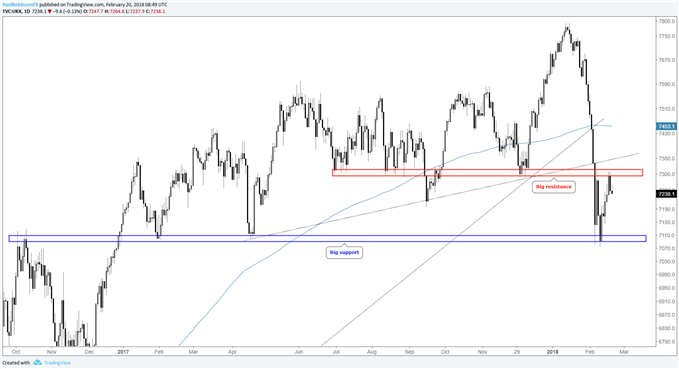

FTSE Highlights:

- FTSE found sellers to start the week around the 7300-line

- For as long as resistance holds in place, so does a downward bias

- If selling becomes aggressive the area around 7100 could come under fire again

What is driving the FTSE and GBP this quarter? Find out in the Q1 Trading Forecasts.

To start the week, the FTSE began from stiff resistance surrounding the 7300-line, and handled it as we expected it would do so initially. It’s the second time since the Jan/Feb plunge ended we’ve seen a retest of former support as resistance, once the day after 7300 broke, the other to start the week.

The turn down keeps this threshold firmly intact as the ‘must overcome level’ if a rally is to develop in the U.K. In terms of support on further weakness, we have to go down towards another big area of interest, ~7100. The area around 7100 became important starting back in October 2016.

Tactically, at the moment all we really have are two big levels to work with. For now, with resistance so close at hand new longs are at risk of quickly failing. This gives shorts the upper-hand at the moment with a backstop not far above.

It’s difficult to say with any high level of conviction how price action will unfold from here. The FTSE may go through a period of trading between the two focused levels until one side gives-way. But in any event, a break of either side will be our cue to look for follow-through.

Struggling right now? We’ve got a guide designed to help you – Building Confidence in Trading.

FTSE Daily Chart

If you’d like to listen in on live analysis pertaining to global equity indices (and commodities), you can join me every Tuesday at 10 GMT time for my technical insights.

Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

To receive Paul’s analysis directly via email, please SIGN UP HERE

You can follow Paul on Twitter at @PaulRobinsonFX