Crude Oil Highlights:

- WTI crude oil bouncing off support, watch 54.77

- Brent breakdown would have initial target of 58

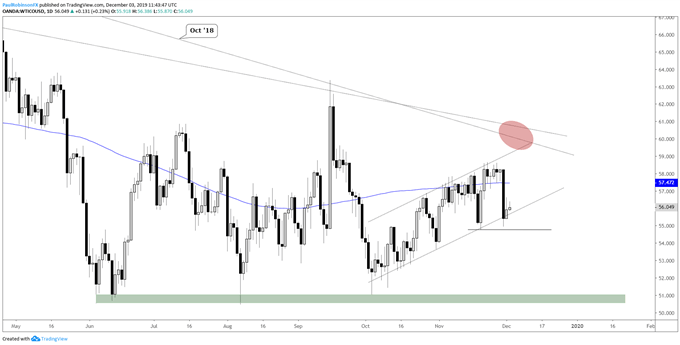

WTI crude oil bouncing off support, watch 54.77

WTI crude oil has been caught in a vortex of choppy trading, indecisively swinging around the past two months. The swings have become more violent the past couple of weeks, perhaps signaling that the upward grinding channel structure is about to be snapped.

It would certainly help bring some much-desired clarity for traders. The channel off the October low isn’t the most defined, but clear enough to firm up a trading bias – stay within and must continue to respect its upward, albeit difficult to trade, trajectory, or break outside of it and give sellers the upper hand.

Given the rough nature of the lower trend-line of the pattern, so as to help avoid getting sucked into a false breakdown, a decline below the lower parallel and 54.77, the most recent swing-low inside the structure, should provide the confirmation needed.

In the event of a break, look for support near the 50-line to be the next focal point with 53.67 lined up as a potential level of support along the way. If things remain as they have, then another swing higher may soon develop back towards the 58s.

Keep an eye on equity markets. It was only a day, but stocks broke with some force and could be in the process of beginning a corrective period. This may help drive oil prices lower should we enter into even a modest risk-off environment.

WTI Crude Oil Daily Chart (channel, 54.77 important)

WTI Crude Oil Chart by TradingView

Trading Forecasts and Educational Guides for traders of all experience levels can be found on the DailyFX Trading Guides page.

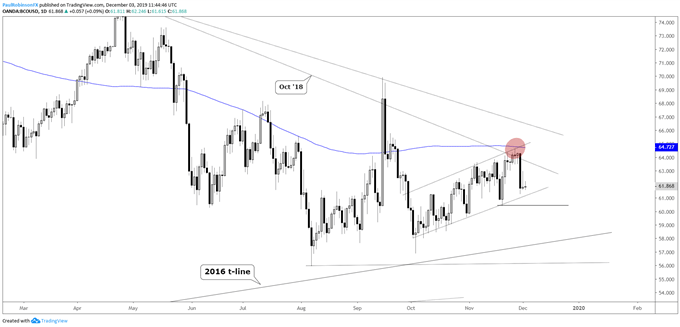

Brent breakdown would have initial target of 58

Brent crude oil continues to work on a channel structure as well, unsurprisingly, and this remains a source of frustration for traders. The ding lower from the April trend-line and 200-day may have begun a move towards 58, where support via price and the 2016 trend-line lie.

But, the UK contract first needs to decline out of the channel and below 60.43 before selling can gain traction. If that fails to develop, a swing higher will have the trend-line from October 2018 and the 200-day in play again, a formidable area of resistance.

Brent Crude Oil Daily Chart (58 targeted on a breakdown)

Brent Crude Oil Chart by TradingView

***Updates will be provided on the above ideas as well as others in the trading/technical outlook webinars held at 1030 GMT on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday each week for the Becoming a Better Trader webinar series.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX