To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

- Crude Oil Technical Strategy: Oil Too Strong To Fight

- Intermarket Analysis Turns Focus of Price Support Of a Weak US Dollar

- Crude Oil Rises for Third Week After Report Shows Jobs Gain

The price of Crude Oil has moved to its best levels since January on its strongest weekly gain since May. Other commodities like Gold are joining therace, which entered into a bull-market with today’s push higher. The turn-around in data points in the United States it naturally turning attention toward the idea that demand may soon start to eat away at the oversupply in the Oil market that could help balance the pressures of oversupply.

The Dollar Story & Its Effect in Oil

Traders wondering if Oil prices have bottomed or not will have to wait and see for confirmation, but two things that should not be underestimated is the effect of the US Dollar on Oil prices and the power of short-sellers exiting their trade in unison to push up a market. Case in point, Chesapeake Energy, one of the most concentrated shortpositions in the market is up 85% this week as short-sellers are seeing limited upside (which means downside for shorts) for now.

Additionally, there is an inverse relationship between the price of the US Dollar and commodities. Right now , the US Dollar may be changing its tune as it approaches the all-important 200-dma. Therefore, if the price of US Dollar continues to fall, and it could if it breaks below the 200-dma, we could likely see a weak USD contributing to support further WTI Crude Oil gains.

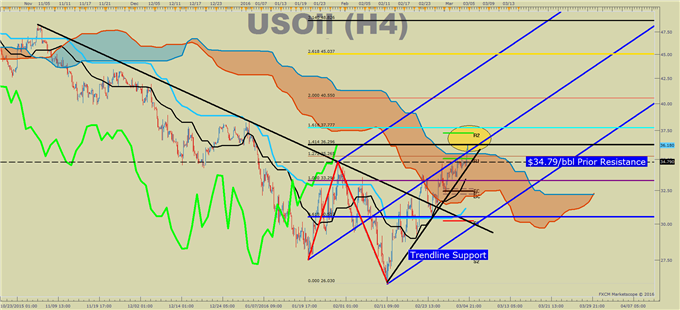

WTI Crude Oil Begins To Look Mighty Comfortable Above Former $34.79/bbl Resistance

Key Oil Price Levels from Here

We are getting awfully close to the 2016 opening price high of WTI Crude Oil at $38.36. A break above there could turn to a similar slingshot move like we saw in the Canadian Dollar against the US Dollar. For now, the most important price support appears to be the $30.00/50 zone that provided the late February low. A hold above there will keep attention on the Opening Range high of $38.36. However, this will likely only be possible on further risk appetite that would be seen in higher stocks, and a weaker US Dollar. Above the opening range high of 2016, traders will next look to the psychologically important $40, which would be a 50%+ move off the current low of $26.03.

Contrarian System Warns of Further Price Support

In addition to the technical focus around the 34% rally resistance, we should keep an eye on Bears unsuccessfully trying to push down the price of Oil. A move into resistance, and possibly beyond aligns with our Speculative Sentiment Index or SSI. Our internal readings of Oil are showing an SSI reading of -1.6628. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders have moved from net long to now net short provides a contrarian signal that US Oil may continue eventually higher through resistance. If the reading were to turn positive yet again, and the price broke back below $32/30, we could begin looking for a retest of the YTD low of $26.03. Until then, higher looks to be the path of least resistance.

T.Y.

Think Oil Has Bottomed? Trade Oil With Low Margin Requirements (non-US Residents only)