To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

- Crude Oil Technical Strategy: Resistance Has Arrived, Watching for Reversal

- The US Dollar Has Found Itself In a No-Win Scenario That Could Limit Downside Force On Crude

- March is statistically the most bullish month of the year for WTI crude oil by mean and median returns

The last week of February proved to be the strong weekly range (open-close) for 2016. This undeniable provided a bid for the Canadian Dollar, but what is interesting is the sentiment around crude. Across the board, we have heard about how the companies are being forced to produce to meet creditor payments because they cannot borrow due to the tightening credit market. This development seems to be a perfect recipe for oversupply, yet the bid in Oil has remained since February 11.

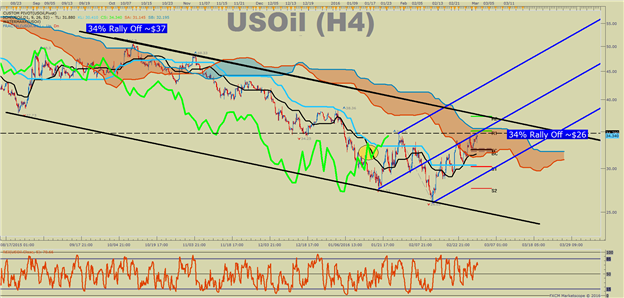

However, the technical picture provides a specific focus at the $34.79/bbl level. Not only did we turn lower from that level in late January, but also that is nearly where we find ourselves now, and it happens to be 34% off the low in February. Why is 34% significant, you ask? That is the move from the low in 2015 that preceded a 49% drop from October to February.

Therefore, if we turn lower from this level again, it is fair to say that we could be about to break back below $30, and possibly $26. However, if we break above that level, we will turn focus on the top of the price channel shown on the chart below that aligns with the Weekly R2 pivot at $37.30. A move above that level would favor not only a channel breakout but also a potential behavior shift that could turn into an all-around risk-on rally.

US Oil Failed in 2015 When Rallying 34%, What Will Happen in 2016?

Free 2-Minute Oil Market Chart & Top News Update Video

Key Support Levels from Here

Because we are interested in the potential upside for WTI Crude Oil, it will be important to gauge how price holds support. A continual holding above support is the classic first steps of an uptrend with life in it. The key zones of support worth watching are the $30.20 low that was a pivotal low on February 24 followed by the February 19 low of $29.03/bbl. If we hold above these intra-trend lows, and the price of the US Dollar weakens again as it did in early February, we could be soon retesting the YTD high of $38.36 up to a bullish head and shoulder’s target of ~$43/bbl.

Contrarian System Warns of Further Price Support

In addition to the technical focus around the 34% rally resistance, we should keep an eye on Bears unsuccessfully trying to push down the price of Oil. A move into resistance, and possibly beyond aligns with our Speculative Sentiment Index or SSI. Our internal readings of Oil are showing an SSI reading of -1.4506. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders have moved from net long to now net short provides a contrarian signal that US Oil may continue eventually higher through resistance. If the reading were to turn positive yet again, and the price broke back below $32/30, we could begin looking for a retest of the YTD low of $26.03.

T.Y.

Think a bottom is in or forming in Oil? Trade Oil With Low Margin Requirements (non-US Residents only)