Gold Price/Silver Technical Outlook:

- Gold price building near-term wedge after macro-wedge breakout

- Silver trying to rise out of long-term wedge

For forecasts, educational content, and more, check out the DailyFX Trading Guides page.

Gold price building near-term wedge after macro-wedge breakout

Last month, gold price exploded out of a wedge formation dating back several years. This put the precious metal in good position to rally much higher, with a measured move target approaching the 1700 level. This will of course take time, but the path of least resistance is higher for as long as the breakout holds.

With that in mind, trading bullish set-ups in the shorter-term could yield good results if macro forces are to remain constructive. Currently, gold is nearing the end of a developing wedge that has been building since the last week of June.

A breakout above the top-side trend-line of the pattern and 1427 should have gold rolling again. In the event of a breakout the next targeted level will be a minor level of resistance created in 2013 around the 1488 level, with more significant resistance from 1522 up to around 1540.

The wedge needs to break, first, though, before getting too geared up for higher prices. A downside resolution or false breakdown before jamming higher, could develop. In the event of a breakdown, given the proximity of the top of the macro-wedge, it may not pay (poor risk/reward) to run with a short. In the event of a false breakdown (a common occurrence for wedges), then once price recoups back above the top-side trend-line of the pattern, then a bullish bias will reassert itself.

Gold Price Weekly Chart (strong wedge-break)

Gold Price Daily Chart (wedging up in near-term)

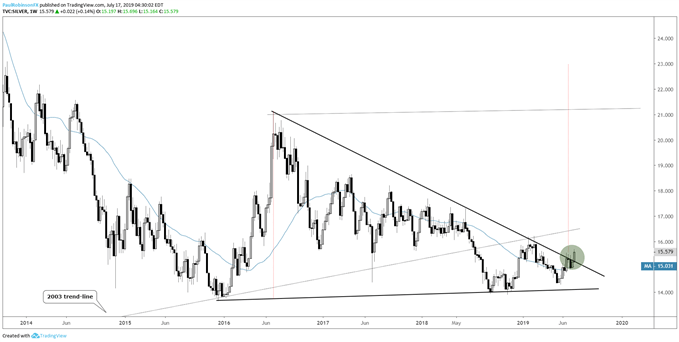

Silver trying to rise out of long-term wedge

Silver has been playing catch-up with gold in recent sessions. While gold consolidates in the near-term silver is trying to break the trend-line from July 2016 that makes up the top of a long-term wedge pattern. A weekly close above the top-side t-line will gear up silver for a sustained move higher along with its big sibling. If price fails back below by Friday, then a neutral bias will remain. In any event, if gold is to maintain its big-picture breakout, then silver will start to offer good-looking bullish set-ups at some point.

Check out the IG Client Sentiment page to see how changes in trader positioning can help signal the next price move in gold and other major markets and currencies.

Silver Price Weekly Chart (trying to break top of wedge formation)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX