Highlights:

- Crude Oil Technical Strategy: Crude Oil downside expected to be limitedon price pattern

- US Stockpiles continue trend of declining despite build in gasoline and Cushing stockpiles

- Next technical Bullish trigger set at lower high from May at $50.00, support near $47.75

- IGCS Sentiment highlight: Sharp rise in short positions provides contrarian signal to look for upside

The streak of back-to-back US crude oil inventory declines since May continued on Wednesday per the Energy Information Administration. For the sixth consecutive week, Crude Oil traders were treated to the favorable news on an announcement of a 6.45m barrel draw for the week ended August 4. However, there was some unwelcome news as stocks at Cushing, OK, a US key delivery hub saw the first inventory build in 12 weeks despite the nationwide decline and gasoline imports came in at a six-year high to lift inventories by 3.42m barrels versus an expected decline of 1.56m barrels. Gasoline is derived from crude oil as it is a major product created from crude refinement.

Bullish crude traders may be disappointed that U.S. and North Korea tensions are not providing a pop for Crude Oil, but the positive effect is seen more clearly in haven assets like the Japanese Yen and Gold, which rose the most in eight weeks. Another development worth watching is the strengthening USD, which has found life in August after an encouraging employment report caused a likely unwinding of the increasingly popular short USD trade. Since Oil is priced in USD, a weaker USD is expected to bring about a higher price of oil, all else being equal.

Last, but not least, the chart pattern may show that Crude bulls should not worry about the lack of upside that we’ve seen in August, which has run counter to the commodity bull market that became the dominant theme in July. The price pattern shows a triangle, which is a pattern favorable for eventual trend continuation, but not the start of an aggressive counter trend move.

The chart below encapsulates the broad price action from 2017. What you can see to the far right of the chart is price breaking above the falling/ bearish price channel. The ceiling of that channel in relation to current price is near $47.75/bbl. If a further price breakdown occurs, I will anticipate the price breakdown halting near this zone before a bounce, and potential uptrend continuation develops. A daily close below $47.75/bbl would encourage a reconsidering the bullish bias.

Given the strong rise in Crude Oil since Q3 began, click here to see the opportunities we’re watching in Oil.

JoinTylerin his Daily Closing Bell webinars at 3 pm ET to discuss tradeable market developments.

After an encouraging EIA report, Oil turns focus to trading outside of the bearish channel

Chart Created by Tyler Yell, CMT

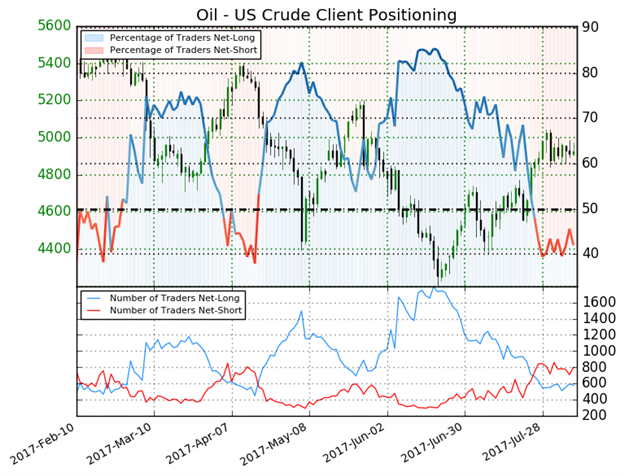

Crude Oil Sentiment: Net-short crude positions provides contrarian signal to look for upside

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

Oil - US Crude: Retail trader data shows 42.0% of traders are net-long with the ratio of traders short to long at 1.38 to 1. In fact, traders have remained net-short since Jul 26 when Oil - US Crude traded near 4869.3; theprice has moved 1.1% higher since then. The number of traders net-long is 2.9% lower than yesterday and 8.7% lower from last week, while the number of traders net-short is 2.8% lower than yesterday and unchanged from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Oil - US Crude prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Oil - US Crude-bullish contrarian trading bias. (Emphasis mine)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell