Gold/Silver Technical Highlights:

- Gold price upward channel in jeopardy of breaking

- Silver rolling over, neckline of H&S could come into play soon

DailyFX has created a library of guides to help traders of all levels navigate markets, check them out today on the Trading Guides page.

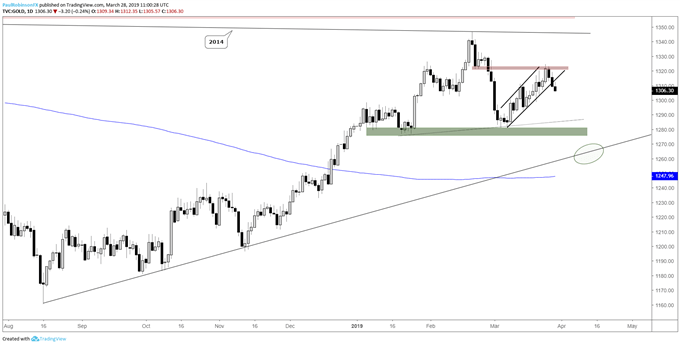

Gold price upward channel in jeopardy of breaking

The focus on this end in gold continues to be the well-defined upward channel, looking like a corrective grind higher that will result in another down-move soon. But even as such, the bullish bias the channel presents must be respected until broken.

That could happen soon, as the underside t-line of the formation is starting to give-way this morning. A breakdown soon should have sellers gaining the upper-hand again with support down in the 1280s becoming the next focal point. The trend-line off the August low (~1260s) is the bigger target on pronounced weakness.

Should the channel break it will require a strong move back inside and ultimately above the high at 1324 to negate a short bias, and even then depending on how price action plays out it might not necessarily turn the picture bullish, but rather just put a neutral stamp on the outlook for the time-being…

Check out the IG Client Sentiment page to see how changes in trader positioning can help signal the next price move in gold and other major markets and currencies.

Gold Daily Chart (starting to break...)

Gold 4-hr Chart (Channel guide)

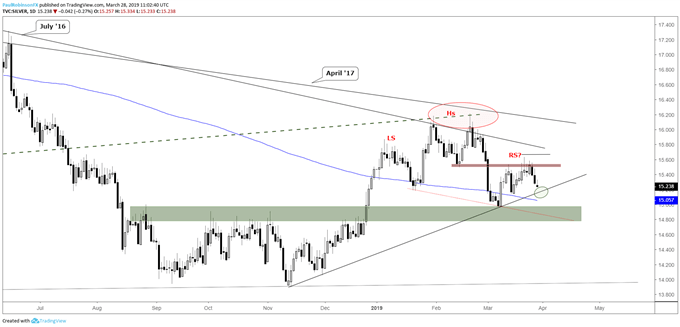

Silver rolling over, neckline of H&S could come into play soon

In silver-like fashion silver is weakening ahead of gold, a pattern seen before as the precious metal continues to lag its big sibling. There is a head-and-shoulders formation gaining further clarity as the latest round of weakness is helping solidify a right shoulder.

The trend-line off the November low needs to be broken first, followed by the 200-day and then range-levels from the fall, before finally the neckline is tested. With all these levels in the vicinity this is why the neckline of this pattern has even more importance than usual. A break below the neckline leaves silver without any support until the November lows/December 2015 trend-line near 14.

Silver Daily Chart (Weakening towards neckline)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX