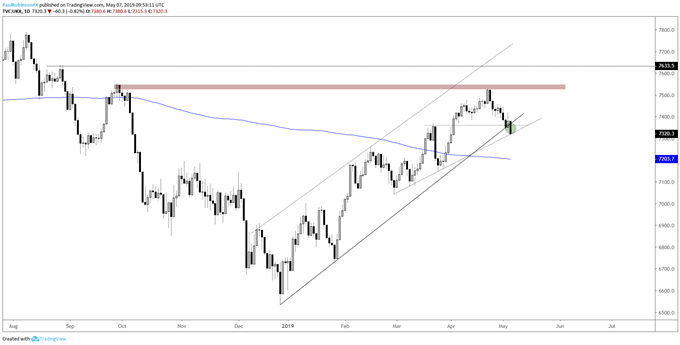

FTSE Technical Highlights:

- FTSE trading below trend-line support from December

- March high in confluence with trend support

- How the next day or two play out could be quite important

For the recently released Q2 FTSE & GBP Forecasts, check out the DailyFX Trading Guides page.

FTSE below confluence of support

The decline off last month’s high has been relatively orderly, and while generally the FTSE has been relatively weaker than other major global markets, it could make for a good long prospect here soon if support holds.

This morning the index is dipping below support of two varying angles; the December trend-line (most important) and the prior swing-high since then, formed in March. If a reversal can develop and hold through the end of today, it could be a solid rejection at support and have momentum turned towards a fresh leg higher.

A rise above Friday’s high at 7418 will help bolster the bullish case that higher prices are in store. As long as the general risk-trade stays intact and support isn’t breached, it’s reasonable to expect the FTSE to rise up to the April high at 7529 or higher towards the next swing level around 7633.

From a tactical standpoint, how the next day or two play out is important because if support is broken with conviction as it could be today, then a daily close below the trend-line and March high will be seen as favorable for shorts.

FTSE Daily Chart (t-line, March high)

Check out this guide for 4 ideas on how to Build Confidence in Trading.

You can join me every Wednesday at 9 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex & CFD Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX