FTSE 100 Technical Highlights:

- FTSE continues to be a global laggard, looks headed lower

- 2016 trend-line could soon come into play on further weakness

For our analysts intermediate-term fundamental and technical view on the FTSE and other major indices, check out the Q4 Global Equity Markets Forecast.

FTSE continues to be a global laggard, looks headed lower

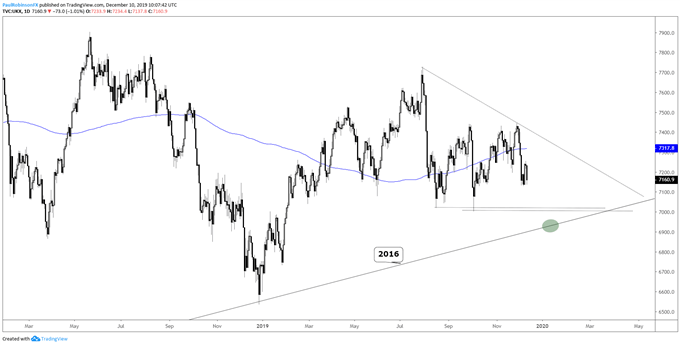

The FTSE is rolling down towards its worst levels since October and August, when the index was heading towards completing a head-and-shoulders topping pattern. The H&S didn’t trigger, but since bouncing off the would-be neckline of the pattern the FTSE hasn’t done itself much good in repairing its overall technical posturing.

The nearly two-month long grind of a rally since the October low suggested that it could break down again as tepid upward momentum was a sign of weak participation. The recent breakdown, lasting only a couple of weeks, has fresh multi-month lows in the scope of a near-term outlook.

A break of 7020/04 (Aug/Oct lows) will have in play the 2016 trend-line that connects with the 2019 low. Despite it only having the bare requirement to constitute a trend-line, that is only two connecting points, it’s still a strong one given the significant bull market lows those two occurrences were.

From a tactical standpoint, the FTSE remains a difficult market to get a handle on, and this week’s ‘Brexit’ vote isn’t likely to make it any easier. But, overall the trading bias is tilted in favor of sellers. Need to be mindful, however, of the 7k area and then the 2016 trend-line along the way. One or both of those levels is seen as having a high likelihood of bringing some type of bullish response.

Check out this guide for 4 ideas on how to Build Confidence in Trading.

FTSE Daily Chart (Short bias, watch price and trend-line support)

UK 100 Index Chart by Tradingview

You can join me every Wednesday at 1030 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex & CFD Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX