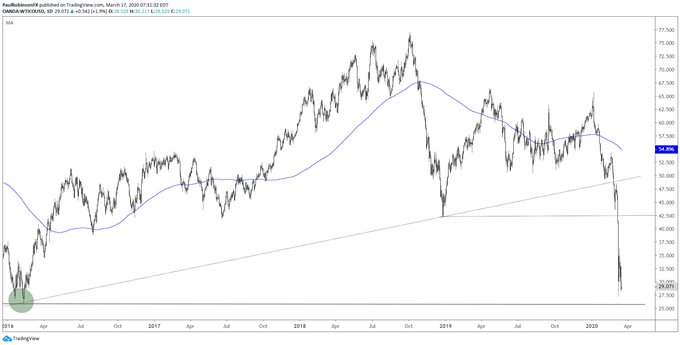

Crude Oil Highlights:

- WTI crude oil low is 25.75, looks likely to test at least

- Brent oil low is 27.34, ‘just’ a 10% move away

WTI crude oil low is 26.89, looks likely to test at least

Crude oil is under major pressure along with pretty much everything else. There is even selling in often safe-haven assets like gold, so something like oil which had its own shock via a pricing war and is also tied to the risk-trade hasn’t stood a chance.

The 2016 low had been a target in mind for some time prior to this crisis, but certainly wasn’t expected to happen in one fell swoop. Price is almost there, only needing to drop a little over 3 bucks from here to reach the 26.89 level.

With financial market volatility as high as it is, we can’t rule out a sharp squeeze higher first, but oil at the moment looks too heavy to perhaps even do that. We shall see. A break of the 2016 low isn’t out of the question, and we may see oil even move down to the cost of production which is around $20 per barrel. At some point there may be a big recovery trade in here, but it doesn’t look like we are there yet, nor is risk/reward particularly appealing.

Nimble short-term traders may still look to short but keeping in mind a squeeze could come, while would-be longs may be best served by being patient and waiting for things to wash out and reverse. The 2016 low for Brent oil is 27.34, “only” about a 10% move from here.

WTI Crude Oil Daily Chart (2016 low near)

WTI Crude Oil Chart by TradingView

Brent Crude Oil Daily Chart

Brent Crude Oil Chart by TradingView

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX