To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- NZD/USD Technical Strategy: Flat

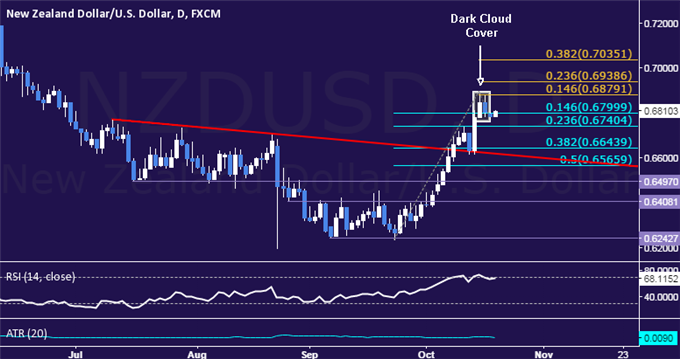

- NZ Dollar Rally Falls Short of Testing 0.69 Figure, Carves Out Bearish Candle Pattern

- Risk/Reward Parameters, Absence of Confirmation Argue Against Taking Short Position

The New Zealand Dollar put in a bearish Dark Cloud Cover candlestick pattern, hinting that a top against its US namesake may be taking shape. Prices stalled after issuing the largest two-day advance in seven months, falling just shy of testing the 0.69 figure.

Near-term support is at 0.6740, the 23.6% Fibonacci retracement. A break below that on a daily closing basis clearing the way for a challenge of the 0.6620-44 area, marked by trend line resistance-turned-support and the 38.2% level. Alternatively, a move back above the 14.6% Fib at 0.6800 opening the door for a test of the 14.6% Fib expansion at 0.6879.

Prices are wedged too closely between near-term support and resistance to justify taking a trade at current levels. Furthermore, confirmation of reversal is absent for now absent a move overturning the series of higher highs and lows in play since late September. With that in mind, we will remain on the sidelines for the time being.

Losing Money Trading Forex? This Might Be Why.