Talking Points

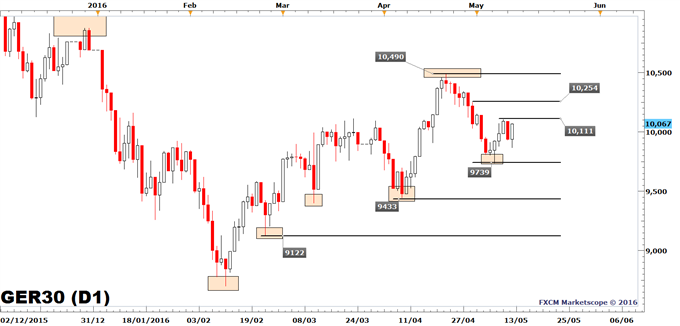

- DAX 30 remains bullish above Friday’s low of 9739.

- The next major resistance level is the April monthly high of 10,490 while a short-term resistance level is the May 10 high of 10,111.

- European Industrial Production rose by a mere 0.2% YoY vs. the 0.9% expected by economists in a Bloomberg poll.

The DAX 30 (CFD: GER30) added to yesterday’s losses and at one point price had given back 61.8% of the gains from Friday’s low of 9739. Most DAX 30 sectors are lower today, led by Financials (-1.23%), while the Utilities Sector was up by 3.18% on the day and presents the only gaining sector at the time of writing. Utilities Sector rose on the share price of RWE AG gaining 6.3% on the day as the firm’s first-quarter profit beat analyst’s estimates.

Technically, the DAX 30 remains bullish above Friday’s low of 9739 as it is the most recent swing low of the bullish trend in place since February when the DAX reached 8700. The April monthly low of 9433 is the next major support level below Friday’s low and is followed by the February 24 low of 9122.

Overhead resistance of a short-term nature is the May 10 high of 10,111, followed by the April 29 high of 10,254. A multi-week resistance level is the April monthly high of 10,490.

The DailyFX Speculative Sentiment Index (SSI) shows that traders are net-long the GER30 (a CFD) by 1.3 vs. each short position. As the SSI is a contrarian indicator, it suggests the GER30 may drift lower.

Our Stock Market forecasts for Q2 2016 are now live on the site. Download them for free.

DAX 30 | CFD: GER30

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

European Industrial Production rose by a mere 0.2% YoY vs. the 0.9% expected by economists in a Bloomberg poll. On the other hand, February’s figure was revised to 1% YoY from 0.8%. The DAX 30 ignored the soft outcome and had gained 15 points, 10 minutes after the release.

The annual growth rate is now near its December 2015 growth rate of 0%. The last time the growth rate was negative was in November 2014.

We note that European Industrial Production YoY rate has had a +0.88 correlation to Eurozone GDP YoY rate over the last 20 years (quarterly data). If the European Industrial Production does not bounce back to higher levels in the months ahead and instead drifts lower, this may suggest a slower Eurozone GDP growth. The GDP annual growth rate for the first quarter was at 1.6% YoY.

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00