing a lift to US real yields and thus sending energy, precious metals, and equities lower in tandem – silver prices meet this threshold.But a weaker US jobs report could stoke speculation that the Trump administration will cede to Congressional Democrats demands for a more robust fiscal spending package, including bolstered unemployment benefits or another one-time distribution to individuals, a potentially politically-appealing prospect for US President Trump ahead of the November elections.

Silver Prices and Silver Volatility at Odds

Both gold and silver are precious metals that typically enjoy a safe haven appeal during times of uncertainty in financial markets. While other asset classes don’t like increased volatility (signaling greater uncertainty around cash flows, dividends, coupon payments, etc.), precious metals tend to benefit from periods of higher volatility as uncertainty increases silver’s safe haven appeal.

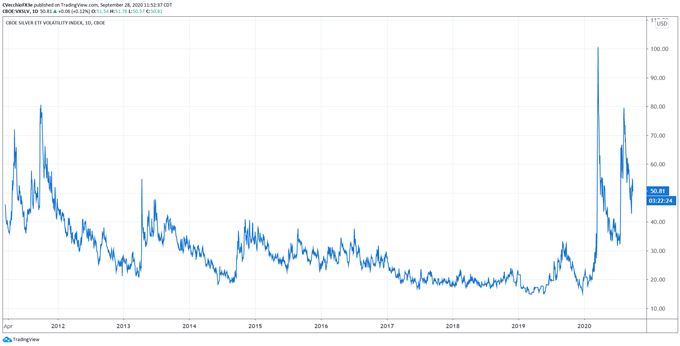

VXSLV (SILVER VOLATILITY) TECHNICAL ANALYSIS: DAILY PRICE CHART (MARCH 2011 TO SEPTEMBER 2020) (CHART 1)

Silver volatility (as measured by the Cboe’s gold volatility ETF, VXSLV, which tracks the 1-month implied volatility of silver as derived from the SLV option chain) was trading at 50.81. The 5-day correlation between VXSLV and silver prices is -0.72 and the 20-day correlation is 0.07. One week ago on September 21, the 5-day correlation was -0.76 and the 20-day correlation was 0.31.

It remains the case that, given the current environment, falling silver volatility is not necessarily a negative development for silver prices, whereas rising silver volatility has almost always proved bullish; in the same vein, silver volatility simply trending sideways is more positive than negative for silver prices.

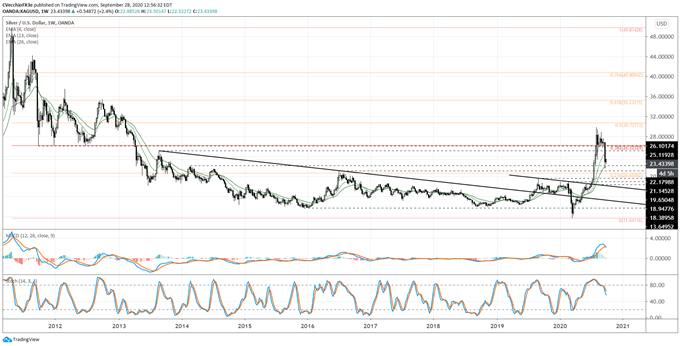

SILVER PRICE TECHNICAL ANALYSIS: WEEKLY CHART (JUNE 2013 TO SEPTEMBER 2020) (CHART 2)

Following the break of the bull flag/triangle, silver prices have fallen back to the weekly 26-EMA, which is the half-year trendline. Likewise, the low formed in September comes as a retest of the 2014 high set near 22.180. It’s very possible that the worst is over for silver prices; a break below the weekly 26-EMA would be a major topping signal, however.

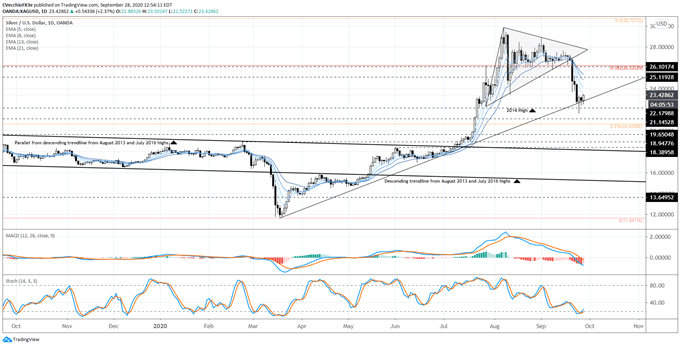

SILVER PRICE TECHNICAL ANALYSIS: DAILY CHART (SEPTEMBER 2019 TO SEPTEMBER 2020) (CHART 3)

Silver prices are facing a critical test in the near-term, having fallen back to the rising trendline from the March and July swing lows – the coronavirus pandemic trendline. A hammer at then inside bar to end last week suggests a near-term low may be forming. Nevertheless, momentum is just turning away from an aggressive negative condition. Silver prices are still below their daily 5-, 8-, 13-, and 21-EMA envelope. Slow Stochastics have started to rise out of oversold territory, while daily MACD’s descent in bearish territory has started to slow.

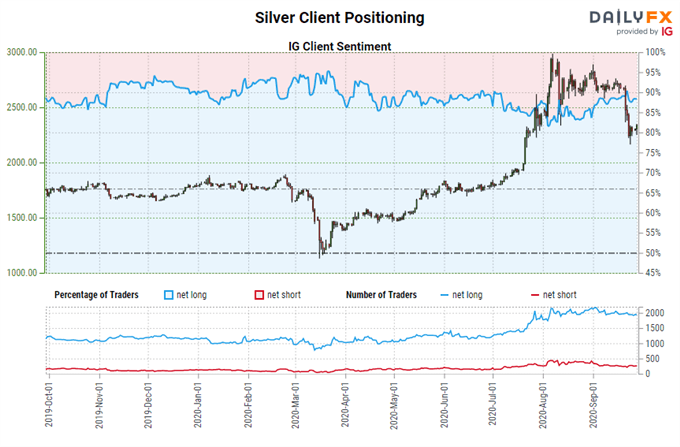

IG Client Sentiment Index: Silver Price Forecast (September 28, 2020) (Chart 4)

Silver: Retail trader data shows 90.12% of traders are net-long with the ratio of traders long to short at 9.12 to 1. The number of traders net-long is 8.09% higher than yesterday and 8.71% higher from last week, while the number of traders net-short is 9.56% lower than yesterday and 15.61% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Silver-bearish contrarian trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist