USD/JPY Rate Forecast Talking Points:

- USD/JPY Price Forecast: buyers likely to continue pushing price higher above 112

- US Dollar is attracting hedge funds after rare-aggressive market selling in December

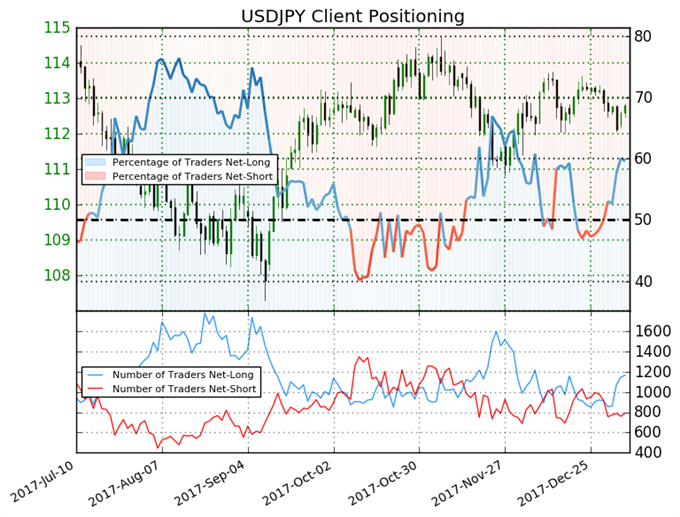

- USD/JPY Rate Insight from IG UK: sharp rise in retail long positions favors downside

The spot price of the Dollar Index fell 9% over 2017 and in so doing, allowed a surprising amount of JPY strength that many did not anticipate with the persistently strong risk sentiment as evidenced by the record highs in equities.

US Dollar Falls toward Weakest Level of 2017

While the USD/JPY rate is a long way away from the 2017 low at 108, traders are likely scratching their head as to why the rate has not risen. Some blame the potentially increasingly hawkish (relatively speaking) Bank of Japan while others see the Fed’s hawkishness (absolutely speaking) as fully priced into the market. Either way, traders should note that the JPY has weakened aggressively against other currencies, most notably EUR.

Check out this great EUR/JPY analyst pick here.

USD/JPY Rate Forecast Looks to Ichimoku for Support

On the price chart with the Ichimoku Cloud technical study applied, traders can see that price looks to be testing support. The cloud base is near 112.30, but looking to the future Kumo (cloud), traders can see little conviction one way or another as the cloud has thinned out.

It’s no small coincidence that the thinning cloud is showing the uncertainty of the future trend (thick clouds tend to indicate a strong trend bias) at the beginning of the year. Traders, whether institutional or retail, tend to see the beginning of the year as the time to make their stakes on their broader macro views and so position setting tends to be strong at the beginning of the year. The beginning of the year and the uncertainty as evidenced by Ichimoku could lead to a nice jump in volatility, which has been supported by the jump in USD/JPY 1-month implied volatility that recently touched the lowest level

Unlock our Q4 forecast to learn what will drive trends for the Japanese Yen and the US Dollar by year-end!

Chart created by Tyler Yell, CMT. Tweet @ForexYell for comments, questions

The short-term resistance of USD/JPY is at the 55-DMA at 112.96 with support at 112.30, the Ichimoku Base and further at 112.10 (100-DMA). Given the time of the year and the lowest implied volatility since 2014, which was an all-time low in FX vol, a breakout that aligns with an increase in implied volatility could be a recipe for a move toward 113.15 (Dec. 27 low) and the 113.75 (Dec. 12 high).

The last three completed trading years have provided dismal moves in USD/JPY of 0.8%, -2.85%, & -3.65% respectively. A key move worth watching would be a jump in implied volatility and a breakout above resistance. However, absent that development, traders should watch for a further slow melting of the price below current price support of 112.

USD/JPY Insight from IG UK Client Positioning

The sharp rise in long retail positions, coupled with the drop in short-positions provides a contrarian bias to favor further losses.

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell