FTSE 100 Technical Highlights:

- FTSE working its way towards top of influential channel

- Watch how price reacts should resistance be met

FTSE working its way towards top of influential channel

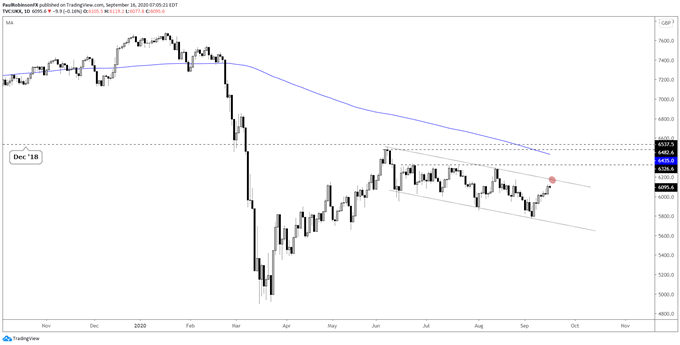

In recent trade the FTSE has been rising off the lower parallel of a downward channel that has been in place since early June. This structure is becoming increasingly dominant in determining the trading bias and may again soon have an impact as the upper parallel nears.

On approach the first thought is resistance is resistance until it is not. Furthermore, the channel is angled to the downside so the path of least resistance, while not strong, is still pointed lower. With that said, resistance in a down trend is typically harder to overcome than resistance in an uptrend.

Should the upper parallel soon be met, then traders looking for shorts may be presented with a solid risk/reward opportunity. If momentum quickly comes in on the sell-side, then it could turn into another leg lower. If selling is tepid, then perhaps the FTSE will try and change character and solidify before attempting to trade above the upper parallel.

It will take that jump over the upper parallel to bring the prospect of higher prices to the forefront and a rally towards the falling 200-day at 6441. Should we see price start to trade back down to the recent low at 5778 and the lower parallel, again watch how price reacts. It may hold as it did earlier in the month, but at some point whether it is a breach to the downside or upside the channel will give-way. And when it does it is likely to spark additional interest in the direction of the break…

FTSE Daily Chart (stuck in channel)

UK 100 Index Charts by Tradingview

Tools for Forex Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX