What’s inside:

- S&P 500 hanging out in record territory, extended but no sellers visible

- Support levels not far below for traders to look to on weakness

- Expectations need to be kept in check, but still opportunity

Find out what’s driving the stock market in our market forecasts.

The combination of an extended market minus a reason to sell is leaving limited room for traders to operate. The past couple of sessions the S&P 500 has been suspended in air with single-digit trading ranges, and while we are likely to see some extra movement here soon, expectations are tempered for seeing out-sized price swings. This doesn’t mean there isn’t opportunity, but the low volatility environment needs to be take into consideration when planning trades.

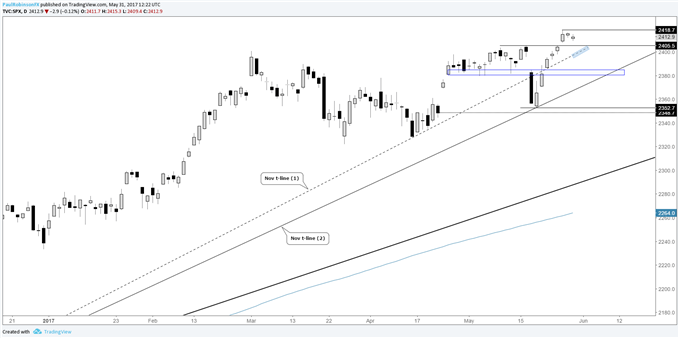

On a small dip, a gap-fill from Friday and the prior record high on 5/16 align right in the 2404/05 area; the first short-term area of support for traders to watch. Not far below there lies the November trend-line recaptured only three days after the dagger down day on the 17th. It’s unclear how relevant this slope will be, so we’ll let price action tell us first. Looking higher, the Friday record high at just shy of 2419 is the only notable level of resistance at this time.

From a tactical standpoint, the approach on this end is to buy dips into support once momentum turns upward and sell into the up-moves. Shorting, outside of perhaps intra-day scalps, holds little edge at this time. A sharp break below the old highs and previously mentioned November t-line could bring in further selling towards the 2380 support zone and the second November trend-line, but for now that isn’t on the table. Another scenario which would potentially pique our interest from the short-side would be to see a sharp reversal day (‘key reversal’, ‘pin-bar’, ‘shooting star’) from new record levels.

S&P 500: Daily

Paul conducts webinars every week from Tuesday-Friday. See the Webinar Calendar for details, and the full line-up of all upcoming live events.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.