To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

- USD/CHF Technical Strategy: Longer-term range, near-term up-trend after Friday’s USD-reversal

- Swissy has put-in extremely bullish price action as rate hike bets have continued to increase around the Federal Reserve.

- SSI - If you’re looking for trading ideas, check out our Trading Guides. And if you want something more short-term in nature, check out our SSI indicator.

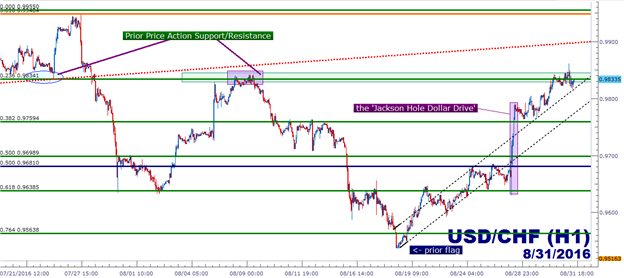

In our last article, we looked at the recent up-tick in price action in the Swissy with the question of whether we were seeing a bear-flag formation or a legitimate bullish reversal of near-term price action. And last Friday gave us our answer after USD/CHF rallied by more than 160 pips in the five hours after Janet Yellen’s speech at the Jackson Hole Economic Symposium. Chair Yellen and Vice Chairman Stanley Fischer successfully prodded markets towards higher-rate expectations, and this drove the U.S. Dollar higher as rate hike bets for the United States began to increase after months of driving lower.

The Swissy has seen considerable rip since that Friday morning batch of speeches, and price action has only continued in a bullish manner to send USD/CHF to a key area of resistance at .9834. This level was the August ‘swing-high’ in the pair while also being the 23.6% Fibonacci retracement of the May high/low in the pair.

On the chart below, we look at this recent near-parabolic movement in the Swissy as U.S. rate expectations have hustled higher.

Created with Marketscope/Trading Station II; prepared by James Stanley

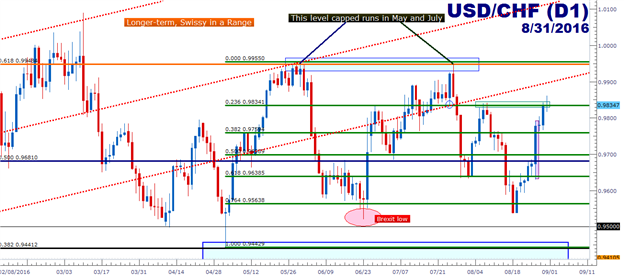

While this extremely strong move could be attractive for continuation potential, traders would likely want to scroll back on the chart to see the ‘bigger picture’ range with the twice-tested Fibonacci resistance level at .9948; which is the 61.8% retracement of the 2010 high to the 2011 low in the pair. Since falling into this range in March of this year, much of Swissy’s price action has been confined to this 450-pip range.

This is relevant for two reasons: A) This could cap top-end profit targets for bullish approaches at a meager 100-110 pips, which, while still ‘workable,’ could make for a difficult situation if chasing a near-parabolic move that’s more than 50 pips away from price action support. And B) should this recent bout of USD-strength reverse, this could make for an attractive short-side swing trade within the range if resistance at .9834 holds, enabling traders to lodge stops above .9948 whilst looking for profit targets in the .9550-.9600 vicinity.

So, while this near-term trend has been strong to the up-side, the longer-term range may present more potential to traders, particularly those looking to fade this recent bout of USD-strength.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX