Want our fresh USD/JPY outlook for Q3? Access our free forecasts by clicking here.

Highlights:

- USD/JPY technical strategy: selling rips, though USD/JPY may not be best JPY long

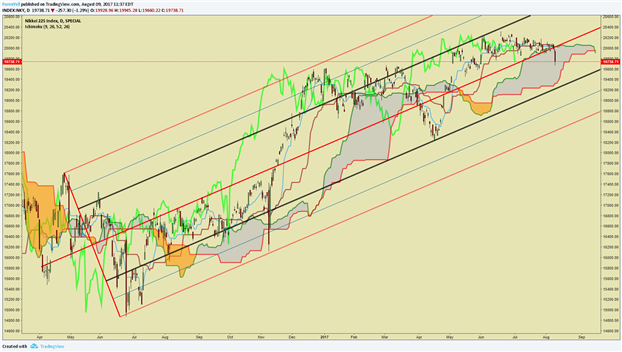

- JPN225 (Nikkei) breakdown may signal further JPY strength on the horizon

- 2017 USD/JPY intraday low of 108.13 should be focus of every technical trader

- IGCS shows the USD/JPY trend lower may continue toward 108.13

There are a handful of assets that are typically labeled as “risk-off.” These assets tend to do well when fear and uncertainty reign and do rather poorly at times of relative peace and rising prices in risk-seeking markets like emerging markets and higher beta equities.

The risk-off assets tend to be the Japanese Yen (JPY), Swiss Franc (CHF), Gold (XAU), and U.S. Treasuries. The recent cause for the bid in these particular markets has been a geopolitical verbal spat that markets are not fully sure how to digest. This demand to capture volatility has been seen in the recent record positioning of VIX positions as traders hope to catch a sudden rise in realized one-year SPX implied volatility.

Regardless of the follow through of President Trump and North Korea’s Kim Jong-un’s threats, traders should note that JPY strength isn’t new. While the JPY strength has aligned previously with USD weakness, which turned around on Friday’s Non-Farm Payroll in the US with supported Average Hourly Earnings, the fact that the JPY strength has been in place for nearly a month means there may be some momentum worth watching.

USD/JPY is wading near 110, and the 2017 low of 108.13 could easily be reached if new fears were to arise. Two points that I would draw your attention to is that CFTC has shown a build-up in JPY shorts in recent months that could quickly unwind (JPY buying to offset the position), and the headline Japanese equity market, the Nikkei has recently broken lower. The Nikkei (immediate chart below) tends to be inversely correlated to JPY and positively correlated with USD/JPY so a further drop in the Nikkei would be expected to align with a falling USD/JPY.

The Nikkei (JPN 225) has recently broken lower aligning with JPY strength

Join Tyler in his Daily Closing Bell webinars at 3 pm ET to discuss market developments.

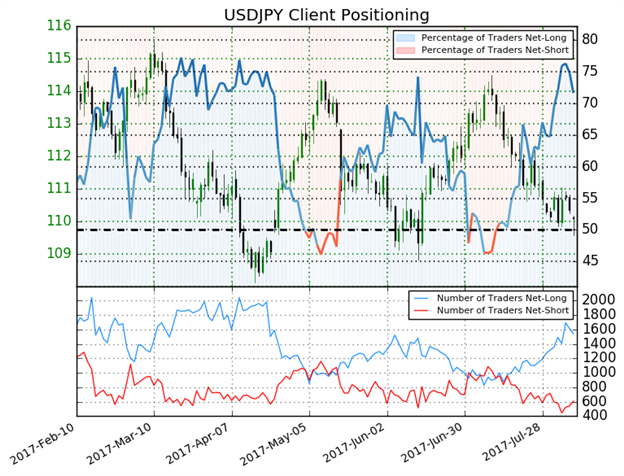

Looking at the chart below, you can see how the price action in USD/JPY aligns with the geopolitical confusion. Both are between a rock and a hard place in terms of knowing which way to break or which direction to favor. While there has been persistent JPY strength since mid-July, we’re also with in a pretty clear range between 114-108, which is highlighted by the two yellow rectangles on the chart. For trader’s not exposed to USD/JPY volatility, it’s likely worth it to be on the watch for a bounce as market threats of a breakdown have often failed to materialize.

However, a break below support at 108.13 would show a larger shift is likely taking place, which you could confirm with a breakdown in the Nikkei as well as a strong bid in other risk-off assets mentioned earlier in the article.

Chart Created by Tyler Yell, CMT

USD/JPY IG Trader Sentiment:USD/JPY trend lower may continue toward 108.13

What do retail traders’ buy/sell decisions hint about the JPY trend? Find out here !

USDJPY: Retail trader data shows 71.7% of traders are net-long with the ratio of traders long to short at 2.53 to 1. In fact, traders have remained net-long since Jul 18 when USDJPY traded near 112.569; price has moved 2.2% lower since then. The number of traders net-long is 7.4% lower than yesterday and 10.2% higher from last week, while the number of traders net-short is 6.4% lower than yesterday and 3.9% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USDJPY trading bias.(Emphasis Mine)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell