Gold Price & Silver Technical Outlook:

- Gold price struggling as expected

- Strong surge needed for a macro-breakout

- Silver outlook hinges on the next move in gold

For forecasts, educational content, and more, check out the DailyFX Trading Guides page.

Gold price struggling as expected

Last week, gold rallied strongly into a major zone of resistance, measuring from the February peak at 1347 up to the July 2016 high at 1375. The macro-wedge has a top-side trend-line running over from 2014, with several important connecting points making the zone ahead quite formidable.

With that in mind the pullback in gold price to start the week came as no surprise. The question is whether it can garner the strength to push on through the aforementioned levels and spark a lasting macro-breakout that could have gold running for the foreseeable future.

In the near-term there may be more problems. Following the initial pullback we are seeing another push higher this morning that could result in a short-term lower high and a dip below yesterday’s low at 1320. How aggressive sellers become in this scenario will be noteworthy.

A modest pullback or failure to trade below this week’s current low could lead to a consolidation pattern from which gold can attempt to make another break of resistance. However, if sellers show up in earnest soon, then we may again be in the process of the seeing the long-term wedge further tighten up.

Check out the IG Client Sentiment page to see how changes in trader positioning can help signal the next price move in gold and other major markets and currencies.

Gold Prices Daily Chart (consolidate or lower-high?)

Gold Prices Weekly Chart (1375+ needed for macro-breakout)

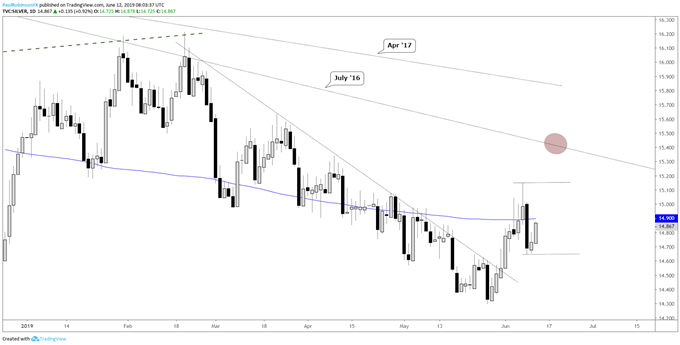

Silver outlook hinges on the next move in gold

Silver is a tough handle, nothing new on that front. Sometimes it trades well, often times it doesn’t. How it goes moving forward will depend on how resistance is handled in gold. A lower-high below 15.14 could be in the works, and if so that puts silver at risk of trading back near the May low on a break of the weekly low at 14.64, even if gold only declines only modestly.

Silver’s tendency has been to decline more rapidly than it rises relative to gold, relative weakness that has been in place for a long time and could very well continue for a long-time to come.

Silver Price Daily Chart

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX