To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

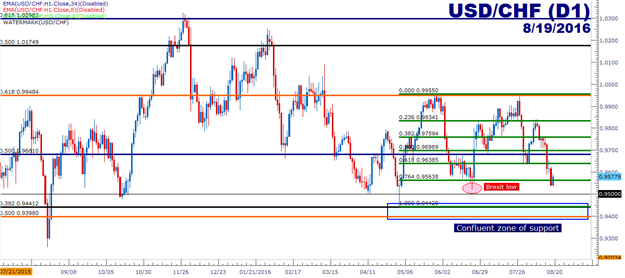

- USD/CHF Technical Strategy: Bearish breakdown on weak-USD; longer-term bullish structure in-tact above .9398.

- U.S. Dollar weakness has driven the Swissy towards the June ‘Brexit-low’ in the pair, also near the .9500 psychological level.

- SSI - If you’re looking for trading ideas, check out our Trading Guides. And if you want something more short-term in nature, check out our SSI indicator.

Last week we warned of a deeper retracement in the prior up-trend of USD/CHF after the currency pair had posed a ‘lower high’ inflection of resistance. And while that prior up-trend was attractive from both a fundamental and a technical view, the risk-reward of the setup was utterly unattractive for chasing long positions, and we drew attention to deeper support levels in the effort of planning-around longer-term bullish positions.

Over the past three weeks, the US Dollar has put in a considerable bout of weakness as markets have grown increasingly skeptical that the Fed may be nearing rate hikes anytime soon, and as this rather pervasive theme has continued to permeate through financial markets, US Dollar weakness has been visible against most currencies, including the Swiss Franc. This has driven price action in the pair down towards those longer-term levels of support, and thus far on the day, the pair is responding with strength.

Swissy is nearing a very attractive zone of support just below the 95-handle. From the level of .9398-.9450, there are numerous iterations of support that could provide motivation for longer-term bullish entries. On the chart below, we look at these various levels of support.

Created with Marketscope/Trading Station II; prepared by James Stanley

But this may not be something that traders yet want to chase, as near-term support is still continuing to build, and if we investigate this morning’s strength on a shorter-term basis, it highlights a shorter-term bear-flag formation. Earlier in the week we had a similar such technical scenario, and as you can see on the below chart, that bear flag eventually broke around the release of FOMC minutes on Wednesday.

Created with Marketscope/Trading Station II; prepared by James Stanley

Bear flag formations can often show up as retracements in a continued down-trend, so this can become usable to traders as they await those deeper support levels in the .9398-.9450 zone; and should this show up over the next week traders can investigate attractive top-side setups in the Swissy.

At this early stage, Swissy price action appears to be working on a retracement in the down-trend. But the potential up-side of bearish plays will likely be limited given the robust support structure sitting below price action, so rather than looking at continuation of the near-term bearishness, traders can keep a watchful eye on support in the effort of looking for the ‘bigger picture’ bullish scenario.

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX