What will save the USD from its 2017 downtrend? Get a free DFX Q3 market forecast here

Key Takeaways:

- DXY Technical Strategy: DXY remains in “sell the rips” mode below 95.17

- DXY polarity point of 96.50 remains technical line in the sand, bearish below

- Dollar weakness picks up pace as EUR breaks to highest weekly close since January ‘15

It was the best of times (for EUR bulls), it was the worst of times (for USD bulls). As the month of July comes to a close, the best thing the USD seems to have going for it in terms of being worth buying is that the market is only pricing in roughly one hike from the Fed in 2018. The market to look at this expectation is the Eurodollar futures spread between December 2018 and December 2017, which is currently below 30bps or a little more than one rate hike in 2018.

Recommended Reading: 3 Big Mistakes Traders Are Making in 2017 And How To Correct Them

The small expectation for Fed hawkishness in 2018 means that the best proponent of USD breakout is from a contrarian perspective, but many including institutional speculators are giving up on the greenback. Case in point, when looking at the market’s form of breakout or breakdown insurance, Risk Reversals in the options market, we see the highest cost to protect against a drop in the USD against the EUR (read: EUR/USD higher is expected) since 2009. The measure used to come up with that figure is the 10-delta risk reversal, which shows a relative extreme not seen since 2009 to have the option to buy (call) vs. the option to sell (put) should an extreme EUR bullish move develop. When looking at EUR/USD, the market is likely focusing on 1.1714, the 2015 high after China shocked the world from devaluing the Yuan in order to support their economy, which appears to have worked well when looking at recent economic data such as GDP.

Either way you cut it, the USD remains on a back foot, and further losses in the DXY should not come as a surprise. The short-term technical level to watch would be 95.17, the high from July 20 when the ECB gave a dovish message that the market ignored to buy more EUR. The broader picture of DXY would discount any bullish view below 96.50, which acts as a polarity point on the chart. A close above this level, some 300 points away, would be the best indication that the hedge funds who are shorting the USD have lost their edge. Until then, to the victor BELONGS the spoils.

If you would be interested in seeing how retail traders’ are bettingin key markets, see IG Client Sentiment here !

Join Tyler in his Daily Closing Bell webinars at 3 pm ET to discuss this market.

DXY below 96.50 keeps thefocus on downside extension targets @ 93.1, EUR/USD >1.16

Chart Created by Tyler Yell, CMT

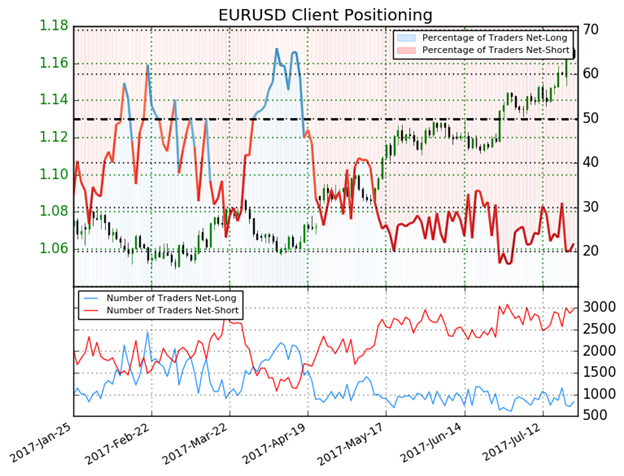

IG Client Sentiment Highlight: EUR (57.6% of DXY) Sentiment favors further DXY downside

EURUSD: Retail trader data shows 21.9% of traders are net-long with the ratio of traders short to long at 3.57 to 1. In fact, traders have remained net-short since Apr 18 when EURUSD traded near 1.06665; theprice has moved 9.1% higher since then. The number of traders net-long is 4.1% lower than yesterday and 20.5% lower from last week, while the number of traders net-short is 2.7% higher than yesterday and 9.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bullish contrarian trading bias. (Emphasis mine)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell