What’s inside:

- S&P 500 rising wedge broke, but consolidation may be as bearish as it gets from here if no turn lower again soon

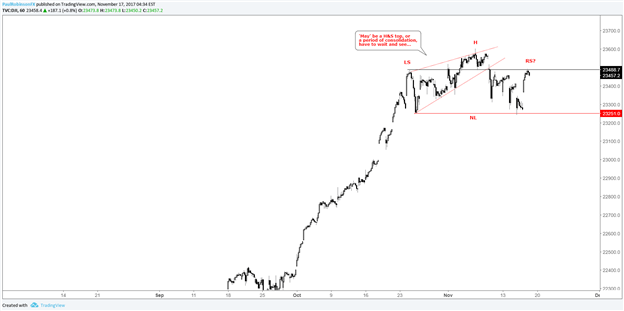

- Dow Jones carving out a possible H&S top, but could also be a consolidation pattern

- Market participants look likely to be best served being patient and waiting for a bit more clarity to present in the days ahead

Check out the DailyFX Quarterly Forecasts to find out how 2017 may end for global stock markets.

Last week, when we looked at U.S. indices, the S&P 500 and Dow Jones were both flashing signs of a forming a ‘mini-top’. Not the top, but a top which could lead to a minor pullback. Since then, we’ve seen a little bit of a decline, but is has been anything but a clean process and smacks more of a consolidation sequence so far.

The S&P 500 rising wedge break is still in play, but about to come off the board given how close the market is to a new high. If we are to see a turn lower, it needs to develop very soon. The June slope, which held as support on several occasions since last month (most recently on 11/14), was broke for a day (11/15) before being recaptured yesterday. Indeed, things are becoming sloppy. The thinking on this end, is that it would be best to see a nice horizontal period of trading, or consolidation, before breaking out into year-end. But we’ll see if the market wants to cooperate.

Check out this guide for tips on Building Confidence in Trading.

S&P 500: Daily

The Dow isn’t presenting us with much better clarity than the broader S&P, but does have one potentially bearish price sequence taking shape in the form of a ‘head-and-shoulders’ pattern (Most easily visible on the hourly time-frame.) The Dow will need to turn down right about now and subsequently break the ‘neckline’ before we have validation, but it’s a scenario worth keeping in mind. Price action could just continue to move sideways, too, and a healthy period of consolidation take shape. As said a minute ago, that could be a good thing for setting up a long-trade later.

The bottom line: The market is still extended and generally choppy. There isn’t likely to be a tremendous amount of momentum showing up in either direction, and traders will need to continue to pick their spots wisely, or stand aside all together until clarify presents itself.

Dow: Hourly

Want to hear Paul’s analysis live? See the Webinar Calendar for details and a schedule of all upcoming live events.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.