NZD/USD Technical ANALYSIS: BEARISH

- New Zealand Dollar pressuring four-month rising trend support

- Break lower might see long-term structural decline re-engaged

- Neutralizing selling pressure probably needs close above 0.67

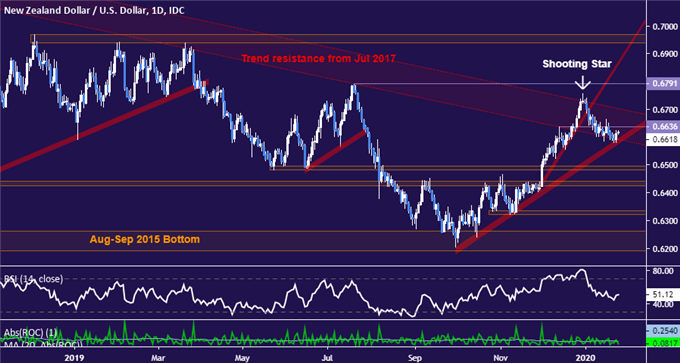

The New Zealand Dollar edged down to test support guiding a three-month recovery against its US counterpart after a telltale Shooting Star candlestick appeared on a test of trend resistance from July 2017 (as expected). The selloff paused here thanks to fillip from better-than-expected CPI data, but the pair tellingly held below immediate resistance at the 0.6636 and kept the near-term series of lower highs intact.

Daily NZD/USD chart created using TradingView

If this proves telling of sellers’ conviction, a break through the upward-sloping floor establishing the rise from October’s swing bottom might be on the horizon. Such a move would paint recent gains as corrective and set the stage for resumption of the longer-term decline. A dense layer of back-to-back support sits in the 0.6425-96 area. Below that is the 0.6322-34 zone, followed by a five-year bottom near 0.62.

Neutralizing near-term selling pressure might begin with a daily close back above 0.6636. Making the case for upward follow-through probably requires a daily close above 2.5-year trend resistance however, which now sits just a hair above the 0.67 figure. Establishing a foothold above that might pave the way to revisit the December 31 high at 0.6756, followed shortly thereafter by the July 19 top at 0.6791.

NZD/USD TRADER SENTIMENT

| Change in | Longs | Shorts | OI |

| Daily | 6% | -13% | 2% |

| Weekly | 40% | -35% | 15% |

NZD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the Comments section below or @IlyaSpivak on Twitter