USD Technical Outlook

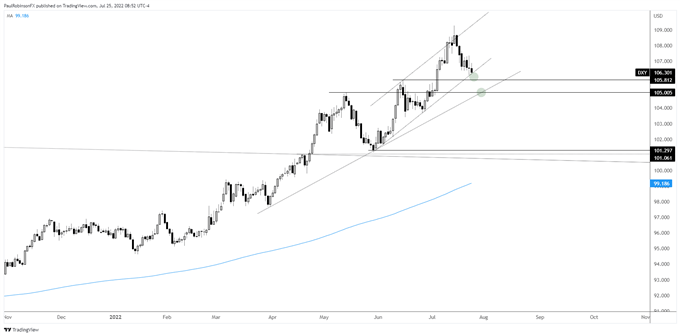

- US Dollar Index (DXY) retracement bringing into play first support test

- If support breaks there are noteworthy levels to look at

US Dollar Technical Analysis: DXY Retracing into First Support Test

The DXY index continues to retrace towards its first level of support since topping out in the middle of the month. Weakness is anticipated to bring in buyers given the broad-scope bull market the dollar is currently in.

The question is, which level will bring enough sponsorship to end the correction? The key will be to watch price reactions at each possible turning point. Ideally, we see a sharp turn around one of the levels, with price action flashing strong signs of a low through a powerful reversal sequence.

The first area of support to watch for such price action is currently in play via the channel line running up from late May. If this doesn’t bring support then just beneath it the June high at 105.81 could put in a floor.

Beneath there a slope from April will come into play, but it’s an unproven line so we would need to see a good reaction off of it to give it any real meaning. This line is in confluence with the May high at 105, so indeed it could gain meaning should it soon get tested.

We can’t rule out an even broader correction that takes price beneath the noted near-term levels, but at this time there isn’t a tremendous of evidence to suggest a serious test of the USD’s trend.

From a tactical standpoint, shorting into a decline that is corrective in nature can be difficult as momentum often lacks in these types of moves. The risk also, of course, is that the decline abruptly ends and turns back towards the prevailing trend.

For would-be longs, it may pay to wait for reversal-type price action that indicates a low has been set. Ideally, it happens at a noted support level to create a backdrop from which to assess risk.

US Dollar Index (DXY) Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX