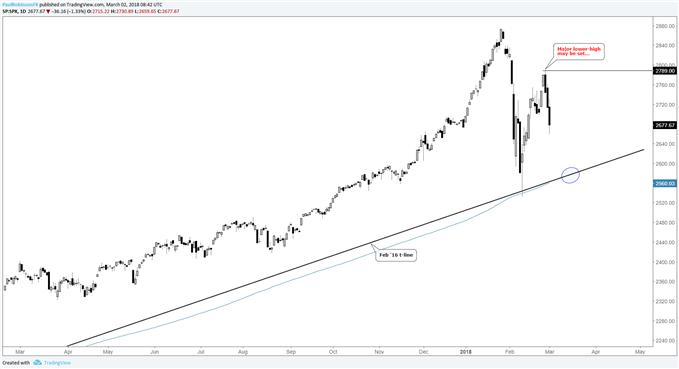

S&P 500 Technical Highlights:

- S&P 500 fell sharply the past three sessions, brings rebound into question

- A major lower-high in the works or retest of prior low?

- Big levels/lines and technical considerations outlined

To view the longer-term technical and fundamental outlook for the S&P 500, or to see our top trade ideas for 2018, check out the DailyFX Trading Guides.

The past three days have brought a substantial amount of selling following the rebound off the Feb low. How developments unfold in the days to follow could hold significant implications, as a big lower-high may be in place. But we still can’t rule out a retest, settle out, and trade back higher just yet, though.

Where a low develops is critical. If we see a modest amount of selling from here but then the market quickly starts a recovery a good distance away from last month’s low, then this gives the long-side of the tape a better shot at seeing a move back towards new record highs.

If more heavy selling continues then in comes the very important trend-line dating back to the February 2016 low, along with the 200-day MA which is riding side-by-side with it. With the S&P sliding that far back down after such a strong bounce, enough technical damage will have been done on two declines that the likelihood we’ve seen a larger top carved out, increases significantly.

Struggling with rising volatility? We’ve got a guide designed to help you – Building Confidence in Trading.

S&P 500 Daily Chart

In this case, sure we might see another rally from long-term support, but the chances that it fizzles out in fairly short order would be high. All-in-all, we’re quickly approaching a cross-road from which the market needs to decide.

It makes the outlook a little tricky at the moment to get a handle on, but with a little patience we should find clarity soon enough. One thing is for sure, volatility is back, and that’s certainly a good thing for traders.

If you’d like to listen in on live analysis pertaining to global equity indices (and commodities), you can join me every Tuesday at 10 GMT time for my technical insights.

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

To receive Paul’s analysis directly via email, please SIGN UP HERE

You can follow Paul on Twitter at @PaulRobinsonFX