To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

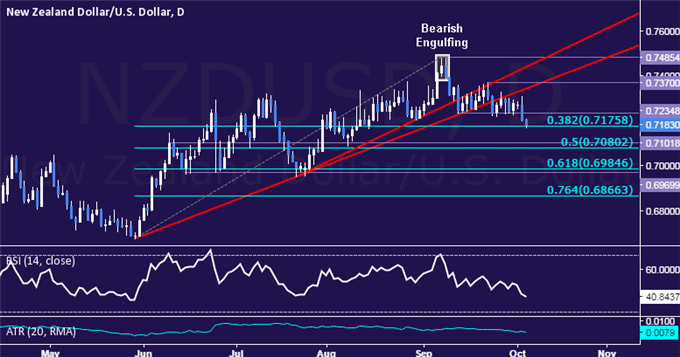

- NZD/USD Technical Strategy: Short at 0.7273

- Kiwi Dollar drops to 2-month low as prices challenge 0.72 mark

- Partial profit booked after short position meets initial objective

The New Zealand Dollar has dropped to the lowest level in almost two months against its US counterpart after prices cleared trend support set from late May. The pair established a top as expected following the appearance of a Bearish Engulfing candlestick pattern below the 0.75 figure.

From here, a daily close below the 38.2% Fibonacci retracement at0.7176 paves the way for a challenge of the 0.7080-0.7102 area (50% level, horizontal pivot). Alternatively, areversal back above the September 22 high at 0.7370 sees the next high-profile barrier at 0.7485, the September 9 top.

A short NZD/USD trade was activated at 0.7273. Prices have now reached the initial target at 0.7176 and profit has been booked on half of the position. The remainder of the trade will remain open to capture any follow-on weakness with a stop-loss trailed to the breakeven level.

What do past NZD/USD price patterns hint about current trends? Find out here !