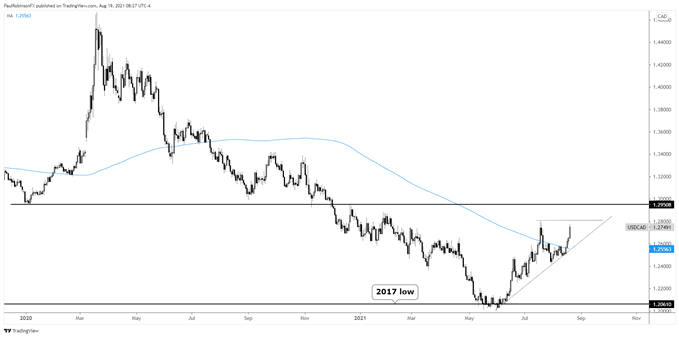

USD/CAD Technical Outlook

- USD/CAD rallying sharply towards best levels of 2021

- May take a break, but momentum suggests higher still

USD/CAD Technical Outlook: Ripping Towards Yearly Highs

Admittedly, USD/CAD is quickly going in the opposite direction I had it pegged for a week or so ago, which is fine – that is what flexibility and stops are for. The recent surge is bringing into play the possibility that we will see the best levels of 2021.

There might first be some stalling momentum, so let’s first see how price behaves around the July spike-high (12807). That high is important because of how it was formed. The surge ended rather abruptly and smacked of an exhaustion-style rip and reverse. I could see a little stalling/pulling back from around the 12800 level before pressing on further towards the yearly high at 12881 and higher.

A short consolidation period would do some good and potentially offer would-be traders an opportunity to join in on a further advance should that be the path moving forward. It is unlikely, unless the digestion period is to become extensive or the pullback deep, that we see the developing trend-line off the June low get touched.

Looking ahead, if the yearly high is broken then the 12950 level will become the focus. It was support in early 2020 and during November and December it acted as support and resistance, respectively. The level appears to have solid meaning. We could soon find out how meaningful.

For now, in wait-and-see mode – want to see how the market generally reacts to the recent surge before stepping out on a limb any further and establishing an aggressive trading bias.

USD/CAD Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX